Municipals saw yields rise in spots along the curve, mostly inside of 10 years, as secondary trading picked up, and more bonds were out for the bid.

U.S. Treasuries moved to lower yields and equities ended in the black.

Triple-A benchmark yield curves saw one to two basis point cuts. After mostly ignoring the better Treasury market the past few sessions, ratios have edged higher.

Municipal-to-UST ratios showed the 5-year at 54%, the 10-year at 77% and the 30-year at 84%, according to Refinitiv MMD. ICE Data Services had the 5-year at 54%, 10-year at 76% and the 30 at 86%.

Supply is a factor along with elevated bids wanteds ($628.29 billion on Monday and $628.08 on Friday) with similar figures reported Tuesday and trading was up 6% over Monday’s levels.

Thirty-day visible supply now sits at $11.55 billion with net negative supply sitting at $8 billion, per Bloomberg data.

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year while high-yield is at -0.64% for October and +5.85% for 2021. Taxables are at -0.43% for the month and a mere +0.07% for the year.

In the primary, Barclays Capital priced for the Wisconsin Health and Educational Facilities Authority (A1/AA-//) $208.13 million of revenue bonds, Series 2021 (Aspirus, Inc. Obligated Group). Bonds in 8/2034 with a 5% coupon yield 1.82%, 5s of 2036 at 1.91%, 4s of 2041 at 2.30%, 4s of 2046 at 2.46%, 3s of 2051 at 3.05% and 4s of 2051 at 2.54%, callable Aug. 15, 2031.

Wells Fargo Corporation & Investment Banking priced and repriced for Lamar Consolidated Independent School District (Fort Bend County, Texas) (Aaa/AAA//) (underlying Aa2/AA//) $141.72 million of unlimited tax refunding bonds with a mix of bumps and cuts. Bonds in 2/2023 with a 5% coupon yields 0.23% (-4), 5s of 2026 at 0.68% (+2), 5s of 2031 at 1.40%, 3s of 2036 at 1.82% (-4), 2.375s of 2041 at 2.43% and 3s of 2045 at 2.20%, callable Feb. 15, 2031, and insured by Permanent School Fund Guarantee Program.

J.P. Morgan Securities priced for the Miami-Dade County Health Facilities Authority (/A/A+/) $161.965 million of hospital revenue and revenue refunding bonds (Nicklaus Children’s Hospital Project), Series 2021A. Bonds in 8/2022 with a 5% coupon yield 0.17%, 5s of 2026 at 0.81%, 5s of 2031 at 1.58%, 4s of 2036 at 2.19%, 4s of 2041 at 2.35%, 4s of 2046 at 2.48% and 4s of 2051 at 2.56%, callable Aug. 1, 2031.

Piper Sandler & Co. priced for Bethel School District No. 403, Pierce County, Washington, (Aaa///) $147.925 million of unlimited tax general obligation improvement and refunding bonds, Washington State School District Credit Enhancement Program. Bonds in 12/2022 with a 4% coupon yield 0.19%, 4s of 2027 at 0.94%, 4s of 2030 at 1.38%, 4s of 2037 at 1.77% and 4s of 2041 at 1.87%, callable Dec. 1, 2031.

In the competitive market, Milwaukee County (//AA/) sold $95.82 million of taxable general obligation pension promissory notes, Series 2021A, to R.W. Baird with a true interest cost of 1.654%. Bonds in 12/2022 with a 2% coupon yield 0.24%, 2s of 2026 at 1.30% and 2s of 2030 at 1.84%. The issuer also sold $4.18 million of general obligation promissory notes, Series 2021B to Baird with 1.5s of 9/2022 at 0.25% and 1.5s of 2025 at 0.60%. The issuer also sold $10.53 million of general obligation transit promissory notes, Series 2021C to J.P. Morgan Securities. Details were not yet available.

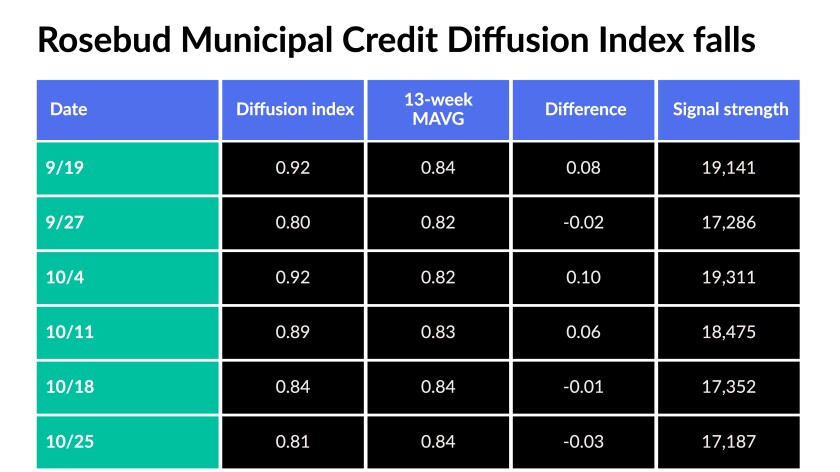

Rosebud Strategies Credit Diffusion Index falls

The index has fallen now for three consecutive weeks for the first time since May. The previous week saw a significant decline from 0.92 to 0.83, while in the most recent week the index fell by 0.02 to 0.81. The current reading of 0.81 is the lowest in six weeks.

The index uses social media to gather commentary on the finances of state and local governments and measures the difference between negative and positive sentiment. The index rises as the difference between negative and positive sentiment rises.

The index, and its 13-week moving average, have now fallen measurably below the 12-month trend line of the Municipal Credit Diffusion Index.

“The moderation in the index reflects an unexpected decline in the signal strength,” said Christopher Mier, founder of Rosebud Strategies. “As we have seen, a reduction in signal strength is correlated with a decline in the index, signifying an abatement in credit concerns.”

Secondary trading

Washington 5s of 2022 at 0.12%. Wake County 5s of 2024 at 0.42%-0.40%. Florida PECO 5s of 2024 at 0.35%.

New York City water 5s of 2026 at 0.67%. Massachusetts 5s of 2026 at 0.71%.

Prince George’s County 5s of 2029 at 1.10%. California 5s of 2030 at 1.21%. Monmouth County, New Jersey, 5s of 2031 at 1.31% versus 1.24% original. New Mexico 5s of 2031 at 1.33%.

Denver County and City 5s of 2033 at 1.35%. Charleston County, South Carolina, 3s of 2033 at 1.56%-1.51%.

Ohio water 5s of 2035 at 1.55%. Georgia 4s of 2039 at 1.69%-1.68%.

AAA scales

According to Refinitiv MMD, the short end saw yields steady on the one year at 0.15% in 2022 and up two to 0.25% in 2023. The yield on the 10-year was steady at 1.24% and the yield on the 30-year stayed at 1.73%.

The ICE municipal yield curve showed bonds rise one basis point to 0.17% in 2022 and one to 0.25% in 2023. The 10-year maturity was up one to 1.22% and the 30-year yield sat at 1.75%.

The IHS Markit municipal analytics curve showed short yields steady at 0.15% in 2022 and up two to 0.23% in 2023. The 10-year yield rose one to 1.24% and the 30-year yield sat at 1.73%.

The Bloomberg BVAL curve showed short yields steady at 0.17% in 2022 and steady at 0.21% in 2023. The 10-year yield was steady at 1.23% and the 30-year at 1.76%.

In late trading, Treasuries were firmer on the 10- and 30-year and equities were up near the close.

The 5-year Treasury was yielding 1.184%, 10-year Treasury was yielding 1.618% and the 30-year Treasury was yielding 2.048%. The Dow Jones Industrial Average gained 14 points, or 0.04%, the S&P rose 0.18% while the Nasdaq gained 0.06%.

Economy

Inflation continues to vex the markets.

“Markets are moving towards pricing in more permanent inflation risks, swayed by the recent rise in commodities,” said Subadra Rajappa, head of Societe Generale’s U.S. Rates Strategy. “Inflation breakevens keep pushing new boundaries.”

Despite rising prices, consumers remain willing to spend, but supply chain issues may tamp their ability.

The Conference Board’s consumer confidence index unexpectedly climbed to 113.8 in October from 109.8 a month earlier. The present situation index rose to 147.4 from 144.3, while the expectations index increased to 91.3 from 86.7.

Economists polled by IFR Markets expected a 108.8 reading for the confidence index.

“This is the first improvement in consumer confidence since June, and is likely partially due to easing concerns about the spread of the Delta variant,” said Scott Anderson, chief economist at Bank of the West.

Respondents said they were more likely to buy a home, auto, or major appliance, “pointing to a solid upcoming holiday season, if retailers can sufficiently restock shelves,” he added.

Of course, a bump in spending could add to inflation expectations. “Consumers’ are expecting inflation to average 7.0% in 12 months, the highest since July of 2008,” Anderson said.

It’s hard to say whether “consumers are willing to spend despite rising inflation, or perhaps, because they believe prices will be even higher in the future,” said Wells Fargo Securities Senior Economist Tim Quinlan, Economist Shannon Seery and Economic Analyst Sara Cotsakis. “Consumer average inflation expectations over the next 12 months rose to a 13-year-high last month. So the possibility that consumers are fearful that prices will be even higher in the future, maybe pulling some future demand forward.”

Meanwhile home sales and home prices are on the rise.

New home sales surged 14% in September to an 800,000 annual pace, well above the 755,000 expected. While the S&P CoreLogic Case-Shiller home price index showed prices gained 19.8% on a year-over-year basis in August.

“Those who are looking to purchase a home are facing bidding wars and competing against all-cash offers,” said Grant Thornton Economist Yelena Maleyev. “The share of first-time buyers has fallen to the lowest rate since 2015 while all-cash sales made up almost a quarter of sales in September.”

The median sales price climbed to $408,800 in September from $401,500 a month earlier, while the average sales price was $451,700, up from 446,900 in August. The median price is 18.7% higher than the $344,400 posted a year ago.

“First-time buyers are being priced out,” she said. “As high material prices and labor shortages continue to drive up the cost of housing, any rise in mortgage rates will be felt by those looking to purchase a new home.”

Regional Fed surveys suggested strengthening in the manufacturing and service sectors, with employment gains and prices mostly rising.

The Philly Fed non-manufacturing index’s general activity index at the firm level recovered most of the 15 points it lost in September. “Firms reported overall increases in full-time and part-time employment,” the report said.

Price indexes “reached all-time highs this month.”

The Richmond Fed reported better activity in both manufacturing and services. Manufacturing “survey results indicate that many manufacturing firms increased employment and wages in October but finding workers with the necessary skills was difficult,” the report said. The trend is expected to continue.

While prices paid dropped in October, prices received rose, with respondents expecting to both to slow in the next 12 months.

In the services sector revenue and demand indexes gained while the local business conditions index stayed “fairly flat.” But expectations are for improved growth in the next half year.

Firms upped wages, while more firms added workers than lost them, although “many struggled to find workers with the necessary skills,” the survey said. “They expected this difficulty to persist and employment and wages to continue to grow in the coming months.”

Prices paid and received rose “slightly,” the survey said, “as growth of prices paid continued to outpace that of prices received. However, participants expected growth of both prices paid and prices received to slow over the next year.”

“Wage pressures picked up to their highest levels on record in the survey’s history, while price pressures also increased and are near historical highs,” said Christopher Slijk, Dallas Fed associate economist.

Primary market to come

Main Street Natural Gas (Aa2//AA-/) is on the day-to-day calendar with $750 million of gas supply revenue bonds, Series 2021A, serials 2023-2031, term 2052. RBC Capital Markets.

Dallas and Fort Worth, Texas, (A1//A+/AA/) is set to price Tuesday $708.1 million of Dallas Fort Worth International Airport joint revenue refunding bonds, taxable Series 2021C, serials 2022-2036, term 2046. Barclays Capital.

Dallas and Fort Worth, Texas, (A1//A+/AA) is also set to price Thursday $300.6 million of Dallas Fort Worth International Airport joint revenue refunding bonds, Series 2021B (non-AMT), serials 2022-2030 and 2043-2045. RBC Capital Markets.

California Community Choice Financing Authority (A2///) is set to price $556.03 million of clean energy project green revenue bonds, Series 2021A (climate bond certified). Goldman Sachs & Co.

AdventHealth Obligated Group (Aa2/AA/AA//) is set to price Wednesday $400 million of corporate CUSIP taxable hospital revenue bonds, Series 2021E. J.P. Morgan Securities.

Westchester County Local Development Corp. (non-rated) is set to price $392.245 million of revenue bonds (Purchase Senior Learning Community Inc. Project), Series 2021, consisting of $213.805 million of Series A, $23.52 million of Series B, $58.73 million of Series C, $89.525 million of Series D and $6.665 million of Series Ser E. HJ Sims & Co.

Ohio (Aa1/AA+/AA+//) is set to price Wednesday $326.055 million of general obligation bonds consisting of: $137.495 million of infrastructure improvement general obligation bonds, Series 2021A-II, serials 2022-2041; $40.355 million of conservation projects general obligation bonds, Series 2021A-CP, serials 2022-2034; $48.325 million of infrastructure improvement general obligation refunding bonds, Series 2021B, serials 2025-2032 and $99.88 million of common schools general obligation refunding bonds, Series 2021C, serials 2026-2032. Citigroup Global Markets.

Lancaster County Hospital Authority (A2/A+///) is set to price Wednesday $296.475 million of revenue bonds (Penn State Health), Series 2021. J.P. Morgan Securities.

The Health and Educational Facilities Board of the Metropolitan Government of Nashville and Davidson County, Tennessee, (A3/A///) is set to price Thursday $293.205 million of taxable revenue bonds (Vanderbilt University Medical Center), Series 2021A and 2021B. J.P. Morgan Securities.

The Industrial Development Authority of Phoenix, Arizona, (non-rated) is set to price Thursday $232.815 million of hotel revenue bonds (Provident Group — Falcon Properties LLC, Project), consisting of $143.585 million, Series A-1, terms 2041, 2051 and 2057; $7.785 million, Series A-2, term 2032 and $81.445 million, Series B, serial 2057. RBC Capital Markets.

Austin, Texas, (//AA-/) is set to price Wednesday $218.08 million of water and wastewater system revenue refunding bonds, Series 2021. Morgan Stanley & Co.

The Indiana Finance Authority (Aaa/AAA/AAA/) is set to price $215.03 million of state revolving fund program bonds, Series 2021B (green bonds). Citigroup Global Markets.

Private Colleges & University Authority (A2//AA-/) is set to price Wednesday $161.88 million of revenue bonds (The Savannah College of Art & Design Projects), Series 2021. Goldman Sachs & Co.

Manor Independent School District is set to price Thursday $156.515 million of taxable unlimited tax refunding bonds, Series 2021B, serials 2022-2044. Jefferies LLC.

California Statewide Communities Development Authority (/AA-/AA/) is set to price Wednesday $135.13 million of health facility revenue bonds (Montage Health), Series 2021A. Piper Sandler & Co.

Successor Agency to the Redevelopment Agency of the City and County of San Francisco (/A//) is set to price $107.34 million of taxable third lien tax allocation bonds, 2021 Series A (affordable housing projects) (social bonds), serials 2023-2031. Citigroup Global Markets.

Clovis Unified School District (/AA-//) is set to price Thursday $100.815 million of federally taxable 2021 certificates of participation, serials 2022-2036, terms 2041, 2046 and 2051. Stifel, Nicolaus & Company.

Competitive:

Los Angeles (//AA/) is set to sell $211.94 million of general obligation bonds, Series 2021-A (taxable) (social bonds) at noon Wednesday and $65.63 million of general obligation refunding bonds, Series 2021-B at 12:30 p.m. eastern Wednesday.

Montgomery County, Maryland, (/AA+//) is set to sell $57.465 million of taxable limited obligation certificates (Facility and Residential Development Projects) Series 2021A Taxable at 10:30 a.m. eastern, and $41.81 million of taxable limited obligation refunding certificates (Facility and Residential Development Projects) Series 2021B at 10:45 a.m. eastern Thursday.