Municipals greatly outperformed a large selloff in U.S. Treasuries Tuesday with yields rising to multi-year highs in the global safety benchmark curve following Federal Reserve officials’ hawkish remarks about shrinking its balance sheet and a likely 50 basis point interest rate increase as soon as May. Equities end in the red.

Munis lagged, as they are wont to do in times of severe volatility, with triple-A municipal yields cut three to four basis points, while USTs were cut up to 17 in the seven-year and double-digit moves to higher yields were across the taxable curve.

The moves to higher yields were stoked by Federal Reserve Governor Lael Brainard saying the Federal Open Market Committee will continue tightening monetary policy through a series of interest rate increases and by starting to reduce the Fed’s balance sheet at a rapid pace as soon as its May meeting. She did not go as far as to say a 50 basis point hike was imminent but Kansas City Fed President Esther George separately said such an increase would be considered at the FOMC’s next meeting.

Muni to UST ratios fell as a result. Muni to UST ratios were at 73% in five years, 86% in 10 years and 99% in 30, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 73%, the 10 at 88% and the 30 at 100% at 4 p.m.

The primary was in full force Tuesday. J.P. Morgan Securities preliminarily priced for the New York Transportation Development Corp. (Baa1//BBB/) $1.355 billion of tax-exempt/alternative minimum tax Terminal 4 John F. Kennedy International Airport Project special facilities revenue bonds. Bonds in 12/2026 with a 5% coupon yield 2.81%, 5s of 2027 at 2.94%, 5s of 2032 at 3.53%, 5s of 2037 at 3.75%, 5s of 2042 at 3.83% and 4s of 2042 at 4.08%, callable at 12/1/2032.

Goldman Sachs priced for institutions the New York Power Authority (A1/AA//) $608.740 million of green transmission project revenue bonds with four to seven basis point bumps on the short end and cuts up to two basis points on the long end. Bonds in 11/2024 with a 5% coupon yield 1.89% (-4), 5s of 2027 at 2.17% (-7), 5s of 2032 at 2.64% (-6), 4s of 2037 at 3.14%, 4s of 2042 at 3.28%, 4s of 2047 at 3.38% (unch), 4s of 2052 at 3.47% (+2), 4s of 2061 at 3.70% and 3.875s of 2061 at par, callable at 11/15/2031.

BofA Securities priced for the New York State Environmental Facilities Corporation (Aaa/AAA/AAA/) $420.610 million of Clean Water State Revolving Fund and Drinking Water State Revolving Fund subordinated SRF revenue bonds, Series 2022A. Bonds in 6/2023 with a 5% coupon yield 1.63%, 5s of 2027 at 2.12%, 5s of 2032 at 2.44%, 5s of 2037 at 2.68%, 4s of 2042 at 2.98%, 4s of 2047 at 3.11% and 5s of 2041 at 2.92%.

Wells Fargo Bank priced for the Massachusetts Bay Transportation Authority (/AAA/AAA/) $295.315 million of assessment bonds, 2022 Series A. The first tranche, $201.645 million of 2022 Series A, Subseries A-1, saw bonds in 7/2023 with a 5% coupon yield 1.64%, 5s of 2028 at 2.10%, 5s of 2032 at 2.39%, 5s of 2037 at 2.65% and 3.125s of 2041 at 3.29%, callable in 7/1/2032.

The second tranche, $93.670 million of sustainability bonds, 2022 Series A, Subseries A-2, saw bonds in 7/2052 with a 5% coupon yield 2.99%, callable in 7/1/2032.

Morgan Stanley priced for the Board of Regents of the University of Texas System (Aaa/AAA/AAA/) $259.455 million of revenue financing system bonds, Series 2022A. Bonds in 8/2023 with a 3% coupon yield 1.69%, 5s of 2027 at 2.12%, 5s of 2032 at 2.40%, 4s of 2037 at 2.78%, 4s of 2042 at 2.93%, 4s of 2052 at 3.09% and 3.25s of 2052 at 3.39%.

RBC Capital Markets priced for the Pennsylvania Economic Development Authority (A2/A/A/) $212.430 million of University of Pittsburgh Medical Center revenue bonds, Series 2022A. Bonds in 2/2023 with a 5% coupon yield 1.86%, 5s of 2027 at 2.52%, 5s of 2032 at 2.88%, 4s of 2037 at 3.43%, 4s of 2042 at 3.55%, 5s of 2047 at 3.37% and 4s of 2052 at 3.72%.

Barclays Capital priced for Monroeville Finance Authority, Pennsylvania (A2/A/A/) $173.065 million of University of Pittsburgh Medical Center revenue bonds, Series 2022B. Bonds in 2/2023 with a 5% coupon yield 1.86%, 5s of 2028 at 2.57%, 5s of 2032 at 2.88%, 4s of 2037 at 3.43% and 4s of 2042 at 3.55%, callable at 2/15/2032.

In the competitive market, the Virginia Public Building Authority (Aa1/AA+/AA+/) sold $236.655 million of public facilities revenue bonds, Series 2022 A Bidding Group 1, to BofA Securities. Bonds in 8/2023 with a 5% coupon yield 1.70%, 5s of 2027 at 2.07%, 5s of 2032 at 2.37% and 5s of 2035 at 2.52%, callable in 8/1/2032.

The authority sold $199.995 million of public facilities revenue bonds, Series 2022A Bidding Group 2to Citigroup Global Markets. Bonds in 8/2036 with a 5% coupon yield 2.58%, 5s of 2037 at 2.60% and 4s of 2042 at 3.03%, callable in 8/1/2032.

The authority also sold $20.055 million of taxable public facilities revenue bonds, Series 2022B to Raymond James & Associates. Bonds in 8/2023 with a 5% coupon yield at par and 2.8s of 2026 at par, noncall.

The Eugene School District No. 4J, Oregon sold $120 million of general obligation bonds, Series 2022, to BofA Securities. Bonds in 6/2023 with 5% coupon yield 1.65%, 5s of 2027 at 2.09%,5s of 2032 at 2.32%, 4s of 2037 at 2.85% and 3s of 2042 at 3.25%, callable at 6/15/2032.

“Munis are as fragile as ever on fixed income market turmoil, resulting in a continued avalanche of fund outflows, selling pressure, and constrained market liquidity,” said Peter Block, managing director of credit strategy at Ramirez & Co. in a Monday report.

Recent and ongoing outflows from municipal bond mutual funds are being affected in part by seasonal reasons but mostly by the macroeconomic environment.

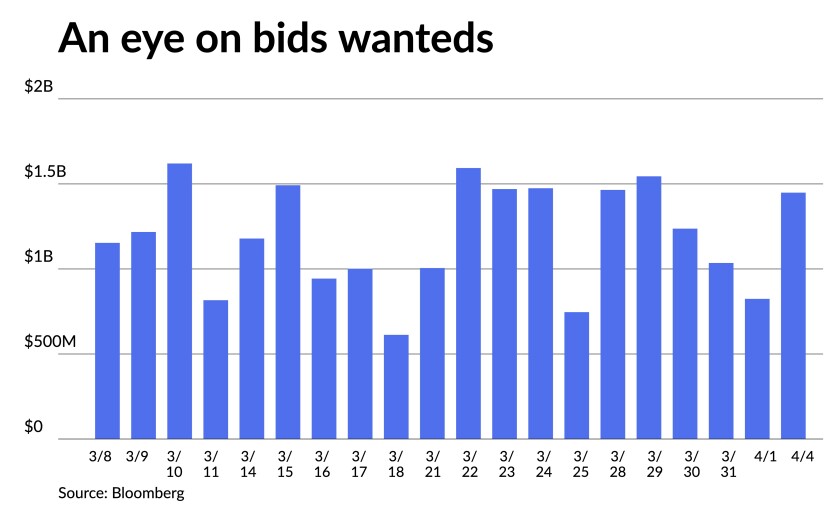

Block said investor offers in competition are about two times the three-year norm — including four days where $1 billion or more was offered — but trading is just 45% above the three-year average, indicating ongoing liquidity imbalances.

Block noted that muni-UST ratios, particularly in 30 years above 100% appear to be cheap, which would normally attract support, but given weak macro and market technical factors, including positive net supply in April and May due to low reinvestment, this typical pattern will likely not materialize for some time.

Block predicts prolonged underperformance, including wider credit spreads, particularly on less defensive structures and weaker credits, as a result of this.

However, the underperformance of municipals relative to taxables is drawing interest from investment grade credit investors seeing the opportunity to add tax-exempt municipal credit to their portfolios without having to sacrifice yield, said CreditSights senior municipal strategists Pat Luby and Jon Ceffalio.

They said taxable investors subject to the 21% federal corporate income tax rate can buy tax-exempt munis at a higher yield than the after-tax yield on comparably rated corporate bonds.

“Many individual investors tend to sell out of fixed income mutual funds when rates are heading higher and NAVs are declining, while total return or relative value investors tend to seek buying opportunities in those kinds of market conditions,” Luby and Ceffalio said.

While many retail investors are reducing their mutual funds positions, relative value investors are investing, and they believe that some of that money is going into muni ETFs.

In the next weeks, they foresee tumultuous market conditions, especially if mutual fund redemptions persist. Furthermore, they foresee little reinvestment demand in April, given the majority of the month’s principal and interest was paid out on April 1.

This week, CreditSights strategists continue to encourage taxable investment grade investors who haven’t been following the tax-exempt municipal market to do so. The new-issue calendar is the most active of the year, with a significant taxable component.

Secondary trading

California 5s of 2023 at 1.84%-1.77% versus 1.62%-1.57% on 3/24.. North Carolina 5s of 2025 at 1.90%-1.89%. Minnesota 5s of 2025 at 1.91%-1.89%. California 5s of 2025 at 1.99% versus 1.88%-1.87% on 3/23. California 5s of 2026 at 2.02%-2.01%.

New York City 5s of 2028 at 2.23%-2.22% versus 2.29% on 3/24. NY Dorm PIT 5s of 2029 at 2.37%. California 5s of 2030 at 2.24%-2.22% versus 2.35%-2.34% Wednesday.

Washington 5s of 2032 at 2.32%-2.31%.

LA DPW 5s of 2037 at 2.60% versus 2.60%-2.58% Thursday and 2.80% original. California 5s of 2041 at 2.66% versus 2.75% on 3/29 and 2/59%-2.58% on 3/22. NYC Transitional Finance Authority 5s of 2042 at 2.99% versus 2.96%-2.95% Monday and 3.14% original.

LA DPW 5s of 2046 at 2.83% verus 2.75% on 3/22. NYC Transitional Finance Authority 5s of 2047 at 3.08%-3.10% versus 3.07% Monday, 3.13%-3.08% Friday and 3.27% original.

Triborough Bridge and Tunnel Authority 5s of 2051 at 3.20%-3.21% versus 3.26%-3.27% Friday and 3.26%-3.27% Friday Thursday.

AAA scales

Refinitiv MMD’s scale was cut three to four basis points at the 3 p.m. read: the one-year at 1.57% (unch) and 1.77% in two years (unch). The five-year at 1.98% (unch), the 10-year at 2.20% (+4) and the 30-year at 2.55% (+4).

The ICE municipal yield curve was cut up to three basis points: 1.54% (+1) in 2023 and 1.83% (+2) in 2024. The five-year at 1.98% (+3), the 10-year was at 2.23% (+3) and the 30-year yield was at 2.60% (+3) in a 4 p.m. read.

The IHS Markit municipal curve was cut up to three basis points: 1.55% (+3) in 2023 and 1.77% (+3) in 2024. The five-year at 2.00% (+3), the 10-year at 2.18% (+3) and the 30-year at 2.58% (+3) at a 4 p.m. read.

Bloomberg BVAL was also cut three to four basis point: 1.56% (+3) in 2023 and 1.80% (+3) in 2024. The five-year at 2.04% (+4), the 10-year at 2.25% (+3) and the 30-year at 2.58% (+4) at a 4 p.m. read.

Treasury yields rose across the curve.

The two-year UST was yielding 2.530% (+11), the three-year was at 2.722% (+12), five-year at 2.709% (+16), the seven-year 2.672% (+17), the 10-year yielding 2.555% (+16), and the 30-year Treasury was yielding 2.578% (+12) at the close.

Primary to come:

The Cities of Dallas and Fort Worth, Texas, (A1/A+/A+/AA/) is set to price Wednesday $1.188 billion of taxable Dallas Fort Worth International Airport joint revenue improvement bonds, Series 2022A, terms 2051 and 2051. Citigroup Global Markets.

The Maryland Economic Development Corporation (Baa3//BBB/) is set to price Wednesday $625.425 million of green Purple Line Light Rail Project private activity revenue bonds, consisting of $100 million of Series 2022A and $525.425 million of Series 2022B. J.P. Morgan Securities.

El Paso, Texas, (/AA+/AA+/) is set to price Thursday $356.325 million of water and sewer revenue improvement and refunding bonds, Series 2022, serials 2023-2052. Ramirez & Co.

The Missouri Health and Educational Facilities Authority (A1/AA-/AA-/) is set to price Thursday $323.510 million of SSM Health health facilities revenue bonds, serials 2025-2034, terms 2047 and 2052. RBC Capital Markets.

The San Jose Financing Authority (Aa3/AA/AA//) is set to price Thursday $165.795 million of taxable Convention Center Refunding Project lease revenue bonds, Series 2022A. Morgan Stanley.

The Chino Valley Unified School District, California, (Aa2/AA-//) is set to price Wednesday $148.205 million, consisting of $75 million of current interest bonds, serials 2023-2027 and 2033-2041, terms 2046, 2051 and 2055; $65 million of capital appreciation bonds, serials 2028-2046; and $8.205 million of refunding bonds, serials 2022-2023 and 2025-2027. Stifel, Nicolaus & Co.

The Florida Development Finance Corp. (/BBB//) is set to price Thursday $121.535 million of Mater Academy Projects educational facilities revenue bonds, Series 2022, serials 2025-2056. PNC Capital Markets.

Hempfield Area School District, Pennsylvania, (/AA//) is set to price Thursday $115.035 million of general obligation refunding bonds, consisting of $475,000 of Series A, serial 2025, $6.040 million of Series B, serials 2023-2027 and $108.520 million of Series 1, serials 2027-2047. PNC Capital Markets.

The Dormitory Authority of the State of New York (//BBB-//) is set to price next week $110 million of Wagner College revenue bonds, Series 2022. Morgan Stanley.

The Henrico County Economic Development Authority, Virginia, (//A-//) is set to price Wednesday $103.995 million of Westminster Canterbury Richmond residential care facility revenue bonds, Series 2022A. Ziegler.