UK government borrowing costs are on course for one of their biggest ever monthly rises — and mortgage rates are set to increase as well — following the bond market meltdown triggered by chancellor Kwasi Kwarteng’s fiscal policy announcement last week.

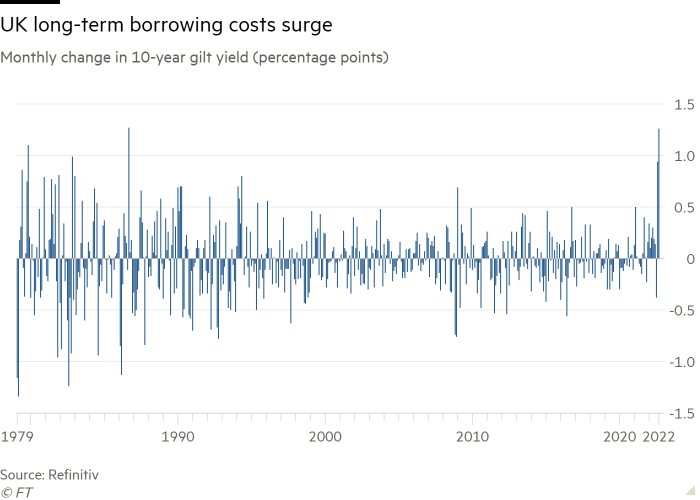

The 10-year benchmark gilt yield has increased by 1.26 percentage points so far in September to 4.1 per cent, marking one of the largest monthly jumps on record in Refinitiv data stretching back to 1979. Bond yields rise when prices fall. Two-year yields have also lurched higher, from 3 per cent at the end of August to 4.3 per cent, the highest in more than 14 years.

The monthly decline remains historic even though gilts prices rallied early on Tuesday.

“The moves are just extraordinary,” said Vivek Paul, UK chief investment strategist for the BlackRock Investment Institute. “The market has delivered its verdict [on the government’s fiscal plans] and it’s not a good one.”

The turmoil in the gilt market has also hit the UK housing sector, with leading mortgage lenders such as Virgin Money and Halifax halting new home loans in response to the soaring yields and volatility.

Ray Boulger, an analyst at mortgage broker John Charcol, said he expected there to be “very few mortgage deals available with rates under 5 per cent” as of next week because of the rise in gilt yields.

The bulk of the gilts sell-off came during the last two trading sessions, after Kwarteng on Friday laid out the biggest package of tax cuts since the 1970s, alongside widely anticipated energy subsidies to shelter households from soaring gas prices. Bond investors have baulked at the extra borrowing pencilled in to pay for the plans, including an additional £70bn of debt sales in the current financial year alone.

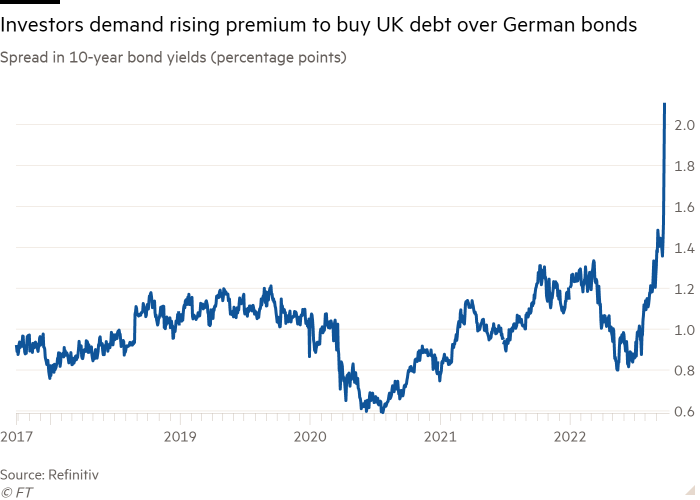

The historic losses for gilts, which will feed through to a substantially higher interest bill for the government if they are sustained, have coincided with a global rout in government debt. However, losses for UK bonds have outstripped rivals such as German Bunds and US Treasuries.

The gap between UK and German 10-year borrowing costs has widened to 2 percentage points, from 1.3 percentage points so far this month.

Adding to the pressure on gilts, Kwarteng’s announcement came a day after the Bank of England confirmed it will begin to sell gilts in its portfolio acquired under previous quantitative easing stimulus programmes, a process known as quantitative tightening. The BoE said it planned to reduce the size of its holdings by £80bn over the next 12 months, to £758bn.

“It’s the additional supply of gilts that’s really spooked markets,” said Jim Leaviss, head of public fixed income at M&G Investments. “Energy subsidies, tax cuts and QT all hitting the market simultaneously is a huge shock.”

The additional bond issuance announced to fund Kwarteng’s policy changes will make it tricky to push ahead with QT, which is scheduled to begin next month, according to Paul.

“The optics of selling gilts start to look really bad,” he said.

The long-term nature of Kwarteng’s tax cuts, as opposed to larger but temporary support for energy bills, has been the biggest worry to some investors.

“Because of the tax cuts, not the energy bill support, five years hence the UK deficit will be significant, bringing fiscal sustainability questions to the fore,” said Dean Turner, economist at UBS Wealth Management.

Additional reporting by Emma Dunkley