Liz Truss has vowed to stick to her tax-cutting plans, breaking her silence on the market turmoil that followed her government’s fiscal policy announcement last Friday.

In a series of interviews on local radio stations, the UK prime minister insisted she would not change course on the economy, saying lower taxes were vital to stave off a recession. But a sell-off in sterling and government bonds resumed as she spoke.

“We are cutting taxes across the board because we were facing the highest tax burden on Britain in 70 years, and that was causing a lack of economic growth,” Truss told BBC Radio Tees.

She added that keeping taxes high “going into difficult economic times” was likely to lead to a recession. “My concern is, I want people to stay in jobs.”

But her administration’s plans for £45bn of unfunded tax cuts and other fiscal measures have prompted a sharp sell-off in sterling and government bonds, forced banks to withdraw mortgage offers and led to censure by the IMF.

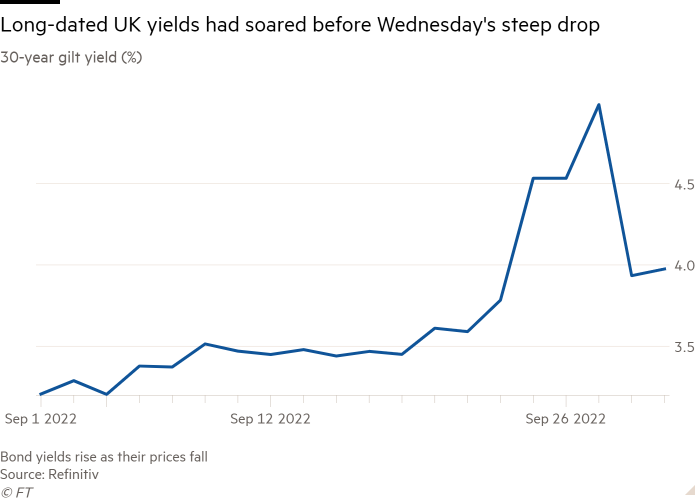

On Wednesday, the Bank of England carried out an emergency £65bn intervention in the gilt market to prevent a meltdown in the pensions sector.

In an interview on BBC Radio Nottingham, Truss said it was “important the UK is on the front foot, we are pulling all the levers we can to drive economic growth”.

The UK’s bond and currency markets remained under pressure after a broad rally on Thursday following the BoE’s intervention.

Sterling gave up the gains it had made on Wednesday after the Bank’s announcement, trading down 0.9 per cent at $1.079.

In gilt trading that began just as Truss’s round of interviews was broadcast, selling pressure nudged up borrowing costs, with the yield on the 30-year bond rising 0.06 percentage points to 3.99 per cent, after having posted its steepest drop on record on Wednesday.

Selling pressure was more acute for shorter-dated UK bonds, with the yield on the policy-sensitive two-year gilt rising almost 0.2 percentage points on Thursday to 4.4 per cent. The benchmark 10-year yield added 0.16 percentage points to 4.17 per cent, partially reversing a drop of almost 0.5 percentage points in the previous session.

Truss praised the BoE for its intervention on government debt, adding it “does a very, very good job on delivering financial stability”.

The prime minister received a hostile response in nearly all of the interviews.

Truss was asked on BBC Radio Nottingham whether she was pursuing a “reverse Robin Hood” after cutting the top 45p rate of tax for higher earners. “That simply isn’t true,” she said.

She added that her government’s energy package — which will limit price rises for households and companies — was likely to reduce inflation by up to 5 per cent as well as increasing economic growth.

On BBC Radio Kent, Truss was asked whether she would reverse the Budget measures for listeners “who cannot sleep at night”. She responded: “I don’t accept the premise of the question. The action we’ve taken has been helping people with their fuel bills.”

She also insisted that the economic turbulence had been chiefly prompted by the war in Ukraine, not last Friday’s fiscal event. “It’s not just Britain facing difficulties, this is a global problem,” she said.

The moves in the UK gilt markets were mirrored in global markets on Thursday, with yields on US Treasuries and German Bunds rising as they were also sold off.

But in an interview on Thursday, Mark Carney, former governor of the Bank of England, tore into the government’s fiscal plans for exacerbating financial instability and working at cross-purposes with the central bank.

Carney rejected ministers’ claims that market turmoil was a global phenomenon, saying, “in the case of the last week, developments have centred around the UK”.

He criticised chancellor Kwasi Kwarteng for “undercutting” institutions such as the Office for Budget Responsibility and Treasury civil servants.

He added that ministers were trying to stimulate short-term growth just as the central bank was trying to restrain it to control inflation.

“Having a partial Budget in these circumstances — tough global economy, tough financial market position — [and] working at cross-purposes with the [BoE] has led to quite dramatic moves in financial markets,” Carney said.

The message from the finance sector, he added, was that “there is a limit to unfunded spending and unfunded tax cuts in this environment”.