According to data from the Bank for International Settlements (BIS), published in the latest BIS Bulletin No. 69, researchers assessed that, on average, most users lost money on their investments over the past seven years. Onchain data, metrics from exchanges, and cryptocurrency application download statistics gathered by BIS researchers suggest that most median retail crypto investors lost money from August 2015 to the end of 2022.

BIS Report Shows Majority of Retail Bitcoin Investors Lost Money Over the Last Seven Years

After publishing recommendations from economists at the Bank for International Settlements (BIS) regarding three policies for global regulators, BIS published a report that explores “crypto shocks and retail losses.” The report initially covers the Terra/Luna collapse and the FTX bankruptcy, during which the researchers observed a significant increase in retail trading activity.

At that time, BIS researchers noted that “large and sophisticated investors” were selling, while “smaller retail investors” were buying. In the section titled “In Stormy Seas, ‘the Whales Eat the Krill,’” it is detailed that “a striking pattern during both episodes was that trading activity on the three major crypto trading platforms increased markedly.”

BIS researchers note that “larger investors probably cashed out at the expense of smaller holders.” The report adds that whales sold a significant portion of bitcoin (BTC) in the days following the initial shocks from Terra/Luna and the FTX collapse. “Medium-sized holders, and even more so small holders (krill), increased their holdings of bitcoin,” the BIS researchers explain.

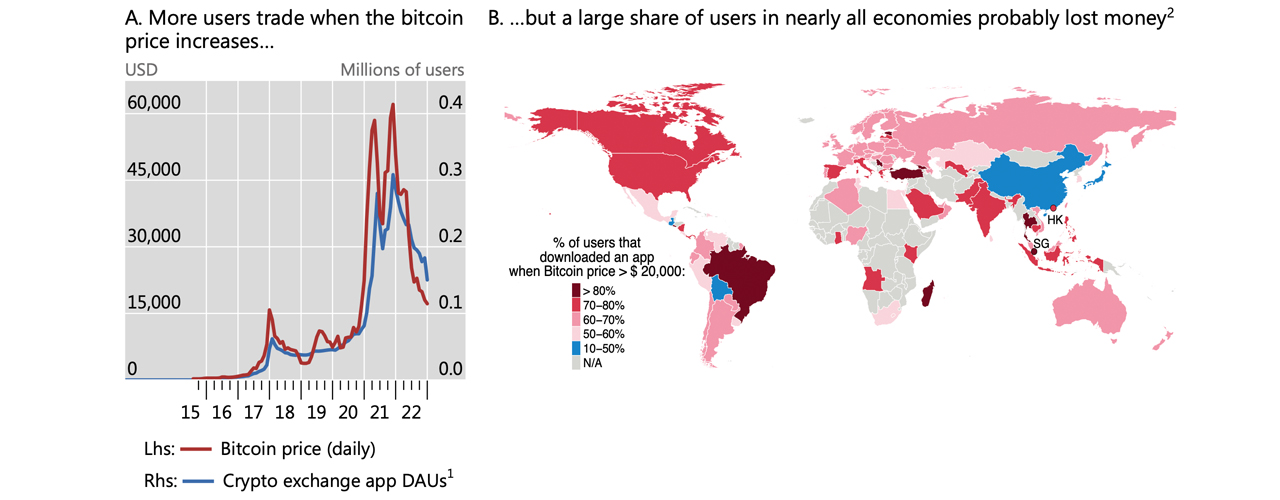

In the second part of the report, BIS calculated metrics from onchain data, overall application download statistics, and exchange data to assess whether most median retail cryptocurrency investors profited or lost money over the last seven years. The data was collected from August 2015 to mid-December 2022, in a section titled “Retail Investors Have Chased Prices, and Most Have Lost Money.”

BIS conducted a series of simulations, such as dollar-cost averaging $100 in BTC per month, and concluded that over the seven-year period, “a majority of investors probably lost money on their bitcoin investment” in nearly all economies in the researcher’s sample. Despite the activity stemming from the Terra/Luna fiasco, the FTX bankruptcy, and the statistics indicating that median retail cryptocurrency investors lost money over the last seven years, BIS researchers insist that “crypto crashes have little impact on broader financial conditions.”

The retail losses and patterns still suggest to BIS researchers that there is a need for “better investor protection in the crypto space.” While the analysis shows there was a “steep decline in the size of the crypto sector,” it has “not had repercussions for the wider financial system so far.” However, BIS researchers claim that if the crypto economy were more “intertwined with the real economy,” crypto shocks would have far greater impacts.

What do you think about the BIS report about crypto shocks and retail losses? Let us know your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer