Municipals were firmer in spots Tuesday, underperforming a U.S. Treasury rally. Equities ended in the black.

Over the last month or so there’s been some volatility in the muni market driven by the Treasury side, said Daryl Clements, municipal portfolio manager at AllianceBernstein.

USTs, which continue to be affected by Fed and related market expectations, saw yields fall five to 17 basis points Tuesday after the release of economic reports on consumer confidence and job openings.

“With Jackson Hole behind us, and not really living up to the usual hype, the focus now switches to the September central bank meetings and the key data releases that could sway them one way or another as policymakers ask themselves whether they’ve already done enough,” said Craig Erlam, senior market analyst for the UK and EMEA at OANDA.

From the Fed’s perspective, he said, “the week is off to a promising start with the JOLTS job opening report much softer than expected, alongside downward revisions to the previous month.”

The Fed, Erlam said, “needs to see a softer labor market to be confident that price pressures aren’t just abating but substantially and sustainably and this report is a move in the right direction.”

Job openings returned to levels last seen in the summer of 2021 and “not too far from where they were pre-pandemic,” he said.

“Further softness over the next few months looks very plausible, which could contribute to a cooler labor market and sustainably lower wage growth,” he said.

As the Fed approaches the “ninth inning” of its rate hiking cycle — which may or may not include one more rate hike — Clements expects over the next 12 months to 18 months, munis will perform very well.

The muni market was positive in June and July, but negative in August. Heading into September, the muni market will weaken a little bit because of technicals, he said.

“But you’re also coming into a point in time where munis are becoming attractive relative [to] Treasuries, and yields [may not be] topping out, but they’re getting pretty close,” Clements said.

From a technical perspective, the market may weaken slightly, but market dynamics are “pretty darn attractive.”

And while muni mutual funds are not seeing the record level of outflows as in 2022, $8 billion has been pulled from mutual funds year-to-date.

“There’s still a lot of cash on the sidelines,” said Matthew Norton, chief investment officer for municipal bonds at AllianceBernstein.

“There’s been pockets of demand and money going back into funds here and there, but what keeps happening is if somebody will come back into funds, and then you’ll see a big interest rate spike, and then people pump [the] brakes a little bit and pull money” out.

Ultimately, he said, when the Fed is done hiking interest rates, people will start talking more about locking in these higher rates.

The conversation at the beginning of 2024 will be more about “getting out of cash because cash yields might potentially be coming down over the next several years,” he said.

There has been an “ebb and flow” when it comes to mutual funds, he noted.

Matt Fabian, a partner at Municipal Market Analytics, said “skittish” fund flows are problematic and, away from exchange-traded funds, they have netted $200 million since July 1.

Even when including ETFs, flows through the second half of the year stand at $2.4 billion, with 70% of that achieved by a single week of ETF inflows in mid-July, Fabian said.

“The resulting lack of any sentiment besides ambivalence has muted price discovery and narrowed investor participation; it is reasonable that issuers have temporarily slowed borrowing plans again (at least versus seasonal expectations),” he said.

Low 30-day new issue supply expectations, not to mention curtailed industry projections for year-end, and a problematic economic backdrop, “will do little to curtail [government] spending austerity,” he said.

This means “today’s higher-yielding bonds likely also carry favorable, scarcity-linked (nominal and relative) performance expectations at least through the year and end probably beyond,” he said.

However, Fabian said, “household and other going-away investors remain hesitant to go bigger with portfolio additions so long as Fed threats mean an undependable bid side from the mutual funds.”

Fundamentals remain strong, Clements said.

From a balance sheet perspective, states are in the best financial shape they’ve been in ever. “They’re sitting on more cash than they’ve ever had relative to their expenses,” he said.

So even if the economy experiences a recession, states are better prepared today than in 2007.

A little bit of weakness remains “on the revenue side for certain states, but for the most part, they have the balance sheet that can weather any kind of any storm,” Clements said.

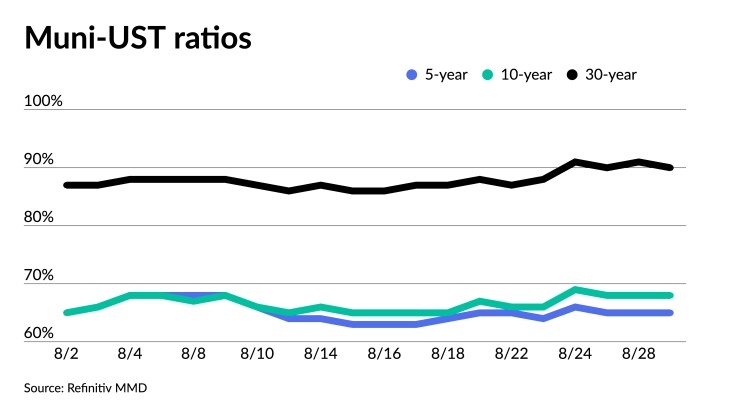

The two-year muni-to-Treasury ratio Tuesday was at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 72% and the 30-year at 92%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 65%, the 10-year at 68% and the 30-year at 90% at 4 p.m.

In the primary market Tuesday, Wells Fargo Bank priced for the Healthcare Authority of the City of Huntsville, Alabama’s (A1///) $190 million of Series 2023A refunding revenue bonds with 5s of 6/2053 with a mandatory tender date of 6/1/2030 at 3.75%, callable 3/1/2030.

Wells Fargo Bank priced for Lakeland, Florida, (/AA/AA/) $154.675 million of energy system revenue and refunding bonds, Series 2023, with 5s of 10/2029 at 3.15%, 5s of 2033 at 3.23%, 5s of 2038 at 3.95%, 5s of 2043 at 4.13%, 5s of 2048 at 4.30% and 4.25s of 2048 at 4.57%.

Citigroup Global Markets priced for South Carolina State Housing Finance and Development Authority (Aaa///) $100 million of non-AMT mortgage revenue bonds, with 3.45s of 1/2025 at par, 5s of 1/2028 at 3.65%, 5s of 7/2028 at 3.69%, 4.2s of 1/2033 at par, 4.2s of 7/2033 at par, 4.4s of 7/2038 at par, 4.75s of 7/2043 at par, 4.85s of 7/2048 at par, 4.9s of 7/2053 at par and 6s of 1/2054 at 4.38%, callable 7/1/2032.

Secondary trading

Connecticut 5s of 2024 at 3.36% versus 3.34% on 8/21. North Carolina 5s of 2024 at 3.34% versus 3.35% Friday. California 5s of 2024 at 3.00% versus 3.00% on 8/16.

Maryland 5s of 2028 at 2.93%-2.92% versus 2.97% Friday. D.C. 5s of 2028 at 2.94%-2.92% versus 2.77% on 8/16 and 2.80% on 8/10. DASNY 5s of 2029 at 3.09%-3.07%.

New Mexico 5s of 2032 at 3.10%. California Educational Facilities Authority 5s of 2033 at 2.81%-2.75% versus 2.78% Monday and 2.76% Friday. Triborough Bridge and Tunnel Authority 5s of 2034 at 3.25% versus 3.14% original on 8/9.

Washington 5s of 2048 at 4.13% versus 4.21% on 8/23 and 4.06%-4.05% on 8/16. Triborough Bridge and Tunnel Authority 5s of 2048 at 4.27%-4.28% versus 4.29%-4.30% Friday and 4.34% on 8/22. Battery Park City Authority 5s of 2053 at 4.20% versus 4.18% Monday.

AAA scales

Refinitiv MMD’s scale was bumped up to three basis points: The one-year was at 3.27% (unch) and 3.16% (-3) in two years. The five-year was at 2.90% (-3), the 10-year at 2.95% (unch) and the 30-year at 3.91% (unch) at 3 p.m.

The ICE AAA yield curve was bumped one to three basis points: 3.28% (unch) in 2024 and 3.21% (-2) in 2025. The five-year was at 2.88% (-2), the 10-year was at 2.86% (-1) and the 30-year was at 3.87% (-1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was bumped up to three basis points: 3.28% (unch) in 2024 and 3.16% (-3) in 2025. The five-year was at 2.91% (-3), the 10-year was at 2.96% (unch) and the 30-year yield was at 3.90% (unch), according to a 4 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 3.27% (unch) in 2024 and 3.18% (unch) in 2025. The five-year at 2.89% (-1), the 10-year at 2.89% (unch) and the 30-year at 3.87% (-1) at 4 p.m.

Treasuries rallied.

The two-year UST was yielding 4.880% (-17), the three-year was at 4.570% (-13), the five-year at 4.264% (-14), the 10-year at 4.108% (-9), the 20-year at 4.411% (-7) and the 30-year Treasury was yielding 4.224% (-5) near the close.

Primary to come:

Jacksonville, Florida (/AA/AA-/AA) is set to price Wednesday $290.345 million of special revenue and refunding bonds, Series 2023A, and special revenue refunding bonds, Series 2023B, consisting of $259.495 million Series 2023A, serials 2024-2043, term 2048, 2053, and $30.85 million Series 2023B, serials 2024-2026. Raymond James & Associates, Inc.

Competitive:

The South Carolina Association of Government Organization (MIG-1///) is set to sell $230.191 million of certificates of participation (South Carolina School District Credit Enhancement Program) at 11 a.m. eastern Thursday.