Municipals were weaker Monday, rising in sympathy with U.S. Treasuries. Equities rallied.

Triple-A benchmarks were cut up three to eight basis points, depending on the scale, while UST yields were up four to nine near the close.

The two-year muni-to-Treasury ratio Monday was at 70%, the three-year was at 70%, the five-year at 71%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 72%, the five-year at 72%, the 10-year at 74% and the 30-year at 91% at 3:30 p.m.

“The combination of higher yields and this week’s heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis,” said CreditSights strategists Pat Luby and Sam Berzok.

“With only five full weeks left between now and Thanksgiving, we view the surge in supply and any cheapening of yields and spreads as an opportunity,” they said.

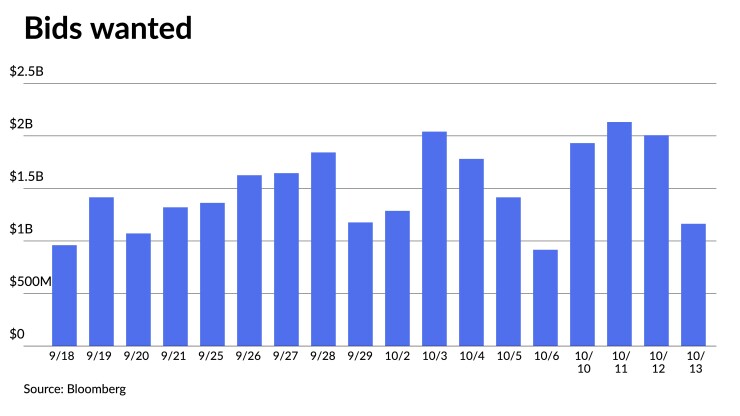

Bond Buyer 30-day visible supply sits at $18.33 billion, with a large amount of that total coming this week.

Mutual fund performance is worth considering as the funds continued to “get hit with outflows, while [exchange-traded funds] raked in investor cash,” noted Birch Creek Capital in a weekly report.

Investors pulled $781 million from muni mutual funds last week, with open end funds losing $1.3 billion, while ETFs gained $518 million, according to LSEG Lipper.

The strength “was initially led by dealers looking to rebuild their inventory after paring risk over the past few weeks of negative performance, however, the inflows led ETFs to aggressively put cash to work,” Birch Creek strategists said.

Due to the development of stronger demand, they said “mutual funds and trading accounts also joined the party, though many mutual funds seem keen on waiting for [this] week’s $12 billion primary calendar for better deals.”

Despite the continued outflows, it does not necessarily indicate an absence of demand, according to CreditSights strategists.

“Increasing municipal bond yields and negative municipal bond mutual fund flows create a vicious circle, in which rising yields result in lower prices and mutual fund NAVs, which tends to be associated with continued outflows,” they said.

When declining NAVs happen toward end of a calendar year, CreditSights strategists noted “tax-loss swaps can add to or extend the redemption cycle.”

Due to the recent sharp increase in yields, they expect mutual fund investors to be “realizing losses by redeeming or swapping mutual fund positions.”

Even if muni yields stabilize, they do not think “mutual fund flows will turn positive before year-end unless there is a clear move in the market towards lower yields (which would slow down or stop tax-loss selling),” they said.

While muni mutual funds have lost $6.2 billion year-to-date, muni ETFs have added $6.7 billion, CreditSights strategists said.

Mutual fund flows have been negative in 29 out of 41 weeks in 2023, while ETF flows have been negative only 16 of those weeks, they noted.

With only 11 weeks left in 2023 year, Birch Creek strategists expect to see “a continued rotation out of mutual funds and into ETFs to lock in tax-losses, but with the higher absolute yields on offer and ETFs who are less discerning in their purchases, this may cause stronger performance than we’d normally see during outflow cycles.”

Secondary trading

Florida 5s of 2024 at 3.61%-3.67% versus 3.85% Thursday and 3.76%-3.75%. Ohio 5s of 2024 at 3.74% versus 3.77% Wednesday. Georgia 5s of 2025 at 3.59%.

NY Dorm PIT 5s of 2028 at 3.53% versus 3.56% Friday. Maryland 5s of 2028 at 3.41%-3.38% versus 3.58%. California 4s of 2029 at 3.49%.

NYC TFA 5s of 2031 at 3.63% versus 3.67%. University of California 5s of 2032 at 3.22%-3.20%. Alexandria, Virginia, 5s of 2034 at 3.44% versus 3.57% on 10/4.

Washington 5s of 2048 at 4.59% versus 4.40%-4.50% Thursday and 4.47% Wednesday. NYC 5s of 2051 at 4.79%. Massachusetts 5s of 2052 at 4.67%-4.66% versus 4.50% Wednesday.

AAA scales

Refinitiv MMD’s scale was cut three to eight basis points: The one-year was at 3.64% (+3) and 3.56% (+3) in two years. The five-year was at 3.34% (+5), the 10-year at 3.41% (+5) and the 30-year at 4.32% (+8) at 3 p.m.

The ICE AAA yield curve was cut three to seven basis points: 3.64% (+3) in 2024 and 3.59% (+3) in 2025. The five-year was at 3.37% (+4), the 10-year was at 3.40% (+5) and the 30-year was at 4.35% (+7) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut three to eight basis points: The one-year was at 3.67% (+3) in 2024 and 3.59% (+3) in 2025. The five-year was at 3.38% (+5), the 10-year was at 3.42% (+5) and the 30-year yield was at 4.33% (+8), according to a 3 p.m. read.

Bloomberg BVAL was cut three to six basis points: 3.66% (+3) in 2024 and 3.60% (+4) in 2025. The five-year at 3.36% (+5), the 10-year at 3.44% (+5) and the 30-year at 4.37% (+6) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.097% (+5), the three-year was at 4.873% (+6), the five-year at 4.717% (+8), the 10-year at 4.709% (+9), the 20-year at 5.075% (+10) and the 30-year Treasury was yielding 4.861% (+10) at 3:30 p.m.

Primary to come:

Connecticut (Aa3/AA/AA-/AAA/) is set to price Wednesday $1.225 billion of special tax obligation bonds, transportation infrastructure purposes, consisting of $875 million of new-issue bonds, Series A, serials 2024-2044, and $350.250 million of refunding bonds, Series B, serials 2025-2034. RBC Capital Markets.

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $1 billion of future tax-secured tax-exempt subordinate bonds, Fiscal 2024 Series C, serials 2025-2048, term 2053. Ramirez & Co.

The California Community Choice Financing Authority (Aa3///) is set to price next week $600 million of green clean energy project revenue bonds, Series 2023F. Goldman Sachs.

The Wellstar Health System, Georgia, is set to price Wednesday $547.190 million of revenue bonds and revenue anticipation certificates, consisting of $296.195 million of Series 2023A (A2/A+//), terms 2048 and 2053; $56.935 million of Series 2023B (Aa1/AAA//), serials 2024-2043; $114.130 million of Series 2023A (A2/A+//), serials 2024, 2027-2032, 2041-2043 and 2053; and $79.93 million of Series 2023A (A2/A+//), term 2053. BofA Securities.

The Oklahoma Turnpike Authority (Aa3/AA-/AA-/) is set to price Tuesday $500 million of Oklahoma Turnpike System second senior revenue bonds, serials 2032-2043, terms 2048 and 2053. RBC Capital Markets.

The School District of Philadelphia is set to price Wednesday $400 million of tax revenue anticipation notes, Series A of 2023-2024, serials 2024. BofA Securities.

The school district (A1//A+/) is also set to price Wednesday $332.450 million of GOs, consisting of $284.995 million of Series A, serials 2024-2043, term 2048, and $47.495 million of Series B, serials 2024-2043, term 2048. RBC Capital Markets.

The West Virginia Hospital Finance Authority (Baa1/BBB+//) is set to price Thursday $384.555 million of hospital refunding and improvement revenue bonds (Vandalia Health Group), Series 2023B, serials 2040-2043, terms 2048 and 2053. BofA Securities.

San Antonio, Texas (Aa2/AA/AA/), is set to price Tuesday $297.230 million of Electric and Gas Systems revenue refunding bonds, New Series 2023C, serials 2024-2044. Siebert Williams Shank & Co.

Charlotte, North Carolina (Aaa/AAA/AAA/), is set to price Thursday $219.785 million of GO refunding bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The Arlington County Industrial Development Authority, Virginia (/AA+/AA+/), is set to price Wednesday $165.635 million of taxable Series 2023A and tax-exempt Series 2023B County Barcroft Projects revenue bonds, J.P. Morgan Securities LLC.

The New Mexico Finance Authority (Aa1/AAA//) is set to price Wednesday $162.945 million of Public Project Revolving Fund senior lien revenue bonds, Series 2023B. Morgan Stanley.

The Brownsburg 1999 School Building Corp., Indiana (/AA+//), is set to price Thursday $160.1 million of ad valorem property tax first mortgage bonds, serials 2027-2043. Stifel, Nicolaus & Co.

Cape Coral, Florida (/AA//), is set to price Thursday $138.085 million of Build America Mutual-insured utility improvement assessment refunding bonds (North 1 West Area), Series 2023. Morgan Stanley.

The Washington State Housing Finance Commission (/BBB//) is set to price Thursday $134.06 million of Seattle Academy of Arts and Sciences Project nonprofit revenue and refunding revenue bonds. Piper Sandler & Co.

The Colorado School of Mines Board of Trustees (A1/A+//) is set to price Thursday $133.53 million of institutional enterprise revenue bonds, consisting of $50.06 million of fixed-rate bonds, Series 2023C, and $83.47 million of term-rate bonds, Series 2023D. Morgan Stanley & Co.

The Conroe Independent School District is set to price Thursday $104.98 million of unlimited tax refunding bonds, consisting of $92.225 million of PSF-insured bonds, Series 2023A, and $12.755 million on non-PSF-insured bonds, Series 2023B. Piper Sandler & Co.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $100 million Series 2023A fresh water revenue bonds, serials 2032-2036, terms 2037, 2038, 2039, 2040 and 2041. Loop Capital Markets.

The New Mexico Mortgage Finance Authority (Aaa///) is set to price Thursday $100 million of tax-exempt non-AMT single-family mortgage program Class I bonds, 2023 Series D, serials 2025-2035, terms 2038, 2043, 2048, 2053 and 2054. RBC Capital Markets.

Competitive

The City and County of San Francisco (Aa1/AA+/AA/) is set to sell $103.92 million of taxable Affordable Housing and Community Facilities Projects certificates of participation, Series 2023A, at 11:15 a.m. eastern Tuesday, and $79.345 million of tax-exempt Multiple Capital Improvement Projects certificates of participation, Series 2023B, at 11:45 a.m. Tuesday.

Massachusetts (Aa1/AA+/AA+/) is set to sell $550 million of GOs, consolidated loan of 2023, Series D, at 11 a.m. eastern Tuesday; $275 million of GO bonds, consolidated loan of 2023, Series B, at 10 a.m. Tuesday; $260 million of taxable GOs, consolidated loan of 2023, Series E, at 11:30 a.m. eastern; $200 million of GOs, consolidated loan of 2023, Series C, at 10:30 a.m. Tuesday; and $188.705 million of GO refunding bonds, Series C, at 12 p.m. Tuesday.

The Empire State Development, New York (Aa1//AA+/) is set to sell $377.825 million of state sales tax revenue bonds, Series 2023A (Bidding Group 2 bonds), at 11 a.m. eastern Thursday; $347.595 million of state sales tax revenue bonds, Series 2023A (Bidding Group 4 bonds), at 12 p.m. Thursday; $270.365 million of state sales tax revenue bonds, Series 2023A (Bidding Group 3 bonds), at 11:30 a.m. Thursday; and #213.51 million of state sales tax revenue bonds, Series 2023A (Bidding Group 1 bonds), at 10:30 a.m. Thursday.