As prolonged and excessively high temperatures broiled parts of the Southwest this year, they were also cooling down the economy and highlighting state and local governments’ heat-related risks and needs.

Record-breaking temperatures in Texas likely reduced the state’s gross domestic product by 1 percentage point or about $24 billion as some companies had a harder time supplying goods and consumers spent less, according to an analysis last week from the Federal Reserve Bank of Dallas.

“The impact of an increase in summer temperatures on Texas GDP growth is twice as pronounced as the change in the rest of the U.S. because summers are generally hotter relative to the rest of the country,” the analysis said.

Bloomberg News

It noted that about a quarter of business executives who responded to the Dallas Fed’s August business outlook surveys said the heat wave led to lower consumer demand, less activity in temperature-sensitive worksites, or reduced labor productivity, which in turn drove declines in revenue and production.

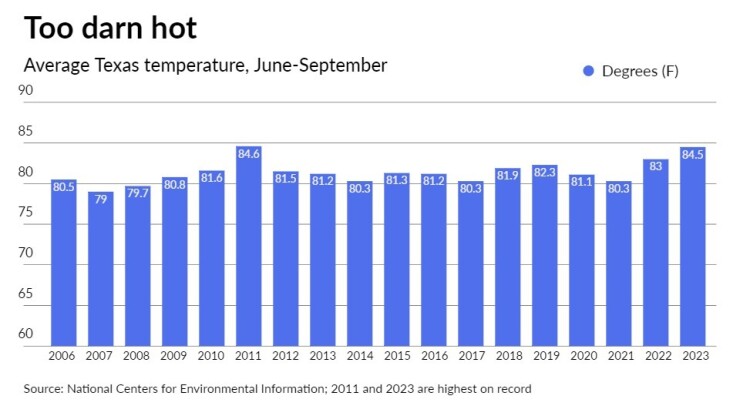

The average temperature in Texas this June through September was the second highest on record at 84.5 degrees, according to National Centers for Environmental Information data going back to 1895. The record of 84.6 degrees was set in 2011.

A July report from The Perryman Group, which estimated a net loss of $9.55 billion in the Texas real gross product assuming a pattern of high heat continued through August, said extreme weather events like heat waves cost the economy billions of dollars.

“Over a long period of time, persistent temperature increases will have even larger and more profound economic consequences,” the report added.

Still, Texas job growth has remained strong with Gov. Greg Abbott on Friday reporting the state broke records last month for total jobs, total labor force size, and total number of Texans working.

“Texas employers added 61,400 jobs in September across diverse industries, marking 24 months in a row that the state has surpassed all previous records for total jobs,” he said in a statement.

Sales tax collections, the largest source of state funding for the Texas budget, have slowed.

“Modest growth in sales tax revenue compared with last year may reflect a slowing pace of economic growth, as well as cooling inflation,” Texas Comptroller Glenn Hegar said in a September revenue report.

Potential long-term economic, demographic, and financial impacts from sustained, excessive heat are on rating agencies’ radar screens.

“It makes logical sense that significant heat for an extended period of time is going to depress economic activity to some extent,” Eric Kim, a Fitch Ratings analyst, said. “That is certainly one of the long-term risks if places become unsustainably hot, or unsustainably under water, or unsustainably subject to wildfire risk.”

He added, however, ratings or outlooks were not changing as a result of this summer’s heat wave, noting the region continues to attract new residents.

Jane Ridley, a S&P Global Ratings analyst, said excessive heat is being watched as it could impact consumer behavior and tax revenue and lead to spending pressures to mitigate its effects.

“We would expect there would be some shifts in expenditures,” she said. “From a credit perspective what we’d want to know is how (issuers are) accommodating those needs within their budgets.”

While environmental, social, and governance factors have become controversial in some parts of the nation, the market is beginning to focus specifically on climate as the main risk factor for municipal investments, according to Tom Doe, president of Municipal Market Analytics.

“The banking side of the municipal industry is starting to recognize that adaptation projects are a significant opportunity for future bond deals,” he added.

In Phoenix, which has been roasting this year, city leaders hope voters on Nov. 7 approve $500 million of general obligation bonds. The four-part bond referendum — the city’s first since 2006 — includes $7.7 million for heat resiliency projects such as expanded tree planting and green infrastructure.

An average temperature of 102.7 degrees in July in Phoenix set the record for the hottest month for a U.S. city as maximum temperatures reached 110 degrees or higher for 31 consecutive days, according to the Arizona State Climate Office.

The nation’s fifth-largest city has GO ratings of triple-A or just a notch lower, but a study this year found heat stress can boost borrowing costs especially for lower credit-quality municipal bonds with longer-term maturities.

“Among the candidate climate change risks, heat stress exposure stands out quantitatively as the most significant contributor to economic damages,” according to the study, authored by four finance professors and presented at a Brookings Institution Municipal Finance Conference.

Disclosure of heat and other climate risks is under scrutiny.

An MMA report in August that examined climate risk disclosure among Phoenix-area issuers that sold debt this year found only the city’s Sky Harbor International Airport and one other issuer, the Salt River Project, provided substantive disclosure.

“I think bond counsel is saying it’s not material to the payment of the bonds and if you disclose it, it might result in higher costs so we don’t have to disclose it,” Doe said, adding he believes “every bond should have some quantified reflection of what its climate risk is.”

David Sanchez, head of the Securities and Exchange Commission’s Office of Municipal Securities, warned bond attorneys last week disclosure of climate-related risks needs improvement.

Respondents to The Bond Buyer’s 2023 ESG survey ranked environmental factors as most important, ahead of governance and social, but the industry’s views on the overall importance of ESG fell slightly from a 2021 report.

Electric utilities and hospitals were also feeling the heat, according to Moody’s Investors Service.

“Hospitals are normally well equipped to handle seasonal surges, but this heat wave is an additional disruption after one and a half years of volume volatility and expense surges,” Moody’s analyst Daniel Steingart said in a statement in July. “Extreme heat brings marginal utility cost increases, expenses associated with setting up cooling stations, need for IV fluids, and clogged emergency rooms.”

In Texas, a booming economy and population coupled with extreme heat is rapidly increasing electricity demand in the state, the rating agency said in a September report.

“The state’s population passed 30 million in 2022, according to U.S. Census Bureau estimates, and is adding an average of more than 400,000 residents each year,” the report said. “At the same time, increasing large flexible loads, like data centers and crypto-mining facilities, and the broad electrification trend, notably in transportation with the greater adoption of electric vehicles, are further adding to load growth.”

Moody’s said San Antonio and Austin, which are each served by city-owned utilities — CPS Energy and Austin Energy — experienced more heat stress for a longer duration this year.

The Electric Reliability Council of Texas, which manages the flow of power to more than 26 million customers in the state, put out 12 energy conservation notices between June and September as it set 10 all-time peak demand records this summer.

A proposed constitutional amendment on the statewide Texas ballot Nov. 7 would create a state energy fund to provide up to $7.2 billion in loans or grants for projects providing regional backup power sources.