During an unexpectedly challenging year so far, following an even more volatile one in 2022, predicting 2024 may seem daunting amid current market conditions.

Despite that, as an industry it’s important to connect and get a sense of where others see various factors impacting the public finance community, from interest rates to ESG.

We would welcome your participation in our annual Bond Buyer Predictions Survey. We want to tap the collective wisdom of leaders across the public finance sector to predict what trends they think will be shaping their industry and informing their business strategies for 2024 and beyond.

We want your thoughts on interest rates, the potential for a recession or economic downturn, what that might mean for state and local government credit. How will regulatory changes affect issuers and investors alike? What impact will ESG factors and new technologies, such as artificial intelligence and electronic trading, have on the market?

Give us about 10 minutes and we will give you an outlook from your peers in a later report as we kick off 2024.

You can fill out the survey via this link.

In 2022, we asked these and similar questions. The top three challenges the industry anticipated in 2022 for 2023 were rising interest rates, confidence in markets/volatility and loss of business or revenues — participants expected 2023 would be a difficult year through which to navigate.

After a disappointing 2022 for bond volume, expectations for municipal bond issuance dropped considerably this year. One-quarter (25%) expected the 2023 volume to be less than 2022 and almost one-third (31%) expected the volume to be around 2022 volume levels. It would appear the industry is on track with those expectations.

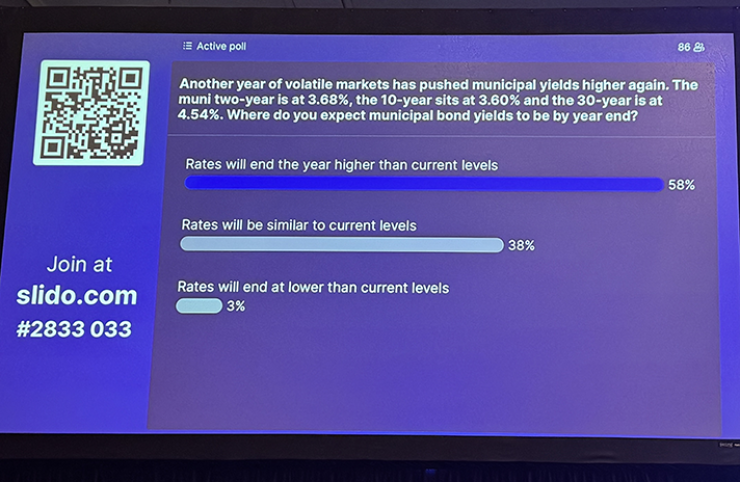

Participants are already thinking about these factors. At our California Public Finance Conference last week, a plurality of participants in a Live Market Survey said they expect municipal interest rates will climb higher by yearend, market volatility will be the biggest challenge facing the industry heading into 2024 and issuance is likely to remain stagnant next year.

We welcome your thoughts by Nov. 1 and look forward to continuing the discussion on the state of the industry.