Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

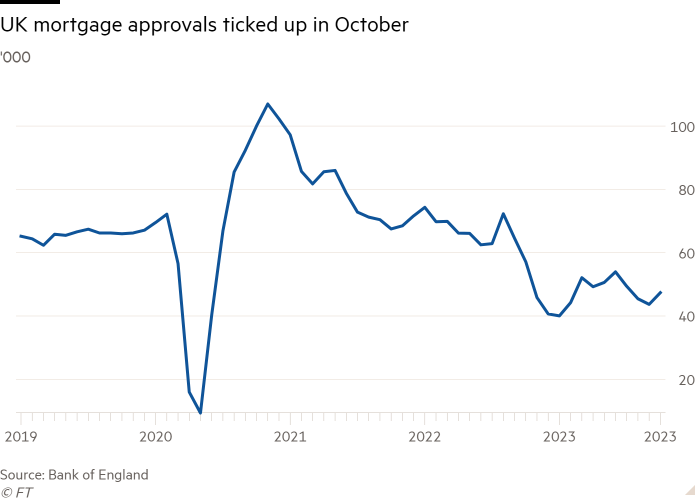

UK mortgage approvals rose more than expected in October, according to official figures published on Wednesday that point to a stabilisation in the property market after a prolonged period of low house sales.

Net mortgage approvals for house purchases rose to 47,400 in October from 43,700 in September, Bank of England data showed. The number was well above economists’ expectations of 45,000 and the highest since July, but about 28 per cent below its level in October 2019, before the pandemic.

Net approvals for remortgaging increased to 23,700 from 20,600 in the same period.

Mortgage approvals provide a timely measure of the health of the housing market, which affects the wider economy via house-related spending and household confidence.

The data released on Wednesday suggests an easing in the housing downturn, after a fall in the cost of some popular mortgage products following the BoE’s decision to leave interest rates at 5.25 per cent in September and November.

Jason Tebb, chief executive of property search website OnTheMarket.com, said it was “clear that the pause in interest rate hikes has boosted market stability and buyer confidence”.

Two-year fixed mortgage rates with 60 per cent loan-to-value eased from 6.2 per cent in July to 5.5 per cent in October, the BoE said, while rates on popular five-year deals have also declined since the summer.

Last month, mortgage providers Halifax and Nationwide reported a month-on-month rise in house prices in October, although the average property was less expensive than in the same month in 2022.

Nevertheless, last month all popular mortgage products remained between two and five times more than expensive than in 2021. Meanwhile, the average rate on new mortgages rose to a 15-year high of 5.25 per cent in October, leaving house sales well below their pre-Covid average.

The BoE data also showed that consumer credit eased only slightly to £1.3bn last month from £1.4bn in September. The figure has remained largely stable over the past two years, although a particularly low number in October 2022 pushed the annual comparison to the highest since 2018.

Paul Dales, chief UK economist at the consultancy Capital Economics, said resilient consumer credit data suggested that “higher interest rates are yet to significantly crimp unsecured borrowing”. However, its strength could also be a result of households being forced to borrow to fund spending, he added.

Consumers also saved more last month, which could negatively affect spending and economic growth. Households deposited £4.6bn in banks and building societies, according to the BoE, the highest since November last year. The rise was driven by flows into fixed-term accounts, which usually pay more interest than instant access accounts.

Samuel Tombs, economist at the consultancy Pantheon Macroeconomics, said he expected spending to rise soon as savings stabilised.

“Households’ saving rate . . . will not increase further, enabling the recovery in real disposable income to feed through to spending,” he said.