Municipals were steady to start the week as investors

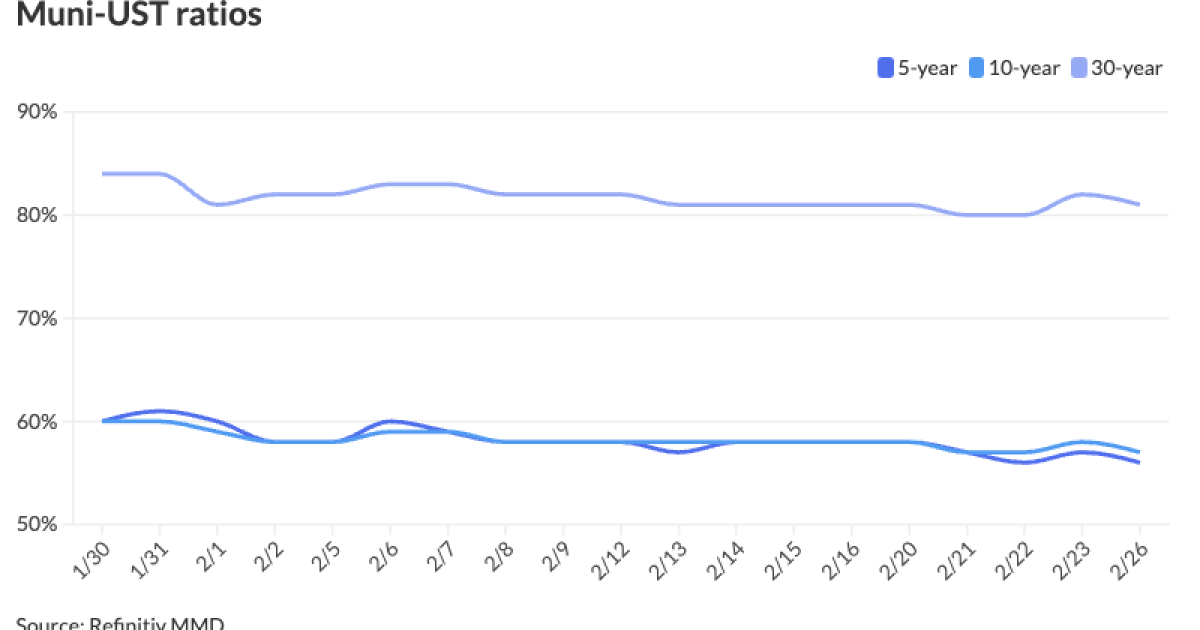

The two-year muni-to-Treasury ratio Monday was at 58%, the three-year at 57%, the five-year at 56%, the 10-year at 57% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 59%, the three-year at 58%, the five-year at 57%, the 10-year at 59% and the 30-year at 82% at 3:30 p.m.

Muni yields were little changed Monday, but yields have risen 12 to 18 basis points since the start of the month.

As muni yields continue to move higher in February, the asset class is “still faring better” than USTs, as they are outperforming USTs, said Jason Wong, vice president of municipals at AmeriVet Securities.

Demand gets a “boost” over the next two weeks as issuers pay out $12.8 billion of March 1 principal repayments, said CreditSights strategists Pat Luby and Sam Berzok.

States with the largest payments are Texas at $2 billion, Pennsylvania at $1.5 billion, South Carolina at $1.3 billion and California at $1.2 billion, they noted.

The supply-demand gap has narrowed with Bond Buyer 30-day visible supply at $10 billion while Bloomberg data shows net negative supply $8.7 billion.

Total redemptions for March will be 15% lower than February’s total, according to CreditSights.

A holiday-shortened week and a smaller new-issue calendar last week led to the muni market being “a bit of snoozer,” said Birch Creek Capital strategists.

Muni mutual funds saw outflows for the third consecutive week, with investors pulling $11.4 million after $140.9 million the week prior.

The smaller outflows meant “flows were near even, though the same pattern seen the past few weeks held true,” Birch Creek strategists said.

Cash continued to move from investment-grade and short-duration funds into long-duration and

With muni valuations “looking extremely stretched,” they noted some of the buying pressure “seemed to ease as a handful of accounts looked to take chips off the table considering the impending supply coming on the horizon.”

However, most funds are holding “their nose” and continuing to “pare down their excess stockpile” due to the amount of cash sitting on the sidelines and the belief that lower rates will happen later this year, according to Birch Creek strategists.

Secondary trading

Wisconsin DOT 5s of 2025 at 2.91% versus 2.96%-2.92% original on Thursday. California 5s of 2025 at 2.82% versus 2.84% Thursday. Maryland DOT 5s of 2026 at 2.75%.

Maryland 5s of 2028 at 2.49% versus 2.49% Wednesday. California 5s of 2029 at 2.46%. Washington 5s of 2031 at 2.53%.

Private Colleges and Universities Authority, Georgia, 5s of 2033 at 2.60% versus 2.62%-2.60% Friday and 2.62% Thursday. University of California 5s of 2034 at 2.34% versus 2.32% Friday and 2.35% Thursday. NYC TFA 5s of 2036 at 2.80%.

Massachusetts 5s of 2049 at 3.85% versus 3.79% Friday and 3.79%-3.77% Thursday. Triborough Bridge and Tunnel Authority 5s of 2049 at 3.84% versus 3.87%-3.86% Wednesday and 3.86%-3.82% on 2/14. LA DWP 5s of 2053 at 3.51%-3.49% versus 3.55%-3.58% Thursday and 3.58% on 2/13.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.96% and 2.74% in two years. The five-year was at 2.44%, the 10-year at 2.46% and the 30-year at 3.59% at 3 p.m.

The ICE AAA yield curve was cut up to one basis point: 2.98% (+1) in 2025 and 2.77% (+1) in 2026. The five-year was at 2.46% (+1), the 10-year was at 2.48% (unch) and the 30-year was at 3.56% (+1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.95% in 2025 and 2.74% in 2026. The five-year was at 2.44%, the 10-year was at 2.47% and the 30-year yield was at 3.57%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.95% in 2025 and 2.81% in 2026. The five-year at 2.46%, the 10-year at 2.53% and the 30-year at 3.65% at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.724% (+5), the three-year was at 4.490% (+4), the five-year at 4.313% (+3), the 10-year at 4.286% (+4), the 20-year at 4.540% (+3) and the 30-year at 4.407% (+4) at 3:30 p.m.

Primary to come

New York City (Aa2/AA/AA/AA+/)

The Bay Area Toll Authority is set to price Wednesday $662.555 million of San Francisco Bay Area Toll Bridge

The Hurst-Euless-Bedford Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $600 million of unlimited tax school building bonds, Series 2024. Jefferies.

Wisconsin is set to price $450 million of GO refunding bonds of 2024, Series 1, and forward-delivery GO refunding bonds of 2025, Series 1. BofA Securities.

The Texas Transportation Commission (Aaa/AAA//) is set to price Tuesday $351.760 million of State Highway Fund first-tier revenue refunding bonds, Series 2024, serials 2024, 2030, 2032-2033. Ramirez & Co.

MMH Master (/BBB+//) is set to price Tuesday $290 million of military housing taxable pooled project surplus cash flow Class I bonds, Series 2024A, serials 2034, 2044. Stifel, Nicolaus & Co.

The Wylie Independent School District, Texas, (Aaa///) is set to price Wednesday $277.385 million of PSF-insured unlimited tax school building bonds, Series 2024. Jefferies.

The Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Tuesday $206.660 million non-AMT social single-family mortgage revenue bonds, Series 2024-144A, serials 2034-2036, terms 2039, 2044, 2049, 2051, 2054. RBC Capital Markets.

The Monmouth County Improvement Authority, New Jersey, is set to price Tuesday $192.544 million of Governmental Pooled Loan Project refunding notes, Series 2024, serial 2025. Raymond James.

Midland County, Texas, (/AA+/AAA/) is set to price Thursday $170 million of certificates of obligation, Series 2024, serials 2025-2044. Frost Bank.

The National Finance Authority (/A+//) is set to price Thursday $168.940 million of tax-exempt social affordable housing certificates, Series 2024-1, Class A. KeyBanc Capital Markets.

Rhode Island Housing (Aa1///) is set to price Wednesday $160 million of homeownership opportunity bonds, consisting of $125 million of non-AMT social bonds, Series 82-A; $9 million of taxable, Series 82-T-1; and $26 million of taxable, Series 82-T-2. RBC Capital Markets.

The Phoenix Union High School District No. 210, Arizona, (Aa1/AA/AAA/) is set to price Tuesday $143.960 million of Project of 2023 school improvement bonds, Series 2024A. , serials 2024-2039. Stifel, Nicolaus & Co.

The Guam Waterworks Authority (Baa2/A-//) is set to price Thursday $134 million of water and wastewater system revenue refunding bonds, consisting of $82.475 million of Series 2024A and $51.525 million of Series 2024B. RBC Capital Markets.

The Utah Housing Corp. (Aa2///) is set to price Wednesday $115.880 million of taxable single-family mortgage bonds, 2024 Series D, serials 2025-2036, terms 2039, 2044, 2050, 2054. Barclays.

The Regents of the University of Minnesota (Aa1/AA//) is set to price Tuesday $107.700 million of GO refunding bonds, Series 2024A, serials 2025-2044. BofA Securities.

The Dormitory Authority of the State of New York (Baa2/BBB//) is set to price Tuesday $100 million of New York Institute of Technology revenue bonds, Series 2024. Morgan Stanley.

The Eagle County School District RE 50J, Colorado, (Aa1///) is set to price Wednesday $100 million of GOs, Series 2024, serials 2036-2043. RBC Capital Markets.

Competitive

The California Infrastructure and Economic Development Bank (Aaa/AAA/AAA/) is set to sell $268.595 million of green Clean Water and Drinking Water State Revolving Fund revenue bonds, Series 2024, at 11:30 a.m., Eastern, Tuesday.

Oyster Bay, New York, is set to sell $165.857 million of water district notes, Series 2024, at 10:45 a.m. Tuesday.

The New Jersey Education Facilities Authority is set to sell $423.125 million of Princeton University revenue bonds, 2024 Series A-1, at 10:45 a.m. Wednesday, and $389.050 million of Princeton University revenue bonds, 2024 Series A-2, at 11:15 a.m. Wednesday/

The Virginia Transportation Board is set to sell $205.275 million of Transportation Capital Projects revenue refunding bonds, Series 2024, Bidding Group 1, at 10:30 a.m. Wednesday, and $214.580 million of Transportation Capital Projects revenue refunding bonds, Series 2024, Bidding Group 2, at 11 a.m. Wednesday.

The Lehigh County Authority, Pennsylvania, is set to sell $165.980 million of water and sewer revenue bonds, Series 2024, at 11:15 a.m. Wednesday.