Municipals sold off Wednesday following another weaker U.S. Treasury session while equities were down near the close.

Muni yields rose two to 13 basis points, depending on the curve, coming on the tailwind of a market correction, said Brad Libby, a fixed-income portfolio manager and credit analyst at Hartford Funds.

Mixed economic data has been challenging for all markets. If the core PCE comes in hotter than expected on Thursday, USTs will likely sell off, with munis following, he said.

The selloff has all but erased earlier-in-the-month gains for munis, though high-yield and short-duration are still in the black for May.

The Bloomberg Municipal Index is at positive 0.13% for May, -1.50% year to date; the High-Yield Index at +1.18% in May, +2.07% YTD; Taxable Municipals at +1.36% MTD and -1.49% in 2024; and, Short Index at +0.31% in May and +1.09% YTD.

With Wednesday’s market moves, it’s likely May’s returns will be in the red.

The recent market moves to higher yields has also led it to move into a higher range of muni-UST ratios, especially in the 10-year part of the curve, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

“After spending much of the year in the 58%-62% range, those ratios are finally becoming more interesting at a notable 67% ratio,” he said.

The two-year muni-to-Treasury ratio Wednesday was at 67%, the three-year at 67%, the five-year at 68%, the 10-year at 67% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 67%, the three-year at 68%, the five-year at 68%, the 10-year at 69% and the 30-year at 84% at 3:30 p.m.

Ratios are still rich compared to historical averages but have begun to look more attractive over the last 18 months, Libby said.

Due to this week’s lower supply slate, he said ratios may “do even better.”

Following this week’s estimated $5.3 billion, Brigati expects more of the “relatively strong” supply that the market has seen over the past several weeks.

Issuance usually slows during the summer months, but the upcoming November election may lead to elevated bond volume, Libby said.

“A lot of issuers are cognizant of the disruptions that the elections may cause in November, so we’re going to possibly see a push of 12 months of supply in 10 months,” he said.

Issuance sits at $184.09 billion year-to-date, up 37.6% year-over-year, per LSEG data.

“It’s certainly been the year of issuance thus far, and probably quite surprisingly, is how well that issuance has been digested by general market,” said Jon Mondillo, head of North American Fixed Income at abrdn.

Part of that stems from the strength of flows, he noted.

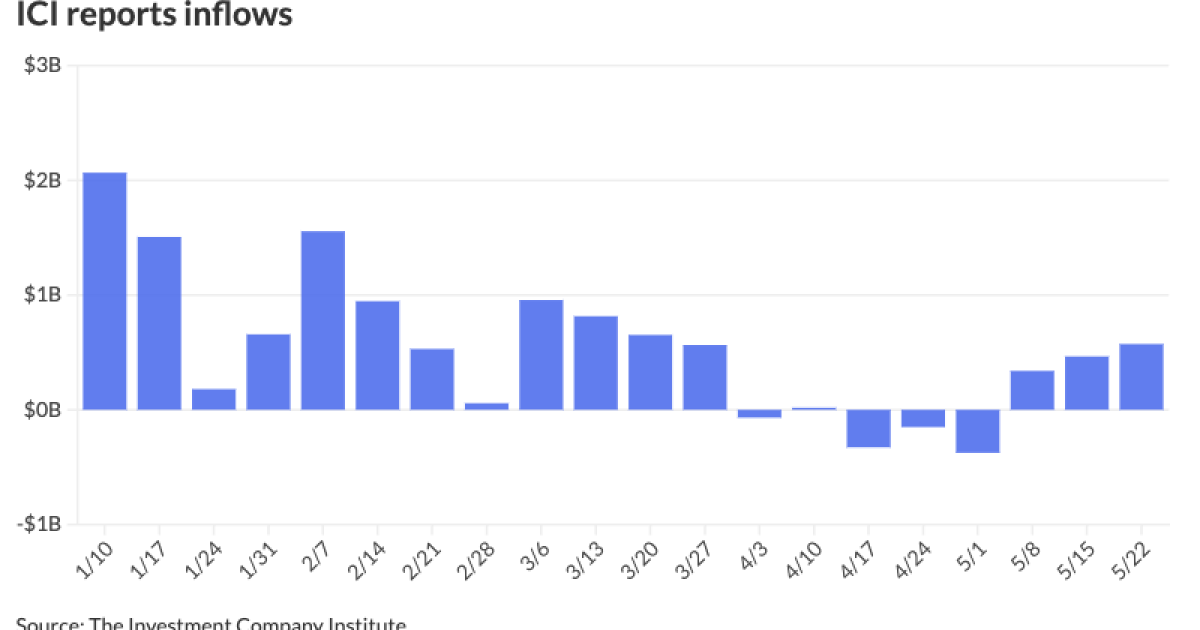

The Investment Company Institute reported inflows into municipal bond mutual funds for the week ending May 22, with investors adding $573 million to funds following $465 million of inflows the week prior. This differs from the

ICI reported

Fund flows are positive year-to-date after two years of significant outflows, Mondillo said.

Muni mutual funds are “rebounding” in 2024 with positive fund flows in both investment grade and high-yield, contributing to the market’s digestion of new deals, according to Mondillo.

While it can be vary among issuer and “where pricing has come in,” some deals can be 10-plus times oversubscribed, speaking to the “health” of the muni market, he said.

The market may not see a reversal of the positive technicals experienced during the summer months when there are “maturing securities, large coupon payments and historically lower issuance,” Mondillo said.

Positive fund flows, along with maturing securities and coupon payments, should bode well for muni debt and total returns looking ahead, he said.

June, July and August are large reinvestment months, with coupon payments coming in to individuals, along with fund complexes, Libby said.

That, he said, will help on the demand side, but it’s unclear what issuers will do on the supply side.

As long as rates stay “well contained,” the supply-demand equation will remain “relatively well balanced,” Libby noted.

Demand is waiting on the sidelines for money to be put to work, with investors waiting for “not just a signal from the Fed that they’re ready to make rate cuts but an actual rate cut,” he said.

In the primary market Wednesday, Goldman Sachs priced for St. Louis (A1/AA/NR/) $287.365 million of Assured Guaranty-insured St. Louis Lambert International Airport revenue bonds. The first tranche, $277.6 million of non-AMT bonds, Series 2024A, saw 5s of 7/2032 at 3.38%, 5s of 2034 at 3.43%, 5s of 2039 at 3.67%, 5s of 2044 at 4.07%, 5.25s of 2049 at 4.30% and 5.25s of 2054 at 4.38%, callable 7/1/2034.

The second tranche, $7.765 million of AMT bonds, Series 2024B, saw 5.25s of 7/2054 at 4.67%, callable 7/1/2034.

Morgan Stanley priced for the Connecticut Housing Finance Authority (Aaa/AAA//) $122.915 million of sustainability Housing Mortgage Finance Program bonds, 2024 Series D. The first tranche, $57.625 million of Subseries D-1, saw all bonds price at par — 3.35s of 5/2025, 3.55s of 5/2029, 3.6s of 11/2029, 3.95s of 5/2034, 3.95s of 11/2034, 4.05s of 11/2039, 4.55s of 11/2044, 4.75s of 11/2049, 4.8s of 11/2054, 4.85s of 11/2059 and 4.9s of 11/2064, callable 5/15/2033.

The second tranche, $65.29 million of Series D-2, saw 3.85s of 11/2064 with a tender date of 5/15/2027 at par.

AAA scales

Refinitiv MMD’s scale was cut five to 10 basis points: The one-year was at 3.41% (+5) and 3.35% (+5) in two years. The five-year was at 3.13% (+10), the 10-year at 3.10% (+9) and the 30-year at 3.96% (+9) at 3 p.m.

The ICE AAA yield curve was cut four to eight basis points: 3.40% (+5) in 2025 and 3.33% (+4) in 2026. The five-year was at 3.13% (+7), the 10-year was at 3.10% (+6) and the 30-year was at 3.92% (+5) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut six to 12 basis points: The one-year was at 3.44% (+6) in 2025 and 3.34% (+6) in 2026. The five-year was at 3.13% (+12), the 10-year was at 3.09% (+12) and the 30-year yield was at 3.95% (+10), according to a 3 p.m. read.

Bloomberg BVAL was cut two to 13 basis points: 3.41% (+2) in 2025 and 3.34% (+7) in 2026. The five-year at 3.12% (+12), the 10-year at 3.09% (+9) and the 30-year at 3.95% (+3) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.976% (+1), the three-year was at 4.793% (+4), the five-year at 4.632% (+5), the 10-year at 4.613% (+7), the 20-year at 4.823% (+8) and the 30-year at 4.733% (+8) at 3:30 p.m.

Negotiated calendar

The Massachusetts Educational Financing Authority is set to price Thursday $473.985 million of education loan revenue bonds, Issue N, Series 2024, consisting of $369.4 million of taxables (/AA//), Senior Series 2024A, serial 2049, term 2033; $53.79 million of AMT bonds (/AA//), Senior Series 2024B, serials 2028-2030, 2032; $10 million of AMT bonds (/A//), Senior Subordinate Series 2024C, term 2032; and $40.795 million of AMT bonds (/BBB//), Subordinate Series 2024D, serial 2054. RBC Capital Markets.

The Fort Bend Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $200 million of PSF-insured variable rate unlimited tax school building and refunding bonds, Series 2024B. Raymond James.

The Homewood Educational Building Authority, Alabama, (Baa2///) is set to price Thursday $188.8 million of CHF – Horizons II Student Housing and Parking Project at Samford University revenue bonds, consisting of $122.195 million of tax-exempts, Series C, serials 2043-2044, terms 2049, 2054, 2056, and $66.605 million of taxables, Series D, serials 2027-2039, term 2043. RBC Capital Markets.

The Irvine Ranch Water District, California, (/AAA/AAA/) is set to price Thursday $166.61 million of refunding bonds, Series 2024A. Goldman Sachs.

The Colorado Springs School District 11 is set to price Thursday $120 million of certificates of participation, Series 2024, serials 2024-2043, term 2048. RBC Capital Markets.

Greensboro, North Carolina, (Aa1/AAA//) is set to price Thursday $116.325 million of combined enterprise system revenue bonds, consisting of $21.155 million of taxables, Series 2024A, serials 2025-2036, and $91.17 million of tax-exempts, Series 2024B, serials 2036-2044, term 2049, 2054. BofA Securities.

The Utah Board of Higher Education (Aa1/AA+//) is set to price Thursday $108.765 million of University of Utah general revenue bonds, consisting of $92.995 million of tax-exempts, Series 2024A-1; $10 million of tax-exempts, Series 2024A-2; and $5.77 million of taxables, Series 2024B. Morgan Stanley.