In another sign of the sector’s recovery, airports are set to flock to the muni market this year as issuers can no longer postpone long-delayed projects and necessary infrastructure maintenance.

Airport issuance got off to a slow start this year with only $3.5 billion priced through the end of May, according to Ramirez’s May airport market update.

Of the $3.5 billion, $2 billion was issued in May, led by $925 million from the San Francisco Airport Commission for the San Francisco International Airport, the firm said.

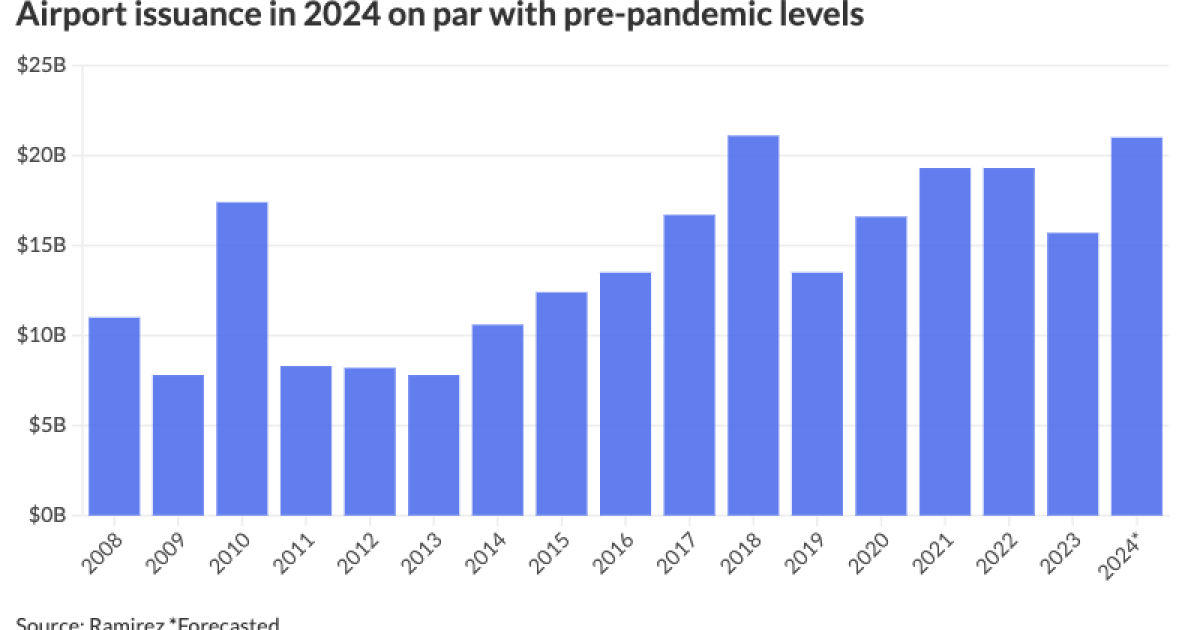

Driven by “ongoing capital expenditure funding and current refunding opportunities,” airport issuance is estimated to reach $21 billion in 2024, with a slew from June through September and more in December, the firm said.

The $17.5 billion of issuance potentially coming to market during the remainder of the year includes the New York Transportation Development Corp. with $1.5 billion of special facilities revenue bonds for JFK Airport’s Terminal One Project later this month.

Despite the lack of supply so far this year, there’s still enough demand for airport issuance and things “are getting done on an orderly basis,” said Sewon Kim, senior managing director and head of the Transportation Group at Siebert Williams Shank.

Investors like airport credits because of “a lot of the yield work that is issued as AMT bonds and there is additional yield that investors pick up as well,” she noted.

“Any kind of additional yield investors can grab, they’ve been grabbing, keeping airport spreads pretty narrow,” said Roberto Roffo, a 30-plus year muni veteran.

In the secondary market for large hub airports, “the spreads of non-AMT airport bonds traded in a tight band by credit; spreads of AMT airport bonds were even more range-bound despite different underlying credits,” Ramirez said in the report.

The increase in supply stems from a “tremendous demand and need for capital improvements, expansion projects, infrastructure upgrades, and maintenance of existing infrastructure,” Kim said.

Airports have endured “a lot of wear and tear” over the years, and due to the pandemic, they “haven’t kept up well” with needed infrastructure and upgrades, Roffo noted.

Many of these projects were put on the “back burner” during to the height of COVID, but airports can no longer ignore the needed infrastructure and upgrades, Kim said, especially as air travel reaches pre-pandemic levels.

“Now that demand is back to where it was a lot of airports that delayed things have restarted what they had to stop because of the uncertainty related to the pandemic,” said Joe Pezzimenti, a director and lead analyst at S&P Global’s U.S. Public Finance Transportation team, at The Bond Buyer’s Southeast Public Finance conference, at the end of May.

“A lot of facilities out there are relatively old, so there’s a big effort to modernize those facilities, as well as trying to accommodate anticipated future growth,” he added.

For the $1.5 billion deal from the New York Transportation Development Corp., the Series 2024 bonds will help finance a part of the initial phase, or Phase A, of the New Terminal One at JFK, according to a preliminary official statement.

The initial phase “provides replacement for airlines at the existing Terminal 1, which will be demolished, and for other airlines expected to be displaced by the redevelopment of other JFK terminals as a part of the Port Authority’s JFK redevelopment plan,” the roadshow states.

Completion of the

“Aging airport infrastructure needs to be replaced, and capacity must be incrementally added to the system to cope with growth in both passenger and cargo traffic,” said Vikram Rai, head of municipal markets strategy at Wells Fargo.

Therefore, to meet infrastructure needs, airports need a total of $151 billion over the next five years, he said, citing data from the Airports Council International.

Some of that issuance may come sooner rather than later as if airports choose to further delay projects, they are also saddled with increased costs, said Jeff Timlin, a partner at Sage Advisory.

“A lot of places probably needed these renovations several years ago, and now, with COVID, supply chain disruptions, and the inflationary pressures, the cost of these projects is cumulative,” he said.

Airports, though, may not always benefit from trying to time the market, market participants said, as these projects have been years in the works.

“They don’t have a lot of flexibility just to pause and wait to see if rates will move a little higher, a little lower; they need to keep the progress of the projects going,” said Seth Lehman, a senior director of Global Infrastructure Ratings at Fitch.

Many large hub airports are “forging ahead” with their capital expenditure plans, most set to be funded by issuing debt, Rai said.

This is partially because a good portion of the federal aid that helped keep airports “afloat” during the pandemic has already been spent, said Mikhail Foux, a Barclays strategist.

And with airports no longer able to count on government assistance, they are forced to tap the muni market, he noted.

Large hub airports are not the only ones issuing large-scale capital projects; now, smaller and medium hub airports are implementing these capital programs, Kim said.

For example, Siebert was a senior manager on a $175 million of AMT airport system revenue bonds from the Greater Asheville Regional Airport, a 60-year-old small hub airport in North Carolina, last year, she noted.

The bonds were issued to expand and modernize the existing terminal to accommodate increased demand, Kim said.

Airports are “looking forward and doing the right things to maintain and keep them competitive in the marketplace,” Roffo said.

This means addressing not only aging infrastructure and COVID-delayed projects, but also upgrading their facilities to stay “ahead of the curve, to have the facilities ready when the demand reaches,” Lehman said.

“Customers want a more enjoyable experience while waiting for the flight or during the layover,” Timlin said.

And with the rebound in airline traffic, issuers can justify renovating these facilities, particularly in areas that would attract alternative revenue sources, he noted.

The airport sector has been steadily recovering since COVID.

Fitch’s 2024 sector outlook for airports is neutral due to “expectations for overall stable credit conditions and a limited range of volatility in volume activities,” the rating agency said in a report.

During the pandemic, many credits got put on a negative outlook, Lehman said.

Some airports with “a little bit more exposure to passenger travel or didn’t have any sort of backstops or only or poorly modest liquidity levels” may have been put on a rate watch, he said.

Most have been restored back to stable, with some, such as Chicago, Houston and Miami, better positioned than they were in 2019 and 2020, Lehman said.

Moody’s outlook for 2024 lists the airport sector as stable as “slowing economic activity weighs on passenger traffic growth,” the firm said in a December report. In an updated sector report from Monday, they noted traffic growth is likely to “surpass” expectations for the year.

In a November report, S&P Global also rated the sector stable, expecting revenue growth to be balanced against “increased financing costs and large step-ups in operations and maintenance expenses as well as renewed capital spending to modernize and expand capacity.”

“Barring any recessionary environment or market catalysts that would tank [most of] the markets, the airline sector is relatively stable and improving,” Timlin added.

While there is week-to-week volatility, there is a positive tone and overall, the market has benefitted airport issuers, Kim said.