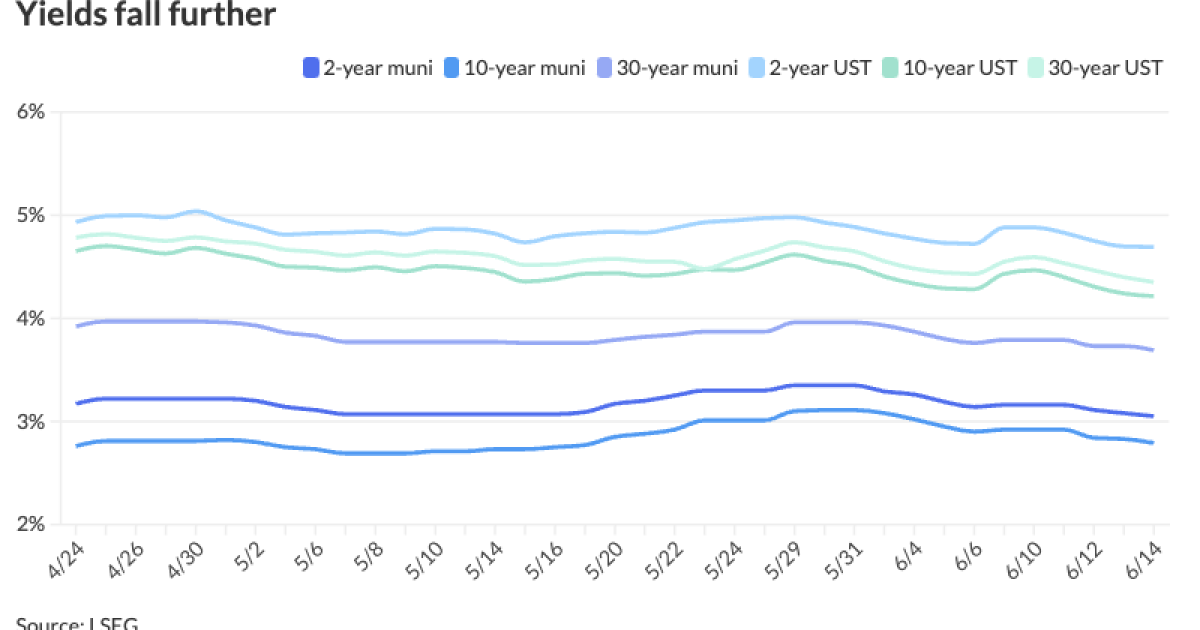

Municipals were firmer ahead of an uptick in issuance next week, while U.S. Treasury yields fell slightly and equities ended mixed.

USTs extended their rally this week after receiving support from “softer” economic data as yields fell 18 to 24 basis points on the week and a total of 20 to 30 basis points month-to-date, Barclays strategists Mikhail Foux and Clare Pickering said.

The muni market has been helped by this turnaround, “especially after it started to show signs of weakness in late May,” they noted.

This rally will continue into the summer but will be “gradual and methodical,” said BofA strategists said.

“A solid job market should support muni credit spreads in the drive toward newer lows, except, perhaps, for the high-yield index,” they said.

If a re-flattening in the UST rates market happens in the future and becomes the consensus, there will probably be an acceleration of the muni market rally, which will likely happen after September, BofA strategists said.

“Our year-end target of 1.80%-1.90% for the 10yr AAA implies a 100bp rally from current levels for the 10-plus year part of the muni curve,” they said.

The market starts pricing in next year’s Federal Reserve rate cuts in the fourth quarter, according to BofA strategists.

Munis, especially the high-yield part of the market, are up “quite a bit” in June, Barclays strategists noted.

However, investment-grade returns are still seeing losses year-to-date for most ratings buckets, they said.

The two-year muni-to-Treasury ratio Friday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 66% and the 30-year at 85%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 67%, the 10-year at 67% and the 30-year at 84% at 3:30 p.m.

“Looking ahead, we are back to a neutral stance, and are waiting for MMD-UST ratios to cheapen further, in order for us to become a bit aggressive, as rate volatility will likely return, in our view,” Barclays strategists said.

Meanwhile, they said, taxable muni spreads have continued “moving sideways,” with the long end slightly outperforming and the credit curve flattening from late April’s “steep” levels.

The Build America Bond extraordinary provision redemption craze has “notably slowed down after the tax-exempt sell-off in late May but Build America Bonds spreads have continued trading in a range, with the spreads of the BBB and single-A rating buckets pretty much on top of each other, relatively close to the T+100 ERP call strikes,” Barclays strategists said.

Taxable supply remains “subdued,” leading to “tight” non-BAB taxable spreads, they noted, with major changes unlikely in the near term, they said.

New-issue calendar rises to $7.3B

The new-issue calendar rises to $7.284 billion next week, with $6.281 billion of negotiated deals coming to market and $1.002 billion of competitive deals on tap.

The negotiated calendar is led by the New York Transportation Development Corp. with $1.5 billion of green AMT special facilities revenue bonds for the

Olathe, Kansas, leads the competitive calendar with $107 million of GO temporary notes.

AAA scales

Refinitiv MMD’s scale was bumped three to four basis points: The one-year was at 3.09% (-4) and 3.05% (-3) in two years. The five-year was at 2.85% (-4), the 10-year at 2.79% (-4) and the 30-year at 3.69% (-4) at 3 p.m.

The ICE AAA yield curve was bumped two basis points: 3.15% (-2) in 2025 and 3.09% (-2) in 2026. The five-year was at 2.85% (-2), the 10-year was at 2.80% (-2) and the 30-year was at 3.68% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped four to five basis points: The one-year was at 3.14% (-4) in 2025 and 3.07% (-4) in 2026. The five-year was at 2.84% (-5), the 10-year was at 2.81% (-5) and the 30-year yield was at 3.68% (-5) at 3:30 p.m.

Bloomberg BVAL was bumped three basis points: 3.14% (-3) in 2025 and 3.09% (-3) in 2026. The five-year at 2.87% (-3), the 10-year at 2.80% (-3) and the 30-year at 3.70% (-3) at 3:30 p.m.

Treasuries were slightly firmer out long.

The two-year UST was yielding 4.689% (-1), the three-year was at 4.426% (-1), the five-year at 4.229% (-1), the 10-year at 4.210% (-3), the 20-year at 4.464% (-3) and the 30-year at 4.346% (-5) near the close.

Primary to come

The New York Transportation Development Corp. (Baa3/BBB-/BBB-/) is set to price Tuesday $1.5 billion of green AMT serial facilities revenue bonds for the John F. Kennedy International Airport New Terminal One Project, serials 2037-2044, terms 2049, 2054, 2060. BofA Securities.

The Public Energy Authority of Kentucky (A1///) is set to price next week $1.108 billion of gas supply revenue refunding bonds, 2024 Series B. Morgan Stanley.

Ohio (Aa2/AA//) is set to price Tuesday $461.020 million of Cleveland Clinic Health System Obligated Group hospital revenue bonds, Series 2024A. BofA Securities.

The New York State Housing Finance Agency (Aa2///) is set to price Tuesday $309.93 million of sustainability affordable housing revenue bonds, consisting of $81.545 million of Series C-1, and $228.385 million of Series C-2. Morgan Stanley.

The Pennsylvania Turnpike Commission (Aa3/AA-/AA-/AA-/) is set to price Tuesday $300 million of turnpike revenue bonds, Series C of 2024, serials 2025-2044, terms 2049, 2054 Loop Capital Markets.

The Oregon Department of Transportation (/AA//) is set to price Tuesday $236.975 million of social grant anticipation revenue bonds, Series 2024, serials 2025-2039. Wells Fargo.

The Detroit Downtown Development Authority is set to price Monday $204.85 million of Catalyst Development Project tax increment revenue refunding bonds, Series 2024, consisting of $114.85 million of Series 2024, serials 2025-2043; and $90 million of Series 2024, term 2048. Jefferies.

The Massachusetts Development Finance Agency (A1///) is set to price Tuesday $196.085 million of Northeastern University Issue revenue refunding bonds, Series 2024A, serials 2025-2043. Barclays.

Raleigh, North Carolina, (Aa2/AA+/AA+/) is set to price Thursday $194.76 million of limited obligation bonds, Series 2024, serials 2024-2039. BofA Securities.

The Indiana Finance Authority (/AAA/AAA/) is set to price Thursday $150 million of green State Revolving Fund Program bonds, Series 2024A, serials 2030-2044. BofA Securities.

The Richardson Independent School District, Texas, is set to price Tuesday $123.895 million of unlimited tax school building bonds, Series 2024. Baird.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Tuesday $116.67 million of taxable social Class I single-family mortgage bonds, Series D, serials 2026-2035, terms 2039, 2046, 2050. Jefferies.

The Georgia Housing and Finance Authority (/AAA//) is set to price Monday $113.75 million of non-AMT single-family mortgage bonds, 2024 Series A, serials 2034-2036, terms 2039, 2044, 2049, 2054. Raymond James.

The Arlington Higher Education Finance Corp. (Ba2///) is set to price Tuesday $107.515 million of BASIS Texas Charter Schools education revenue bonds, Series 2024. Morgan Stanley.

Competitive

Olathe, Kansas, is set to sell $106.6 million of general obligation temporary notes, Series 2024-A, at 10:30 a.m. eastern Tuesday.

Layla Kennington contributed to this story.