Municipals were steady Monday ahead of a surge in supply, as U.S. Treasury yields fell slightly out long and equities were mixed near the close.

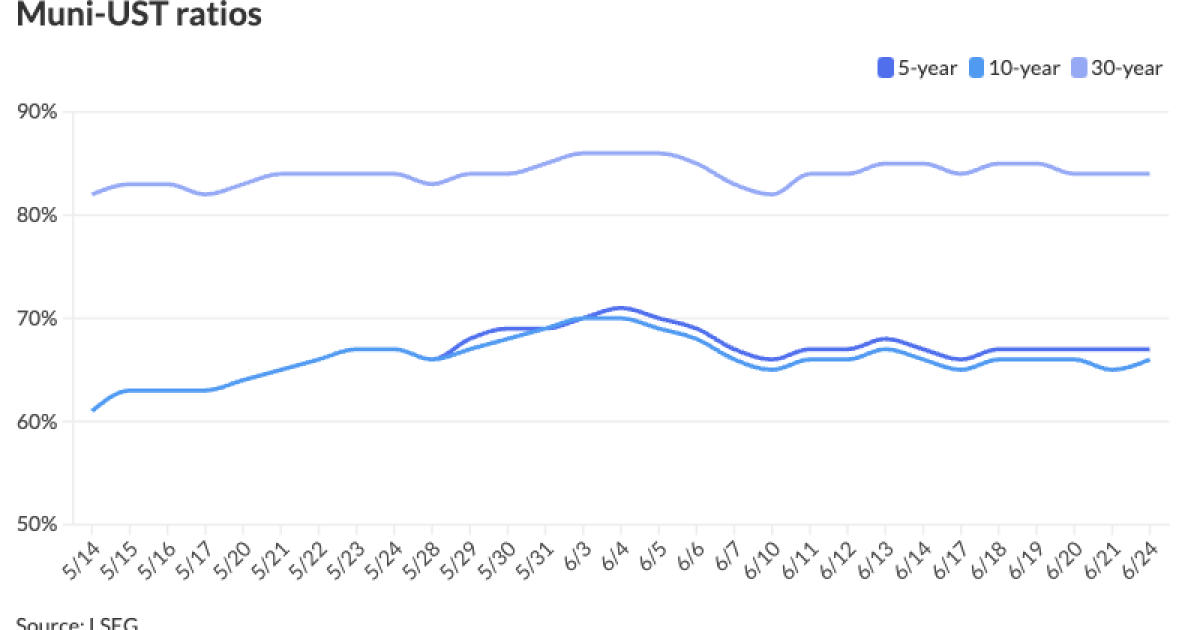

The two-year muni-to-Treasury ratio Monday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 66% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 67% and the 30-year at 84% at 3:30 p.m.

“Munis continue to recover this month after a dismal end to the month of May,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Munis have recovered around 27 to 32 basis points in June, pushing month-to-date returns to 1.76% and year-to-date losses “closer back into the green” as the asset class is only down 0.18% so far in 2024, he noted.

With the “pretty good run” month-to-date, it would not be unexpected to see “the market take a breather, and with a large calendar this coming week, it may again move sideways,” said AllianceBernstein strategists in a weekly report.

However, July reinvestment at an expected $15 billion, should be a tailwind, they said.

The muni market is still “positioned to perform well, with elevated yields and relative values that are fair value to cheap at the short and long ends of the yield curve but somewhat expensive in the belly,” AllianceBernstein strategists said.

This week’s $12-plus billion calendar includes a “diverse mix of ultra high-grade, specialty state, and mid-grade deals,” Birch Creeks strategists said.

The negotiated calendar is led by Los Angeles with $1.5 billion of tax and revenue anticipation notes, followed by the Massachusetts Bay Transportation Authority with $1.05 billion of senior sales tax bonds and the Triborough Bridge and Tunnel Authority with $800 million of payroll mobility tax senior lien refunding green bonds.

Washington leads the competitive calendar with $1.37 billion of GOs in five series.

With one week remaining in June and an anticipated slowing of issuance in July, demand for reinvestments should continue as “we anticipate yields to fall as we wait for any rate cuts coming later this year,” Wong said.

With yields falling, there could be a “surge” of muni issuance later this year, he said.

Last week, the muni market had a “ho-hum week alongside the lack of Treasury volatility, lighter new-issue calendar, and just four trading days,” said Birch Creek Capital strategists in a weekly report.

Munis were steady for the week, though

The 10-year muni-UST ratio was at 66.22% versus 66.77% the week prior, he noted.

Desks reported “lighter” liquidity last week, Birch Creek strategists said.

Customer purchases were down 8%, while bid wanteds fell 6% below the recent average, despite a “notable uptick” in the 20-plus year part of the curve, they said, citing J.P. Morgan data.

Fund flows were “marginally positive” as LSEG Lipper reported inflows of $16 million to muni mutual funds, Birch Creek strategists said.

This marks the third straight week of inflows, led mostly by long-term funds, Wong noted.

Inflows could continue as investors look to lock in higher yields ahead of the Fed cutting rates, he noted.

In the primary market Monday, Wells Fargo priced for Kansas Department of Transportation (Aa2/AA//) $444.785 million of highway user tax revenue refunding subordinate lien bonds, Series 2024A, with 5s of 11/2025 at 3.17%, 5s of 2029 at 2.96% and 5s of 2034 at 3.03%, noncall.

In the competitive market, the St. Louis Community College District (/AA//) sold $213.365 million of certificates of participation bonds, Series 2024, to BofA Securities, with 5s of 4/2028 at 3.03%, 5s of 2029 at 3.00%, 5s of 2034 at 3.09%, 5s of 2039 at 3.40% and 4s of 2044 at 4.16%, callable 4/1/2034.

Los Angeles (Aa2//AAA/)

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.09% and 3.05% in two years. The five-year was at 2.85%, the 10-year at 2.79% and the 30-year at 3.69% at 3 p.m.

The ICE AAA yield curve was cut up to one basis point: 3.14% (+1) in 2025 and 3.07% (unch) in 2026. The five-year was at 2.88% (+1), the 10-year was at 2.84% (+1) and the 30-year was at 3.67% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.14% in 2025 and 3.08% in 2026. The five-year was at 2.85%, the 10-year was at 2.82% and the 30-year yield was at 3.67% at 4 p.m.

Bloomberg BVAL was unchanged: 3.14% in 2025 and 3.09% in 2026. The five-year at 2.88%, the 10-year at 2.80% and the 30-year at 3.71% at 3:30 p.m.

Treasuries were a touch firmer out long.

The two-year UST was yielding 4.733% (flat), the three-year was at 4.461% (flat), the five-year at 4.266% (-1), the 10-year at 4.245% (-1), the 20-year at 4.482% (-2) and the 30-year at 4.377% (-2) at 3:45 p.m.

Negotiated calendar

Los Angeles (MIG-1/SP-1+//) is set to price Wednesday $1.5 billion of tax and revenue anticipation notes, serial 2025. Loop Capital Markets.

The Massachusetts Bay Transportation Authority (/AA+/AAA/AAA/) is set to price Tuesday $1.05 billion of senior sales tax bonds, consisting of $951.99 million of Series A bonds and $99.71 million of sustainability Series B bonds. Morgan Stanley.

The Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/) is set to price Wednesday $800 million of payroll mobility tax senior lien refunding green bonds, Series 2024C. J.P. Morgan.

The Omaha Public Power District (Aa2/AA//) is set to price Wednesday $608.755 million of electric system revenue bonds, consisting of $293.54 million, Series 2024A, serial 2026-2045, terms 2049, 2054, and $315.215 million, Series 2024B, serial 2025-2045. BofA Securities.

The Wisconsin Health and Educational Facilities Authority (/BBB/BBB/) is set to price Wednesday $381.905 million of Marshfield Clinic Health System revenue refunding bonds, Series 2024A, serials 2025-2029, 2031-2033, 2035-2036, term 2054. Barclays.

The Marshfield Clinic Health System (/BBB/BBB/) is set to price Wednesday $176.975 million of taxable corporate CUSIPs, Series 2024, term 2034. Barclays.

The Connecticut Health and Educational Facilities Authority is set to price Thursday $337 million of Yale New Haven Health Issue tax-exempt self-liquidity weekly VRDNs revenue bonds, Series 2024C. Barclays,

The Grand River Dam Authority, Oklahoma, (A1/AA-//) is set to price Tuesday $286.82 million of revenue refunding bonds, Series 2024A. Goldman Sachs.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $250 million of drinking water assistance fund sustainability revenue bonds, Series 2024A, serial 2033-2037, terms 2038, 2039, 2049, 2041, 2041, 2043, 2044, 2045. Stifel, Nicolaus & Co.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Tuesday $250 million of residential mortgage revenue bonds, consisting of $150 million of non-AMT bonds, Series 2024C, serials 2025-2035, terms 2039, 2044, 2049, 2054, 2054, and $100 million of taxables, Series 2024D, serial 2025-2034, term 2039, 2044, 2048, 2054. Ramirez.

The Mansfield Independent School (/AAA/AAA/) is set to price Tuesday $198.365 million of PSF-insured unlimited tax school building bonds, serials 2025-2054. Raymond James.

The Clear Creek Independent School District, Texas, (Aaa//AAA/) is set to price Wednesday $170.255 million of PSF-insured unlimited tax school building and refunding bonds, Series 2024, serials 2025-2044. BOK Financial Securities.

Quincy, Massachusetts, (/AA//) is set to price Tuesday $169.033 million of GO bond anticipation notes of 2024 bonds, serial 2025. Ramirez.

The State Building Authority of Michigan (Aa2//AA/) is set to price $130 million of revenue refunding bonds for the Facilities Program, Series II, serials 2024-2044, terms 2049, 2054, 2059. Jefferies.

The Greater Texas Cultural Education Facilities Finance Corp. (Baa2///) is set to price Wednesday $119.485 million of revenue bonds for the Texas Biomedical Research Institute Project, consisting of $99.525 million of tax-exempts, Series 2024A, serials 2030-2044, terms 2049, 2054, and $19.960 million of taxables, Series 2024B, term 2037. BofA Securities.

The Lewisville Independent School District, Texas, (/AAA//) is set to price Thursday $112.265 million of PSF-insured unlimited tax school building and refunding bonds, serials 2025-2044. Siebert Williams Shank.

The Harris County Cultural Education Facilities Finance Corp., Texas, (Aa3/AA-//) is set to price Tuesday $111.015 million of Memorial Hermann Health System tax-exempt self-liquidity weekly VRDNs hospital revenue refunding bonds, Series 2024F, term 2054. Barclays.

The Little Elm Independent School District, Texas, (/AAA//) is set to price next week $105.995 million of PSF-insured fixed and variable rate unlimited tax school building bonds, Series 2024, serials 2025-2044, terms 2049, 2054, 2054. Jefferies.

The Hamilton County Public Building Corp., Indiana, (/AAA//) is set to price Tuesday $102.69 million of lease rental revenue bonds, Series 2024, serials 2026-2050. Baird.

The Colorado Health Facilities Authority (Aa1/AA+) is set to price Tuesday $100 million of tax-exempt self-liquidity daily VRDNs revenue bonds, Series 2024D, term 2064. Barclays.

The Kings Local School District, Ohio, (/AA//) is set to price Thursday $100 million of school improvement unlimited tax general obligation bonds, Series 2024. RBC Capital Markets.

Competitive calendar

Texas is set to sell $107.835 of college student loan bonds, Series 2024A, at 11 a.m. eastern Tuesday, and $93.005 million of college student loan refunding bonds, Series 2024B, at noon eastern Tuesday.

Washington is set to sell $386.465 of various purpose general obligation bonds, Series A, 2025A Bid Group 1, at 10:15 a.m. eastern Tuesday, $45.180 million of taxable general obligation bonds, Series 2025T, at 10:30 a.m. eastern Tuesday, $443.470 million of various purpose general obligation bonds, Series A, 2025A Bid Group 2, at 10:45 a.m. eastern Tuesday, $208.390 million of motor vehicle fuel tax and vehicle related fees general obligation bonds, Series 2025B, at 11:15 a.m. eastern Tuesday, $286.580 million of various purpose general obligation refunding bonds, Series R-2025A, at 11:45 a.m. eastern Tuesday.

The Little Rock School District is set to sell $101.885 million of construction bonds for the Arkansas School District Intercept Program, Series B, at 11 a.m. eastern Tuesday.

Collin County, Texas, is set to sell $212.070 million of limited tax permanent improvement and refunding bonds, Series 2024, at 11:30 a.m. eastern Wednesday.