Issuance rose in June as improved market momentum, growth of Build America Bond refundings and

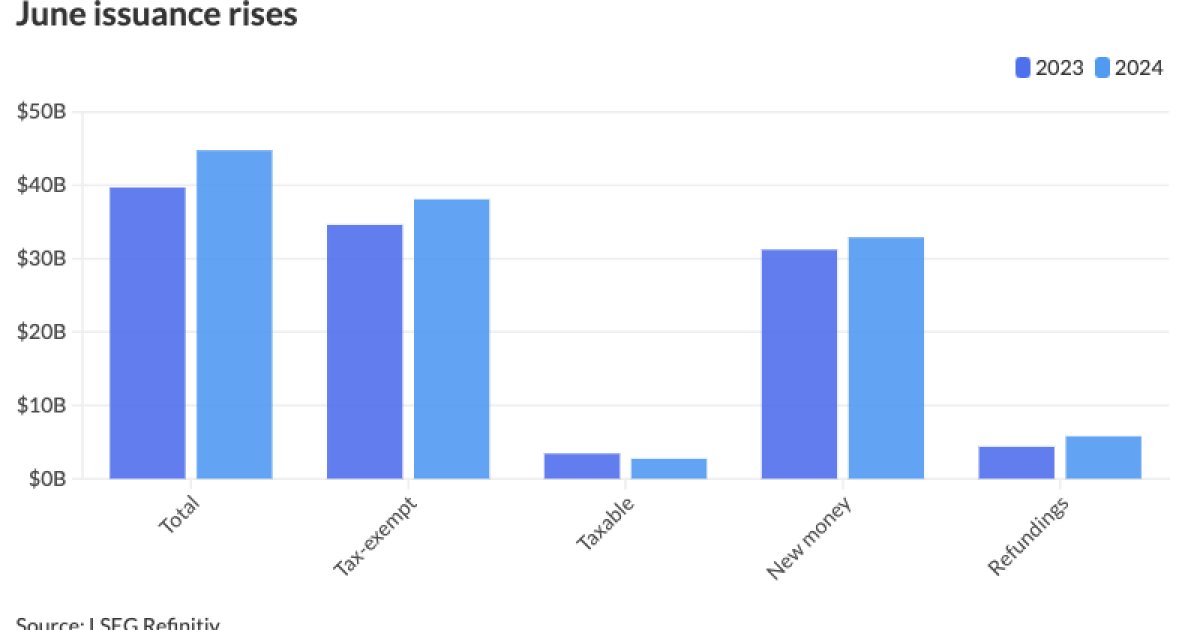

June’s volume came in at $44.769 billion in 798 issues, up 12.8% from $39.705 billion in 867 issues in 2023. June’s total is above the 10-year average of $42.252 billion.

Issuance for the first half of the year now sits at $283.786 billion, a 30.4% increase from $183.076 billion in 1H23.

In the first half of 2024, winding down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

Additionally, expected rate cuts never materialized, prompting issuers waiting for a lower entry point to realize “they’re not going to get that, at least for the near future,” he said.

The increase in volume in June is a “carryover” from the surging issuance in May, said Pat Luby, head of municipal strategy at CreditSights.

“Issuers like investors started the calendar year expecting the Fed would cut rates late in the first quarter of the year,” Luby said. “But when that did not happen, market consensus shifted around.”

Several issuers who had delayed issuance during the first few months of the year, hoping for lower borrowing costs, proceeded to come to market in June as the fiscal year ends for most states, he said.

“That provided incentives to go ahead and get into the market, get deals priced, to get financing locked in,” Luby said, adding “you can’t wait on the Fed forever.”

With all months seeing gains year-over-year, June’s increase in issuance is “not entirely surprising,” said Alice Cheng, a municipal credit analyst at Janney.

After a 47% surge in issuance in May, volume rose 12.8% year-over-year in June, following on the momentum of the first five months of 2024.

The weeks of the Federal Open Market Committee meeting and the Juneteenth holiday contributed to the volume only ticking up slightly, as issuance fell below $10 billion for both of those weeks, the new norm over the past several months.

However, the month saw several billion-dollar-plus deals come to market — contributing to soaring issuance — as mega deals have become more commonplace this year, Luby noted.

“There is a different kind of liquidity in the primary market than the secondary market,” he said. “When you get larger deals, it tends to stimulate buying demand…when you see bigger supply, it tends to stimulate bigger demand.”

One such mega deal was the

The demand for the deal was strong, Welch said, noting supply begets demand.

While issuance falls to a paltry $244.8 million next week, Cheng said the summer months could see a continued increase, helped by Friday’s “solid” economic figures.

Issuance is projected at $36 billion for July and $44 billion for August, according to Vikram Rai, head of municipal strategy at Wells Fargo. Both figures would be above 2023 figures, according to LSEG data.

For the remainder of 2024, Luby said the election is a notable factor for issuance patterns for Q3 and Q4.

Instead of the election altering “appetite to borrow,” it will contort to the timing of when issuers borrow, he said.

“We’ll see a surge of volume in the back half of the third quarter, but I think it will be compressed into the September through early October timeframe,” Luby said.

June issuance details

Tax-exempt issuance in June was at $38.087 billion in 707 issues, a 10% increase from $34.624 billion in 750 issues a year ago.

New-money and refunding volumes both increased. The former rose 5.4% to $32.906 billion from $31.231 billion, while the latter increased 32.6% to $5.791 billion from $4.367 billion.

Revenue bond issuance increased 21% to $29.838 billion from $24.665 billion in June 2023, and general obligation bond sales ticked down 0.7% to $14.932 billion from $15.039 billion in 2023.

Negotiated deal volume was up 16.8% to $35.141 billion from $30.094 billion a year prior. Competitive sales increased 23.7% to $9.423 billion from $7.618 billion in 2023.

Bond insurance rose 9.8% to $3.886 billion from $3.541 billion.

Bank-qualified issuance fell 2.2% to $818.9 million in 204 deals from $837.6 million in 216 deals a year prior.

In the states, the Golden State claimed the top spot year-to-date.

Issuers in California accounted for $35.884 billion, up 31.2% year-over-year. Texas was second with $32.695 billion, up 17.5%. New York was third with $28.034 billion, up 55.1%, followed by Florida in fourth with $12.37 billion, up 83.2%, and Massachusetts in fifth with $8.857 billion, an 89.5% increase from 2023.

Rounding out the top 10: Washington with $7.54 billion, up 68.7%; Alabama with $6.55 billion, up 61.8%; Illinois with $6.27 billion, down 20.9%; New Jersey with $5.908 billion, up 30%; and Virginia with $5.307 billion, up 46.7%.