Municipals improved, outperforming small losses in U.S. Treasuries Tuesday, while equities closed with the Dow and S&P 500 hitting records. The day’s moves followed the Federal Open Market Committee meeting minutes that signaled the Federal Reserve will be cautious with further policy easing.

If the economy progresses as expected, “it would likely be appropriate to move gradually toward a more neutral stance of policy over time,” the minutes from the meeting ended Nov. 7 relayed.

“Earlier this month, Chair [Jerome] Powell noted that there was no ‘hurry’ to cut rates,” noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, “confirm a broad support for taking a more cautious approach in easing monetary policy.”

The municipal market strength continued Tuesday with triple-A yield curves seeing yields fall up to five basis points, while USTs saw losses of up to 4 basis points.

“Market strength has continued as [separately managed account]-based distribution of municipals to retail customers has improved, deepening and broadening,” said Matt Fabian, a partner at Municipal Market Analytics.

Fixed income ended last week with only a “modest net rally,” but “demand for liquid municipal names and primary issues was strong as retail investors began earnest buying into year-end and ahead of this week’s minimal holiday calendar,” he said.

“And although USTs were better last week — maybe via a flight-to-safety sentiment as the Ukrainian defense intensified — the recent trend has ignored the Fed’s plans for more cuts, experiencing instead full curve weakness, maybe in expectation of higher deficits (supply) and Trump plans for tariffs/immigration (inflation), or maybe just in response to the strong post-Trump equity rally,” Fabian said.

Still, if UST softness happens in December, munis may continue to outperform.

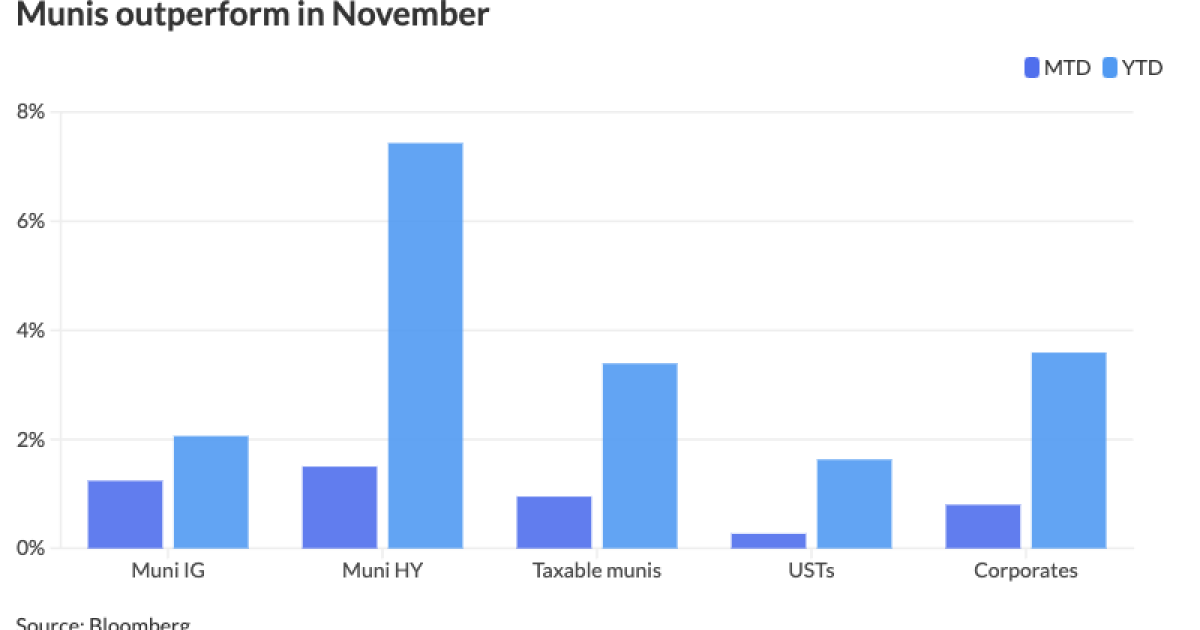

Munis are returning 1.24% in November and 2.06% year-to-date, according to the Bloomberg Municipal Index.

High-yield munis are seeing gains of +1.50% month-to-date and +7.43% year-to-date. Taxables are in the black at +0.95 month-to-date and +3.39% in 2024.

USTs are seeing gains of 0.27% in November and 1.63% this year.

Corporates are posting positive returns of 0.80% month-to-date and 3.59% year-to-date.

The two-year municipal to UST ratio Tuesday was at 61%, the five-year at 63%, the 10-year at 66% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 62%, the five-year at 63%, the 10-year at 67% and the 30-year at 82% at 4 p.m.

“Munis hopped on the trade-them-up train [Monday], helped in large part by more attractive ratios along the entire curve on a strong UST rally,” said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

The largest secondary volume increase happened outside of 10 years where “more than a 50 basis point slope (20s10s) encouraged more active bidding,” she said.

The very short end was the “least reactive” as trade flows were off around 13% from the prior session, Olsan said.

“With the gains posted, certain longer structures may begin to reach resistance levels,” she noted.

A new-issue sale of Florida Turnpikes (Aa2/AA) last week brought a 4% due 2049 at a 4.10% original yield, while follow-through trading Monday was “generated closer to par, where any premium levels to develop in similar bonds would harken back to early October,” she said.

Bidsides will be more “in tune with external factors” without the benefit of much new-issue guidance this week, Olsan said.

While issuance has been heavy this year, it slowed in November, with the final week capping off a lackluster finish.

Preliminary figures have issuance for November at $24.1 billion, down 34.6% year-over-year and the lowest monthly total in 2024, according to LSEG.

While there may only be two outsized weeks of issuance in December, demand remains robust.

Redemptions in December will be $37 billion, a four-month high, said Pat Luby, head of municipal strategy at CreditSights.

Dec. 1 will see $19 billion of principal and $10 billion of interest, he noted.

The states that will see the largest amount of redeemed bonds are Ohio at $2.3 billion, followed by Washington with $1.8 billion and Illinois with $1.6 billion, Luby said.

Dec. 1 redemption date for should provide munis “near-term support for the supply that will develop,” Olsan said.

In 2020 through 2022 December’s returns were “modestly positive,” she said.

However, December 2023 saw the market follow November’s “outsized return” to post a 2.3% gain, Olsan said.

“If the current strength in the curve does hold, down-in-coupon, down-in-credit structures would be expected to draw additional interest,” she said.

In the primary market Tuesday, Jefferies priced for the Aerotropolis Regional Transportation Authority, Colorado, $205.25 million of non-rated special revenue bonds, with all bonds priced at par: 5.5s of 12/2044 and 5.75s of 2054, callable 12/1/2029.

BofA Securities priced for the California Municipal Finance Authority (/A-//) $100 million of solid waste disposal revenue bonds, Series 2017A, with 4.1s of 12/2044 with a mandatory tender date of 12/1/2025 at par.

AAA scales

Refinitiv MMD’s scale was bumped up to four basis points: The one-year was at 2.73% (unch) and 2.59% (unch) in two years. The five-year was at 2.64% (unch), the 10-year at 2.83% (-4) and the 30-year at 3.67% (-4) at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 2.82% (-1) in 2025 and 2.65% (-1) in 2026. The five-year was at 2.63% (-1), the 10-year was at 2.86% (-1) and the 30-year was at 3.65% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to six basis points: The one-year was at 2.80% (unch) in 2025 and 2.62% (unch) in 2026. The five-year was at 2.60% (unch), the 10-year was at 2.84% (-4) and the 30-year yield was at 3.62% (-5) at 4 p.m.

Bloomberg BVAL was bumped up to three basis points: 2.76% (-1) in 2025 and 2.59% (unch) in 2026. The five-year at 2.62% (-1), the 10-year at 2.87% (-2) and the 30-year at 3.54% (-3) at 4 p.m.

Treasuries were little changed.

The two-year UST was yielding 4.252% (-2), the three-year was at 4.211% (flat), the five-year at 4.189% (+1), the 10-year at 4.299% (+2), the 20-year at 4.559% (flat) and the 30-year at 4.470% (flat) at the close.