Global investment banks are racing to redirect Chinese groups’ initial public offerings towards Hong Kong after new cyber security rules instituted by Beijing halted lucrative tech listings previously heading for New York.

About 20 Chinese companies had publicly disclosed plans to raise $1.4bn from share sales in New York this year, Dealogic data showed. But that was before regulators in Beijing launched an investigation into Didi Chuxing, just days after the Chinese ride-hailing group’s $4.4bn New York flotation. News of the probe sent Didi shares down 20 per cent from its IPO pricing.

The intervention by Chinese regulators has thrown further US listings into doubt and set off a scramble to redirect deals. Advising Chinese companies on IPOs has been a lucrative business for banks including Goldman Sachs and Morgan Stanley, generating fee revenue of $460m in the first half of the year.

“We’re speaking to everyone about it. All the Chinese issuers planning New York IPOs are looking at whether they can pivot to Hong Kong,” said a senior capital markets banker in Hong Kong.

Strict listing rules in Hong Kong, such as minimum profitability requirements, meant that many companies would struggle to sell shares in the territory, the banker said. “If you want to do a deal this year, at best you’ll be delayed until 2022 and at worst you won’t be able to do it.”

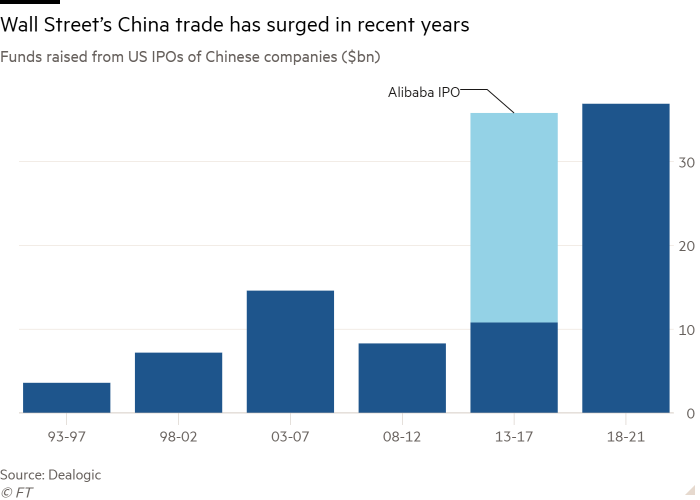

In the first half of the year, 34 Chinese companies raised $12.4bn in New York IPOs, a record high on both counts, helping prop up US banks’ fee revenues even as US-China tensions worsened. More than $2tn worth of shares already trade in New York.

Hong Kong appeared to offer a good alternative, bankers and lawyers said, as Beijing’s control over the financial hub meant that it would be less affected by the new rules on foreign listings that have hit share sales in New York.

Data security issues, brought to the fore by the Didi shock, are at the centre of China’s crackdown. Days after the ill-fated IPO, the Cyberspace Administration of China, or CAC, launched a cyber security review into the company.

Top officials in Beijing then called for a new regulatory regime to police overseas IPOs, and the CAC proposed rules banning companies with more than 1m users from listing abroad without a security review and official permission.

Two Wall Street bankers in Hong Kong said companies with a large data component to their business were among those most rapidly switching listing plans to Hong Kong and swallowing the associated delays and costs. “If you don’t have a data angle, they will wait until things calm down and see. The problem is no one wants to be the first,” one banker said.

Chinese tech groups going public have long favoured New York for its deeper, more liquid markets and ease of listing compared with Hong Kong, where companies are vetted by both the city’s securities regulator and the stock exchange. Bankers also enjoy higher fees of 5 to 7 per cent on funds raised through US share sales, compared with about 2 per cent in Hong Kong.

Bruce Pang, head of research at investment bank China Renaissance, said Chinese listings in New York would suffer until the details of the regulatory regime were hashed out among perhaps a dozen Chinese regulators — after which it could take months for companies looking to list abroad to gain approval.

Pang added that a growing number of Chinese companies faced an urgent need to go public. “If they can’t wait, Hong Kong will be their only choice,” he said.

The biggest beneficiary of the rules has been Hong Kong Exchanges and Clearing, whose shares have jumped 14 per cent this month.

Hong Kong’s stock exchange appointed its first non-Chinese chief executive this year, Nicolas Aguzin, a former JPMorgan banker who was born in Argentina.

Aguzin will be tasked with maintaining HKEX’s attractiveness to mainland Chinese issuers, which make up more than 80 per cent of its equity, while burnishing its image to foreign issuers, which have largely disappeared since a spate of luxury goods, including Prada and Samsonite, listed a decade ago.

However, one senior executive at HKEX said that while the exchange could benefit in the short term from diverted IPOs “the direction of travel does not look good”.

“At the moment, the screws are being turned on issuers, but the next logical step is to turn the screws on investors”, the executive said. “I predict that governments and regulators will make it harder for that capital to flow.”