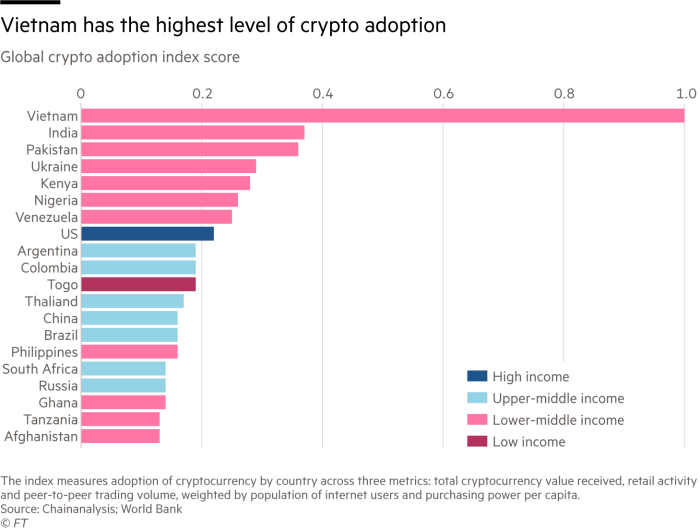

In Lagos, Nigeria’s commercial capital, a software coder bills her client in London and is paid in bitcoin, sidestepping a costly banking system and the naira currency’s miserly official exchange rate. In São Paulo, Brazil, a dentist puts his monthly savings into an exchange traded fund investing in a basket of cryptocurrencies that is the second most popular ETF on the local bourse. Individuals and businesses in Vietnam invest, trade and transact so much in bitcoin and other cryptocurrencies that the south-east Asian nation has the world’s highest rate of crypto adoption.

In advanced economies, cryptocurrencies are viewed by many in the financial world with suspicion — the domain of zealous “crypto bros” and a speculative and highly volatile fad that can only end badly. Regulators in Europe and the US have issued stark warnings about the dangers of trading crypto.

But in the developing world, there are signs that crypto is quietly building deeper roots. Especially in countries which have a history of financial instability or where the barriers to accessing traditional financial products such as bank accounts are high, cryptocurrency use is fast becoming a fact of daily life.

“While everyone was paying attention to [Tesla chief executive] Elon Musk’s tweets, and which institutional investor or CEO was saying what they thought about bitcoin, there was this entire story unravelling in emerging markets around the world that’s really powerful,” says Kim Grauer, director of research at Chainalysis, a leading data company in the sector.

“There’s a massive crypto footprint in many of these countries . . . [and] a massive amount of entrepreneurial opportunity.”

Chainalysis ranks Vietnam first for crypto adoption worldwide — one of 19 emerging and frontier markets in its top 20, with only the US among advanced economies making an appearance at number eight in 2021. “It’s very striking this year, [adoption] is a story of emerging and frontier markets,” adds Grauer.

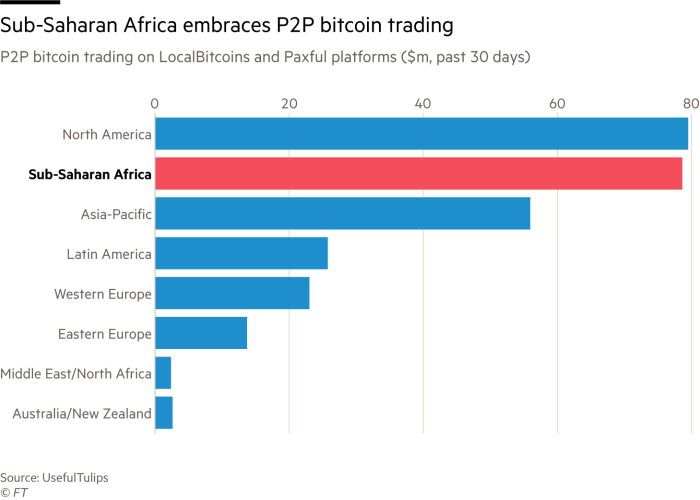

Separate data from UsefulTulips.org, tracking bitcoin transactions on the world’s two biggest peer-to-peer crypto trading platforms, show that in the past few weeks, sub-Saharan Africa has overtaken North America to become the geographical region with the highest volume of this kind of crypto activity.

On Tuesday, the small central American nation of El Salvador — population 6.4m — will become the first in the world to make bitcoin legal tender, meaning merchants from car dealers to coffee shops will be obliged to accept it as payment. The project faces the scepticism of the IMF, among others. But some view it as groundbreaking.

“We should take it very seriously,” says Paul Domjan, co-author of the 2021 book Chain Reaction: How Blockchain Will Transform the Developing World. “It changes the position of bitcoin in the [global financial] system and it accelerates the whole debate about digital currencies.”

An alternative to weak currencies

Emerging markets are fertile ground for cryptocurrencies, often because their own are failing to do their job. As a store of value, as a means of exchange and as a unit of account, national currencies in some developing countries too often fall short. Unpredictable inflation and fast-moving exchange rates, clunky and expensive banking systems, financial restrictions and regulatory uncertainty, especially the existence or threat of capital controls, all undermine their appeal.

Nigeria, Africa’s most populous country, is a case in point. Its impatient, youthful population has to contend daily with high unemployment, the vagaries of black market currency exchanges and capital controls. As the price of oil, the country’s main export, dropped during the pandemic and further squeezed dollar supply, many businesses were unable to pay foreign suppliers and lenders, almost leading to the default of a World Bank-backed power plant that provides a tenth of Nigeria’s electricity. For individuals sending or receiving remittances or billing customers, the lack of dollars is a constant headache.

“When you touch boots to the ground in Africa, specifically Nigeria, and talk to people about their everyday challenges with money, you see that it is almost unfathomable to us in the west to imagine,” says Ray Youssef, chief executive of Paxful, a peer-to-peer crypto exchange that allows users to trade directly with one another. In these transactions, bitcoin are held in escrow accounts by the platform until the payment clears — whether by bank transfer, mobile money or gift card.

A third of the company’s users are in Africa, and Nigeria is its biggest market, the company says, with 1.5m users — an 83 per cent increase in the year to June. Peer-to-peer rival LocalBitcoins also has most of its customers in developing markets in Latin America and Africa, as well as Russia.

Transactions vary in size, from retail investors buying small amounts of crypto for under $100, to merchants settling invoices, to financial services businesses that have been built on these platforms and employ rosters of people. “There’s a lot of commerce happening between China and Nigeria, importing of goods using cryptocurrency, because the foreign exchange policy has locked out the everyday entrepreneur who doesn’t have a massive amount of money to get into international trade,” says Grauer.

In countries such as Venezuela and Brazil, the cost and bureaucracy of legacy financial systems means many people are more comfortable experimenting with and switching between different cryptocurrencies.

“We thought that people would adopt one cryptocurrency and that would be their primary one, and what we have found instead is they use different ones for different purposes,” says Ryan Taylor, CEO of Dash Core Group, a cryptocurrency network that first entered Venezuela in 2016. Coins such as Dash get used more for smaller purchases, bitcoin for larger ones because of higher fees, and litecoin for things like paying satellite bills, he says.

The big exchanges such as Binance and Coinbase still dominate crypto services throughout the developing world. In Latin America, central and south Asia and Africa, more than 80 per cent of cryptocurrencies by value sent to these regions moves through exchanges. Binance sent over $14bn worth of crypto to eastern Europe in the year to June 2020, accounting for 20 per cent of all funds sent through the exchange globally. It was also the exchange of choice in Latin America, sending more than $3bn in crypto to the region over the same period.

It also offers an alternative to traditional remittances, a crucial lifeline for many developing economies. Transferring money back and forth across borders through traditional channels such as Western Union can be prohibitively expensive.

“If you want to send money to the African country next door, it’s a veritable nightmare, and sending money outside of Africa — to America, Europe, China, whatever it may be — is almost impossible unless you are rich,” says Youssef.

According to the World Bank, the cost of sending $200 to countries in sub-Saharan Africa averaged 9 per cent of the transaction value in the first quarter of 2020, the highest of any world region, and can go into double digits in some places.

On peer-to-peer crypto networks, however, these fees are typically about 2-5 per cent, according to LocalBitcoins. Average transaction fees for bitcoin were below $3 in August 2021, according to data provider BitInfoCharts, while for ethereum they ranged between $8 and $44 over the same period.

But some observers believe there are considerable dangers in cryptocurrencies being used for remittances or other payments.

Paola Subacchi, professor of international economics at the University of London’s Queen Mary Global Policy Institute, says a better solution for migrant workers would be to reduce the cost of remittances. “This is a bad remedy for a problem that should be solved using technology we already have.”

She adds: “Cryptocurrencies and crypto companies present themselves as instruments for financial inclusion, but those excluded from traditional financial facilities are precisely those who can least afford to take any risks with their money.”

More mainstream investment

As with peers in advanced economies, there is plenty of speculative fervour in parts of the developing world about bitcoin – especially in middle-income countries.

Yet crypto investment has already made greater inroads into the investment mainstream in some emerging markets than it has in advanced ones.

In the US and the UK, for example, regulators have yet to approve the creation of cryptocurrency ETFs, which allow investors to gain exposure to the potential gains and losses of bitcoin and others without directly owning any themselves. Brazil this year became one of only a handful of countries where cryptocurrency ETFs are available.

Hashdex Asset Management has launched three regulated crypto ETFs on the São Paulo stock exchange this year, which together have over 160,000 investors.

Its flagship fund, HASH11, tracks an index co-developed with Nasdaq based on a basket of crypto assets. Charging a 1.3 per cent management fee, it currently has net assets of R$2.17bn ($421m), and is the second-most owned ETF on the bourse.

Marcelo Sampaio, Hashdex chief executive, describes its customer base as “the mainstream financial market”.

“It’s the whole range from the largest institutional investors in the country to the smallest average Joe investors in the stock exchange,” he says.

Hashdex continued to attract new investors during downturns in the crypto market, such as recent dips provoked by Tesla’s decision to no longer accept bitcoin payments and China’s crackdown on crypto mining. “What that shows is that even with a severe correction in the market they were investing long-term,” Sampaio says.

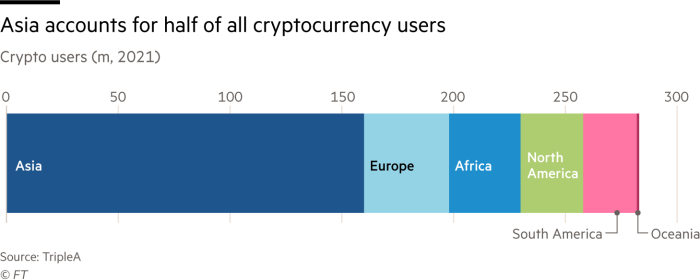

Brazil is the leading country in Latin America for cryptocurrency users, with 10.4m people, according to analysis by TripleA, a Singapore-based provider of crypto payment solutions.

Crypto’s growing popularity in Brazil is demonstrated by local exchange Mercado Bitcoin, whose total transaction volumes were up sevenfold by the end of August compared with 2020. The company recently secured a $200m investment from the Japanese technology group SoftBank and its customers have doubled to 2.8m in the past year.

“In Brazil, almost all activity is related to investments and trading,” says Daniel Cunha, a Mercado Bitcoin executive. “[But] in Argentina, stable coins have a very important presence as a strategy to defend [against the changing] value of the currency. In Mexico, the use of crypto for remittances represents a very large part of the market.”

Leapfrog to blockchain

The speed with which many developing countries have taken to crypto is not the first example of such early-adopter behaviour.

Perhaps the best-known modern example is M-Pesa, a mobile payment system first developed in Kenya that allowed millions of people without bank accounts to make cash withdrawals and deposits, transfers and payments through their mobile phones, delivering financial inclusion through technological innovation.

To some enthusiasts of the new currencies, the spread of crypto is the first stage in the next great leap, as users get used to trusting the so-called distributed ledger technology (DLT) of which blockchain — the backbone of crypto — is one application.

In Chain Reaction, Domjan and his co-authors note that institutions of trust, including the holders of public records such as land registries and licensing agencies, tend to be weaker in the developing world. And, they argue, where you see such weaknesses, it is easier for DLT or blockchain-based systems to be “good enough” to offer an attractive alternative.

“It seems rational to expect such innovation . . . to have the biggest impact in developing countries,” they write.

Domjan says such applications could unlock a host of “dead capital” to feed investment and growth.

Warnings of instability

While crypto acolytes are excited about El Salvador’s bitcoin currency experiment, most regulators have greeted it more frostily.

After El Salvador’s announcement, the IMF warned in late July of the dangers inherent in countries adopting cryptocurrencies as legal tender. The US-based multilateral lender said that widespread use of the volatile tokens could undermine “macroeconomic stability” and potentially expose financial systems to widespread illicit activity.

The UK’s Financial Conduct Authority has warned that “if consumers invest in these types of products, they should be prepared to lose all their money”. The Basel committee of global banking regulators said in June that “the growth of crypto assets and related services has the potential to raise financial stability concerns and increase risks faced by banks” — including fraud, hacking and terrorist financing.

Consumer protection, particularly from scams large and small, is a huge concern in crypto markets. Unfortunately, the most vulnerable in poorer countries often pay the price. “There’s a lot of hype around [crypto], so I think people may be more willing to invest where they’re more desperate,” says Grauer.

Many national regulators have found themselves ill-equipped to deal with digital asset companies that claim not to be domiciled anywhere.

In countries such as Zimbabwe, regulators have come down hard on crypto ventures, only to reverse their positions. Zimbabwe’s central bank has said it is drafting a policy framework for regulating cryptocurrencies, after banning local banks from transacting with them in 2018. In Nigeria, the central bank banned commercial banks from dealing with companies involved in cryptocurrency transactions — which quickly found a workaround using third-party accounts.

Some observers, including the Central Bank of Nigeria, have expressed concerns that inexperienced investors could lose their meagre savings gambling on a highly speculative asset. “Small retail and unsophisticated investors also face high probability of loss due to the high volatility of the investments in recent times,” the bank said, as it sought to clamp down on the trade

But while most crypto services say they are keen to comply with regulators, they believe excessive bureaucracy will drive people to seek out their services. “If a central bank decides to impose some direct form of restrictions on their people, you will see a flood of those people coming to [crypto platforms] looking for help,” says Youssef. “They all move with the flux of the geopolitical world, and we have to be ready for that.”

In El Salvador, the government has decided that rather than clamping down on crypto, it should embrace it. For Domjan, whether the project succeeds or fails, it has changed the game.

“El Salvador is a genuine country,” he says. “It’s not under sanctions, it’s a member of the IMF, it is inserted in the international financial system. The point is, it confers an element of legitimacy. We will learn lessons about how a country could implement an internationally tradable digital currency as a means of settlement.”

Additional reporting by Neil Munshi in Lagos and Michael Pooler in São Paulo