The world’s financial markets rarely sit glued to their screens waiting for the no-nonsense Norges Bank to pronounce its verdict on Norway’s monetary policy. This week was different. The 0.25 percentage point rise in its interest rate was the most visible expression yet of a turn in the monetary policy cycle that is spreading across the world.

No longer are central bankers seeking to do whatever they can to ensure money is available for households, companies and governments to borrow at exceptionally favourable rates. Along with Norway’s monetary tightening, the first in any advanced economy since the pandemic began, four emerging economy central banks — Pakistan, Hungary, Paraguay and Brazil — also raised the cost of borrowing this week, while the US Federal Reserve and Bank of England both signalled a move towards tightening monetary policy.

These guardians of monetary policy are generally satisfied that the economic recovery has proved stronger than they feared at the start of the year. But they are beginning to worry that money might become too cheap for too long. That would threaten rising inflation, excess borrowing and even financial instability as the world emerges from the coronavirus crisis.

“A normalising economy now suggests that it is appropriate to begin a gradual normalisation of the policy rate,” said Oystein Olsen, the Norges Bank governor, explaining the bank’s decision. Noting the rise from a floor of zero per cent to 0.25 per cent interest rates was unlikely to be the last, he added that as inflation rose towards its 2 per cent target, a gradual programme of interest rate rises would counter the emergence of financial imbalances such as high household debt and house prices.

To different degrees, Norway’s economic trends are matched across advanced economies. Robust forecasts from the OECD showed G20 countries continuing to recover to the point that it forecast they would return to the output and employment levels, expected before the pandemic hit, by the end of 2022.

Compared with the aftermath of the 2008-09 financial crisis, when advanced economies never came close to eliminating the damage of the recession, the OECD’s forecasts would be a remarkable achievement.

But such is the level of ambition this time compared with a decade ago that the forecasts still did not satisfy the OECD’s chief economist, Laurence Boone. Many economies had high unemployment before the pandemic, she says, especially in Europe, and so they could “do better”. It is not enough, she adds, to simply return economies back to “where they were before but with more debt”.

Persistent price rises

Such high ambition for the global economy alongside the disruption to normal patterns of consumption during the pandemic has generated multiple difficulties that no longer can be ignored.

Shipping costs have risen almost fivefold since the start of 2019 with less dramatic but equally unusual increases in raw material and food prices. A global semiconductor shortage has delayed deliveries of goods and prevented manufacturers from meeting consumer demand, especially in the automotive sector. With supply chain bottlenecks and outbreaks of Covid-19 disrupting the smooth flow of goods, prices have begun to rise, further adding to the ugly prospect of a slower period of growth.

“This is already quite a change from the pro-growth/commodity reflation investment mindset seen [just] a few months ago,” wrote the team of global economists at Citi this week.

A world of stubbornly persistent price increases and unpredictable bumps in the recovery is difficult for central banks to deal with. Their standard operating mode is to assume they have as good an understanding of employment levels and the production of goods and services as is possible and then aim to manage levels of spending accordingly so that inflation remains low and stable, normally targeting a 2 per cent rate.

In the recovery from Covid-19, with energy prices rising and supply shortages becoming acute, it is much harder to have a grip on what is possible and the likely level of spending required in economies with coronavirus still present. So central banks have to set interest rates while guessing both the level of supply and demand.

This week, the mounting evidence of labour shortages and the apparent recovery in spending generated the tilt toward being more aggressive with interest rates. The US Federal Reserve’s monetary policy meeting on Wednesday featured the most explicit acknowledgment yet that it is preparing to dial back the emergency support put in place in the early days of the pandemic to stave off a much more pronounced contraction.

Jay Powell, the Fed chair, pressed ahead with plans to reduce the $120bn a month asset purchase programme the central bank had pledged to maintain until it saw “substantial further progress” on the dual goals of average 2 per cent inflation and maximum employment. He teed up an announcement at the next meeting in November to officially kick-off the “tapering” process that would steadily reduce the purchases, and said there was backing across the Federal Open Market Committee for the stimulus to be wound down entirely by mid-2022.

His remarks came with a fresh set of individual projections about the future path of US interest rates, which showed that an increasing number of officials are pencilling in a rate rise next year. The committee is evenly split on a 2022 adjustment, according to the projections, with at least three rate increases now forecast by the end of 2023.

“The [FOMC] has decided that because inflation looks more persistent and the risks of it feeding through to expectations and a wage-price spiral are higher, they should [act] a little faster . . . in pulling back on the accommodation,” says Donald Kohn, a former Fed vice-chair now at the Brookings Institution.

The Bank of England is also viewing a sharp rise in prices and disappointing growth as evidence that inflation is likely to stay higher for longer — at a rate above 4 per cent for much of 2022 — than it had earlier predicted. That has translated into a worry that the lack of slack in the labour market and the rise in inflation, however temporary, could feed into companies feeling relaxed about raising prices and wages.

Philip Rush, founder of the consultancy Heteronomics, says there was a distinct “hawkish bias” in the BoE minutes of its meeting this week. That led most economists to take the central bank’s words as a signal that it was set to start raising rates in February, with a slim possibility that this date might even come forward to November.

As with the Fed, the BoE’s tone was far different to earlier this summer when both central banks set high hurdles that had to be crossed before they would even consider tightening policy.

The eurozone is not quite in the same place. It has a more deep-seated problem of low inflation and 1m more people unemployed than at the start of the pandemic.

Christine Lagarde, the European Central Bank president, reiterated her view that inflation was “temporary” in a CNBC interview on Friday and that the outlook will “fall into place” when bottlenecks are resolved. But she also noted that high energy prices would remain a problem for longer and that growth and inflation had picked up faster than the ECB had expected.

Lagarde’s reassurance was not entirely matched in tone by one of her vice-presidents this week. Luis de Guindos told a Financial Times online event that “there are risks of much more persistent pressures on inflation in the future” especially if the recent jump in prices, fuelled in part by the surge in energy costs, feeds into higher wage demands.

Turkey goes it alone

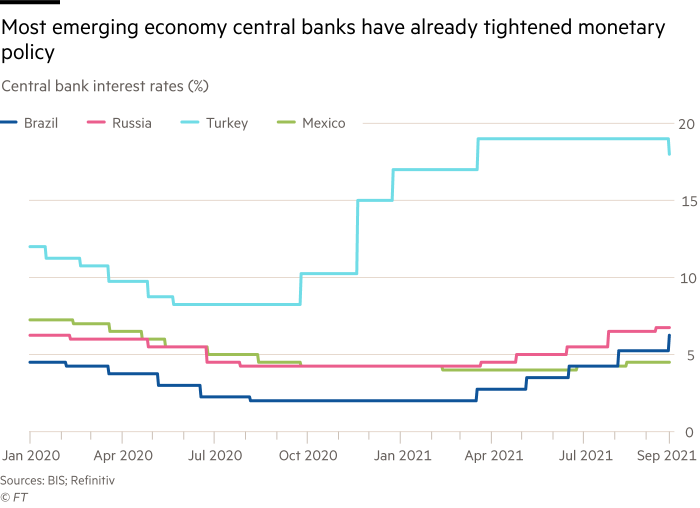

Emerging economies often do not have the luxury of being able to wait and see before acting. Without long histories of inflation control, investors hold their feet closer to the fire and demand action when prices start to rise. Food and energy also account for a larger share of spending and in many large emerging economies — Argentina, Brazil, Mexico, Russia and Turkey — the outlook has become troubling with the OECD saying high inflation was “likely to persist for some time”.

In most of these countries, central banks have already responded with higher interest rates. Brazil increased its policy rate by 1 percentage point on Wednesday to 6.25 per cent, with the central bank blaming “higher input costs, supply restrictions and redirecting of services demands towards goods” for influencing its decision.

An outlier from this global tilt towards more restrictive monetary policy is Turkey, where the central bank ignored orthodox economic views, declared inflation to be temporary and cut interest rates by 1 percentage point to 18 per cent, even after inflation hit 19.25 per cent in August.

Most saw this as a politically motivated move by a central bank governor who had been placed in the job in March after President Recep Tayyip Erdogan sacked his predecessor for clamping down too hard on inflation. The Turkish lira duly fell in a move that will squeeze domestic incomes further with higher import prices. Highly risky, Turkey’s economy will now be under the spotlight to see whether its export sector responds to the weaker lira and whether inflation really is kept in check.

Turkey was the exception this week that proved the rule. Orthodox central banks have shifted. They have all been surprised by how fast inflation has picked up this year and the emergence of global supply shortages as people’s spending has shifted from services to goods. They all hope the inflationary problems will be temporary but with energy prices rising fast, high inflation might persist longer than they thought only a few weeks ago.

Even the most powerful economies in the world now worry about inflation in a way that was unthinkable earlier in the year. The ground has shifted and monetary policy stances have turned the corner. Central banks now have a bias towards tightening policy.