While gold is generally perceived to be the best hedge against inflation, a report written by author Kelsey Williams has now questioned this longstanding assertion. In the report, Williams argues that the current gold price of around $1,810 per ounce is much lower than the commodity’s average price in 1980.

Gold Price Rise Lags Behind Inflation

Williams’ averments suggest the yellow metal’s rate of increase in value over the past 41 years has lagged behind that of inflation. In a report that was published by FX Empire, the author uses nominal and inflation-adjusted gold prices to illustrate this point.

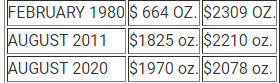

For instance, according to a table shared in the report, the nominal price of gold has been on an upward trajectory from $664 per ounce recorded in February of 1980 to $1,825 by August 2011. However, when adjusted for inflation, it is the February 1980 price that rises the fastest, to $2,309, compared to the August 2011 price which is pegged at $2,220.

A similar trend is also observed in August 2020 when gold recorded its all-time high of $2,070. For instance, the same table shows that at one point when the price in August was $1,970, the commodity’s inflation-adjusted price is in fact $2,078.

Why Gold Is Declining in Real Terms

This illustration by Williams could mean investors that have traditionally taken positions in gold are in fact not getting the best protection. The author himself offers his thoughts on why the price of gold has been declining in real terms. He said:

Since gold’s higher price over time is a reflection of the ongoing loss in purchasing power of the US dollar, it cannot be expected to exceed previous price peaks on an inflation-adjusted basis. By the same token, it is not unreasonable to expect it to match the peaks. The one factor which is likely limiting gold’s price from matching previous price peaks is that the overall effects of Federal Reserve inflation are continuing to have less and less impact.

Although the author does not suggest a better alternative store of value to gold, the report does show that gold has not matched the rate of the dollar’s deterioration.

Do you agree with what Williams has said about the price of gold? Tell us what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer