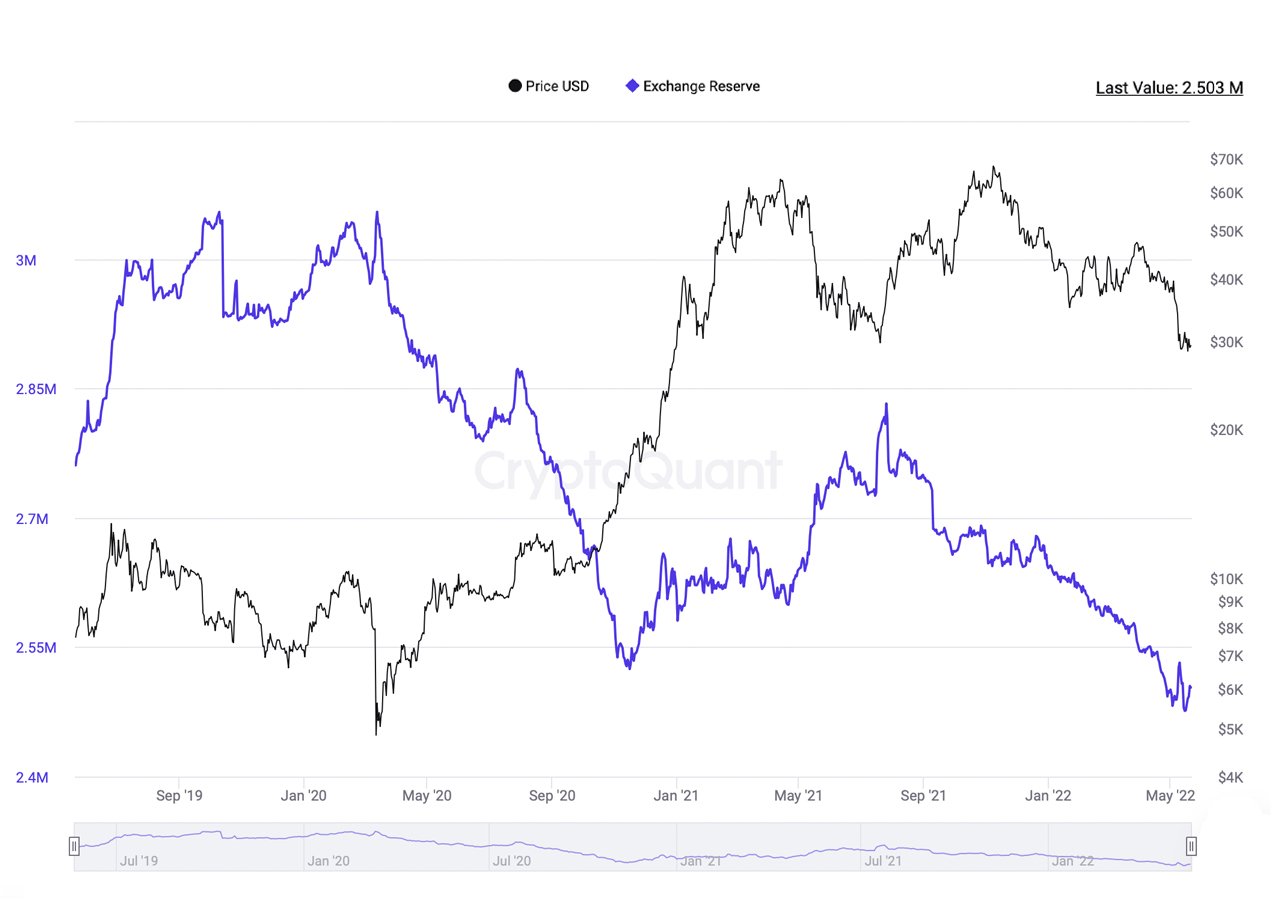

Amid the market carnage tied to Terra’s recent fallout, bitcoin sent to exchanges saw a brief spike on May 7, jumping more than 2% higher from 2.481 million to 2.532 million bitcoin. Despite the recent increase of bitcoin sent to trading platforms, the number of bitcoins on exchanges today remains lower than ever before.

Bitcoin Continues to be Taken Off Exchanges

Bitcoin (BTC) continues to be removed from centralized cryptocurrency exchanges as the number is much lower than the lows that were recorded on November 15, 2020. 248 days earlier, on March 12, 2020, the day after the infamous ‘Black Thursday,’ there were just over 3 million bitcoin held on centralized digital currency trading platforms.

During the course of that time frame, the number of BTC held on exchanges dropped 15.86% on March 12 from 3 million BTC to 2.524 BTC on November 15, 2020. In more recent times, the number of BTC held on exchanges has been lower and in May the metric hit two significant lows.

First on May 2, 2022, cryptoquant.com data shows there was 2.481 million BTC held on exchanges. The 2.481 million bitcoin was 1.70% lower than the number of BTC held on November 15, 2020. However, amid the Terra blockchain fallout and the terrausd (UST) de-pegging event, there was a brief spike of BTC deposits sent to exchanges.

After the low on May 2, there was a 2% increase in BTC deposits sent to centralized crypto exchanges. But that metric changed real quick as the 2.532 million bitcoin high on May 7, dropped over the course of the following week down 2.21% lower to 2.476 million BTC.

Out of $73 Billion in Bitcoin Held on Trading Platforms, 5 Exchanges Hold Over $50 Billion

At the time of writing, there’s 2.503 million bitcoin worth $73.7 billion held on digital currency trading platforms. Data provided by Bituniverse’s Exchange Transparent Balance Rank (ETBR) indicates Coinbase holds roughly 34% of the bitcoin held on exchanges. The ETBR list shows that Coinbase holds 853,530 bitcoin on the trading platform which is valued at roughly $25.14 billion using current BTC exchange rates.

13.58% of the 2.503 million bitcoin kept on exchanges is held by Binance. Binance is the second-largest exchange, in terms of BTC holdings, as it currently controls a stash of 340,410 BTC worth roughly $10 billion.

Okex commands the third-largest position, in terms of BTC holdings, as the company currently holds 266,530 BTC, or 10.62% of the aggregate total. Huobi Global commands the fourth largest position today, with 160,950 bitcoin held on the platform. Huobi’s BTC stash equates to 6.39% of the entire 2.503 million bitcoin held by exchanges.

The crypto exchange Kraken is the fifth largest BTC holder with 102,900 bitcoin held or 4.07%. Between the top five exchanges, as far as BTC reserves held is concerned, the group of trading platforms holds 68.66% of the 2.503 million bitcoin.

The five exchanges command 1.724 million BTC worth $50.7 billion out of the aggregate of 2.503 million worth $73.7 billion. While there’s a lot less BTC held on exchanges, the number of bitcoin held by these trading platforms is largely concentrated on Coinbase, Binance, Okex, Huobi, and Kraken.

What do you think about the amount of BTC kept on centralized exchanges? What do you think about the 68% held on five crypto trading platforms? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, cryptoquant.com data,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer