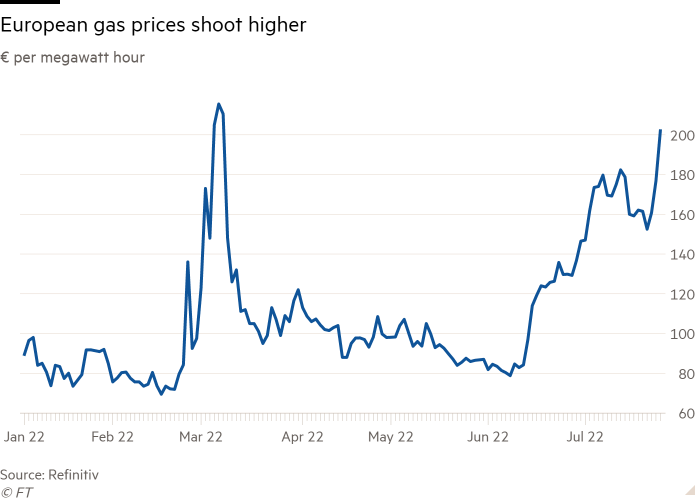

European gas prices have surged 30 per cent in two days after Russia deepened supply cuts to the continent in Moscow’s latest attempt to weaponise energy supplies.

Futures contracts for delivery next month tied to TTF, the European benchmark wholesale gas price, jumped 20 per cent on Tuesday to breach €210 per megawatt hour, the highest level since early March, a day after Russia warned of lighter flows on the largest pipeline supplying the region. Prices are more than 10 times higher than the average between 2010 and 2020.

Russian state-backed energy group Gazprom said on Monday that flows on the Nord Stream 1 (NS1) pipeline would plummet to 33mn cubic metres from Wednesday because of turbine maintenance issues. That would amount to a fifth of the pipeline’s capacity and half of current levels.

“Everyone in the market was expecting Russian volumes to drop,” said James Huckstepp, manager of Emea gas analytics at S&P Global Commodity Insights, a consultancy. “But the market wasn’t expecting flows to fall this quickly.”

The rise in gas prices came as EU ministers struck a watered-down deal on Tuesday to reduce gas consumption by 15 per cent over winter with exemptions for certain member states less dependent on Russian gas.

The higher gas prices indicate the mounting pressure on Europe to seek alternative supplies to keep homes warm and industry operating through the coming winter. Failing that, politicians are warning that gas will have to be rationed for businesses, factories and even households.

Benchmark power prices in Germany were pushed to a fresh record high of €370 per MWh by the rise for gas, a fuel used to generate electricity. Prices rarely rose to more than €60 per MWh before 2021.

In a sign of the concerns about how high energy prices will affect the eurozone economy, the euro fell 0.9 per cent on Tuesday to $1.012.

“We are now beyond the limits of affordability for many industrial users, and we might see recession alarms going off soon,” said Kaushal Ramesh, a senior analyst at Rystad, an energy consultancy.

NS1 recommenced the flow of gas to Europe last week at 40 per cent of capacity after returning from scheduled maintenance. But Russian president Vladimir Putin followed through on a warning that supplies would slump on Wednesday because sanctions were causing issues for turbines that needed to undergo maintenance.

European politicians have decried the Kremlin’s moves as “weaponising” gas supplies to the continent. Ukrainian president Volodymyr Zelenskyy added to the criticisms late on Monday, accusing Moscow of “gas blackmail” against Europe.

Moscow blamed sanctions for the drop in flows. Kremlin spokesman Dmitry Peskov told reporters that a key turbine for NS1 was on its way after maintenance and was expected to be installed “sooner rather than later”.

But he added: “The situation is critically complicated by the restrictions and sanctions that have been imposed on our country.”

European gas prices closed as high as €215 per MWh in the early days of Russia’s invasion of Ukraine. Prices settled somewhat in the weeks after, but they have rebounded since June as the Kremlin showed its willingness to leave Europe short of gas.

Toby Copson, managing partner at Trident Markets, a gas trading company, said gas prices globally were likely to feel even more upward pressure when China came to the market to buy supplies for winter.

“It’s got all the makings for a crisis across the board,” he said. “There’s not enough supply, they haven’t injected enough into storage recently and it’s a disaster situation Europe is sitting in.”