Municipals were firmer Thursday as municipal bond mutual fund outflows returned, while U.S. Treasuries were steady and equities ended mixed.

The three-year muni-UST ratio was at 55%, the five-year at 57%, the 10-year at 63% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 55%, the five at 57%, the 10 at 63% and the 30 at 89% at 4 p.m.

Triple-A benchmarks were bumped up to seven basis points the day after the Federal Open Market Committee hiked rates 25 basis points.

A few developments in recent sessions “may have staying power should the new outlook on upcoming FOMC actions gain traction,” said Kim Olsan, a senior vice president of municipal bond trading at FHN Financial.

Ultra-low ratios inside 10 years “didn’t allow for much of a response, other than in California where trading is now firmly through 2% in AA- and AAA-rated names (select New York prints between 5 and 10 years on the curve have similar handles),” she noted.

Currently, “buyers in these super-specialty states can acquiesce to lower ranges” based on the net tax equivalent yield benefit, but “further price gains would likely require a longer-term supply crunch,” according to Olsan.

The offset to a firmer curve, she said, is that issuers’ financing opportunities improve, especially in the refunding category.

“Trailing 12-month average monthly supply is $31 billion as high rates challenged issuance,” she said. “That level is 47% above what last month generated, but conditions could present themselves to increase volume.”

Intermediate yields “have traded to a 60% retracement of last year’s average 2.45% MMD rate and the 1.55% low from January 2022,” she said.

Another leg down in yield would “potentially test the 2.00% area on either limited supply or greater demand,” Olsan said.

If fund flow reporting is any measure of buyer interest, “the demand component may factor more prominently in coming weeks,” she said.

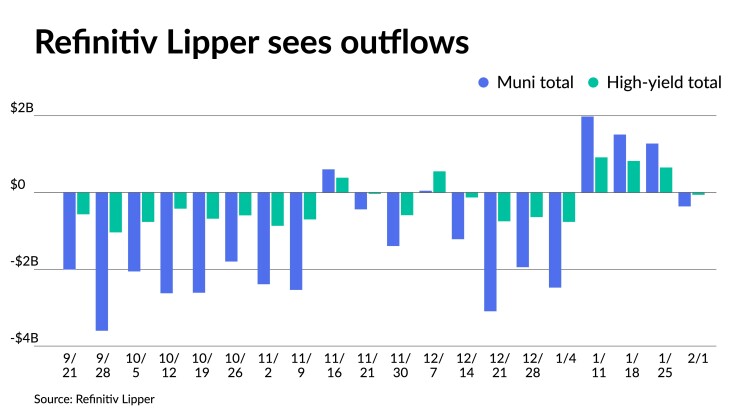

However, outflows returned as Lipper reported $361.649 million was pulled from municipal bond mutual funds in the week ending Wednesday after $1.277 billion of inflows the week prior.

High-yield saw $59.788 million of outflows after $652.279 million of inflows the week prior, while exchange-traded funds saw outflows of $713.581 million after $610.812 million of outflows the previous week.

Despite outflows this week, both Lipper and the Investment Company Institute recorded multi-week, multi-billion dollar inflows.

“The downstream effect being seen so far is 1) large-scale names (i.e., Ohio GOs, AA-utilities) are trading closer in spread to respective AAA spot levels and 2) wider-trading names (i.e. single-A airports) are compressing after dramatic widening last year,” she said.

Longer-term rate direction, she noted, “is more complicated with the variety of coupon structures in play.”

“Friendlier outlooks on inflation will carry performance in 4% coupons — already this year several issues have implemented longer 4s as buyer interest has been renewed,” she said.

The rate hike impact on muni yields in 2022 “could offer some guidance for the coming months,” Olsan noted.

“Seasonality (heavier supply and redemption cycles) was a factor in how much of a reaction the hikes had on the muni yield curve,” she said.

March, April, June and August brought higher supply figures “with both March and June coinciding with rate hikes,” she noted.

Short- and long-term yields “corrected higher but also led to a curve flattening,” she said.

January’s MMD slope “closed at 133 basis points but by August had flattened to 108 basis points,” she said. “A moderation or pause in hikes over the next several months could present flatter conditions,” per Olsan.

The inherent tax-exemption and strong credit quality — as well as current market technicals — are sustaining strong demand for municipal bonds, according to Wesly Pate, senior portfolio manager at Income Research + Management.

“Overall municipal market health and investor demand remain exceptional as indicated by ratios, spreads, and new issue subscription levels,” Pate said.

Two of the sector’s characteristics — tax-exemption and high credit quality — are contributing to the strong demand, he noted.

“Municipal credit proved resilient throughout the pandemic and through recent inflation-driven market turbulence,” Pate explained.

“The market has historically seen rather benign impacts from debt-ceiling related measures and a lack of near-term political headwinds from either elections or legislative measures is leaving the market mostly unfazed,” he continued.

“Lack of supply coupled with a highly sought tax-haven continues to buoy the asset class,” Pate said.

The benefits of the tax exemption are proportionate to yields, according to Pate. “Amid the current higher rates, this results in meaningful value, he added.

Strong credit footing leaves the municipal market well positioned against recessionary concerns overall, according to Pate. ”Lack of supply coupled with overall higher yields will remain supportive of market health and likely keep ratios inside of longer-term averages,” he said.

However, Pate expects to see a softening of ratios from the current exceptionally low levels. ”While an obvious harbinger is not present, rarely does the market hold these relative levels for an extended period,” he said.

In the primary market Thursday, Piper Sandler priced for the Fort Worth Independent School District, Texas, (Aaa///) $274.890 million of PSF-insured unlimited tax school building bonds, Series 2023, with 5s of 2/2024 at 2.34%, 5s of 2028 at 2.09%, 5s of 2033 at 2.28%, 5s of 2038 at 2.96%, 4s of 2042 at 3.73% and 4s of 2048 at 3.98%, callable 2/15/2033.

Secondary trading

California 5s of 2024 at 2.24%. Florida Board of Education 5s of 2025 at 2.15%. LA DWP 5s of 2026 at 1.98% versus 2.02% Wednesday.

Triborough Bridge and Tunnel Authority 5s of 2028 at 2.09% versus 2.21%-2.22% Wednesday and 2.37%-2.30% original Friday. Massachusetts 5s of 2029 at 2.06%-2.02% versus 2.10% Tuesday. Texas Water Development Board 5s of 2030 at 2.11%-2.10% versus 2.20%.

Spokane County School District #81, Washington, 5s of 2038 at 2.87%-2.85%. Austin ISD, Texas, 5s of 2039 at 3.10% versus 3.13%-3.10% on 1/26 and 3.10% original on 1/19. Kansas Development Finance Authority 5s of 2040 at 2.96%.

Washington 5s of 2047 at 3.33% versus 3.42% original on 1/23. Illinois Finance Authority 5s of 2047 at 3.89%-3.87% versus 4.01%-3.99% Monday and 4.32%-4.30% on 1/10. Massachusetts 5s of 2048 at 3.47% versus 3.44% Wednesday and 3.37% on 1/20.

AAA scales

Refinitiv MMD’s scale was bumped up to seven basis points. The one-year was at 2.27% (unch) and 2.14% (-2) in two years. The five-year was at 1.99% (-4), the 10-year at 2.13% (-6) and the 30-year at 3.13% (-7) at 3 p.m.

The ICE AAA yield curve was bumped three to six basis points: at 2.27% (-3) in 2024 and 2.19% (-3) in 2025. The five-year was at 2.00% (-6), the 10-year was at 2.10% (-6) and the 30-year yield was at 3.16% (-5) at 4 p.m.

The IHS Markit municipal curve was bumped two to seven basis points: 2.29% (-2) in 2024 and 2.14% (-2) in 2025. The five-year was at 2.04% (-2), the 10-year was at 2.13%(-7) and the 30-year yield was at 3.11% (-7) at a 4 p.m. read.

Bloomberg BVAL was bumped one to six basis points: 2.29% (-1) in 2024 and 2.12% (-2) in 2025. The five-year at 2.03% (-5), the 10-year at 2.16% (-5) and the 30-year at 3.17% (-6).

Treasuries were little changed.

The two-year UST was yielding 4.098% (+1), the three-year was at 3.771% (+1), the five-year at 3.488% (flat), the seven-year at 3.444% (flat), the 10-year at 3.398% (flat), the 20-year at 3.663% (-1) and the 30-year Treasury was yielding 3.550% (-1) at 4 p.m.

Fed redux

“For investors, the most important takeaway [from the Federal Open Market Committee meeting] is that the focus in 2023 has shifted from rapidly rising inflation to slowing economic growth,” said Whitney Watson, deputy co-head of fixed income at Goldman Sachs Asset Management.

This backdrop “will see the correlation between bonds and risk assets turn less positive, or even negative,” she said.

“The improved hedging properties of bonds combined with higher income and total return potential presents investors with the most opportunistic environment in fixed income markets in more than a decade, even after the strong performance seen in January,” Watson said.

It won’t be easy for the Fed to achieve 2% inflation, said Robert Bayston, head of U.S. government and mortgage portfolios at Insight Investment. “Although we believe core inflation is likely to improve to the 3% to 4% region by the summer, keeping it there and achieving the ‘last mile’ journey to the Fed’s 2% target remains difficult.”

While the Fed has made progress, “it has not yet won the war on inflation, and we see markets as too optimistic about the trajectory of rates in 2023 and beyond,” he said.

As such, Bayston believes “investors should tread carefully.”

Scott Anderson, chief economist at Bank of the West, agreed. “Market optimism is overdone both on the rate expectation side and the disinflation side.”

Fed Chair Jerome Powell “kept all options on the table for upcoming FOMC meetings,” he said, noting “the market view of future inflation and Fed rate policy appears to be somewhat different than the Fed’s median at the last FOMC meeting, but didn’t completely rule out that the market has it wrong,” he said.

“The language of the policy statement and Chair Powell’s press conference underscored the Fed’s shift away from aggressive rate hikes and toward slowly feeling out the appropriate terminal rate by moving in smaller increments,” said Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets and a member of the Shadow Open Market Committee.

The policy statement, he noted, “included new language suggesting the committee will use past and incoming data to determine the ‘extent’ of future hikes rather than the ‘pace’ (with the latter featuring in the December policy statement).”

Economists were split over whether March would be the final rate hike for the Fed.

“Regardless of the Fed’s rhetoric, we continue to believe that the Fed will pause after one more rate hike in March,” said Joseph Kalish, chief global macro strategist at Ned Davis Research. “Softer labor markets are the key for giving the Fed confidence that inflation is heading back to its 2% target.”

“We expect one final 25bp hike in March,” said James Knightley ING Chief International economist. “Recessionary forces will then make the case for rate cuts later in the year.”

Meanwhile, others thought another rate hike would happen in May.

Anderson believes “the Fed will need to raise the Fed funds rate another 50 basis points before pausing.” He expects 25 basis point hikes in March and May then “a prolonged pause.”

“The market continues to fight the Fed, putting an 82% probability of a 25 basis point rate hike in March and only a 38% probability of another 25 basis point rate in May with a full 50 basis points of Fed rate cuts before the end of the year,” he said.

And Levy continues to expect the “Fed to hike rates by 25bp at both the March and May meetings, to a terminal rate of 5.00-5.25%, although the final hike in May is likely to be a close call.”

Though economic slowdown “might make the case for a pause in the May meeting, a lot of easing in the labor markets is needed before the Fed is likely to prove willing to cut rates,” said Christian Scherrmann, U.S. economist at DWS Group.

While the market sees cuts in 2023, he does not expect any before 2024.

Economic data could play a role in the Fed’s decision-making.

“Weaker economic data between now and May, could lead the Fed to pause before the low end of the range gets to 5.00%,” said James Ragan, director of wealth management research at D.A. Davidson.

As the year moves along, he is “concerned about recession signals.”

“This includes severe weakness in housing, PMI surveys that point to contraction, recession signals from the Conference Board’s Leading Economic Index (and the inverted yield curve),” Ragan said. “We believe that equity markets are not sufficiently considering the potential for a more severe economic downturn or recession.”

Mutual fund details

Refinitiv Lipper reported $361.649 million of municipal bond mutual fund outflows for the week ended Wednesday following $1.277 billion of inflows the previous week.

Exchange-traded muni funds reported outflows of $713.581 million after outflows of $610.812 million in the previous week. Ex-ETFs, muni funds saw inflows of $351.932 million after inflows of $1.887 billion in the prior week.

Long-term muni bond funds had inflows of $231.352 million in the latest week after inflows of $924.075 million in the previous week. Intermediate-term funds had outflows of $24.783 million after inflows of $312.132 million in the prior week.

National funds had outflows of $52.125 million after inflows of $1.233 billion the previous week while high-yield muni funds reported outflows of $59.788 million after inflows of $652.279 million the week prior.