On Feb. 14, 2023, Milena Mayorga, the Salvadoran ambassador to the United States, announced that her country is considering opening a second bitcoin embassy in the Lone Star State. Mayorga said that Texas is “our new ally” and the goal is to expand “commercial and economic exchange projects.”

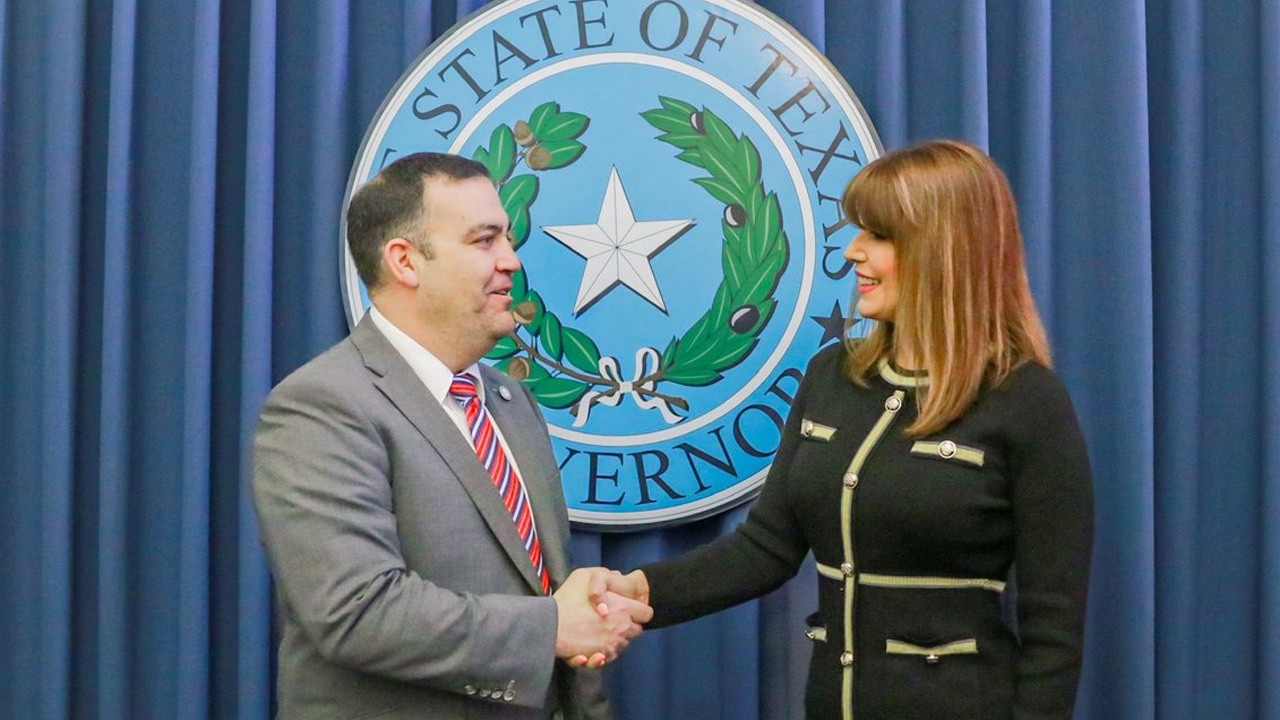

Ambassador Milena Mayorga Fosters Growing Relationship Between El Salvador and Texas

This week, Milena Mayorga, the Salvadoran ambassador to the U.S., discussed her recent meeting with Texas Secretary of State Joe Esparza. Mayorga stated that government officials were considering the possibility of opening a second bitcoin embassy in the state. She noted that discussions had already taken place with authorities from Lugano, Switzerland about a similar bitcoin embassy concept.

“The state of Texas, our new ally,” Mayorga tweeted. “In my meeting with the deputy secretary of the Government of Texas, Joe Esparza … We discussed the opening of the second [bitcoin] embassy, and the expansion of commercial and economic exchange projects.”

The Salvadoran ambassador’s proposal comes after El Salvador’s approval of the Digital Assets Issuance Law in January 2023 and a recent mission statement on El Salvador’s economy by the International Monetary Fund (IMF). The IMF noted that El Salvador had managed to avoid cryptocurrency-related risks due to the slow and tepid adoption of bitcoin in the country. This development also follows comments by Salvadoran President Nayib Bukele regarding disinformation in the media.

El Salvador’s finance minister, Alejandro Zelaya, took to Twitter to refute claims made by some national and international media, tweeting: “El Salvador has met its debt obligations. We announce that on this day we have completed the payment of the 2023 Bond for $800 million, plus interest.”

The Salvadoran ambassador, Mayorga, noted in her own Twitter thread that Texas Secretary of State Joe Esparza had expressed a positive view of the relationship between El Salvador and Texas in terms of commercial and economic exchange, with the two entities having exchanged $1,244,636,983 in 2022.

Will the potential opening of a second bitcoin embassy in Texas further strengthen the relationship between El Salvador and the Lone Star state, and potentially boost the adoption of cryptocurrencies in the region? Share your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer