Credit Suisse shares tumbled more than 20 per cent to an all-time low following comments from its largest shareholder that it would not provide the bank with any more capital.

Trading in Credit Suisse shares was halted on Wednesday after they sank as low as SFr1.73. The declines came after the chair of the Saudi National Bank, which bought a 10 per cent stake in Credit Suisse last year, ruled out providing the bank with any more financial assistance.

The latest woes at the troubled Swiss lender reignited a broader sell-off in European bank stocks, which were already reeling this week from the fallout from the collapse of Silicon Valley Bank.

BNP Paribas shares dropped 8 per cent and Société Générale fell 9 per cent by mid-morning. Deutsche Bank lost 7 per cent and ING 8 per cent. Wider equity markets were dragged lower, with the Europe-wide Stoxx 600 dropping 2.1 per cent.

Credit Suisse had on Tuesday revealed that its auditor, PwC, identified “material weaknesses” in its financial reporting controls.

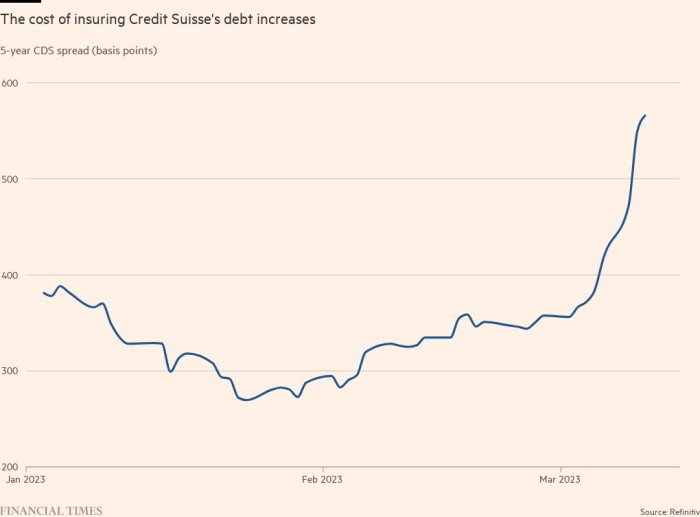

The spreads on the bank’s five-year credit default swaps — which indicate investor bearishness — widened to 565 basis points on Wednesday, from 350bp at the start of the month.

Asked on Bloomberg TV whether the SNB would be open to providing capital to Credit Suisse if there was a call for additional liquidity, SNB chair Ammar Alkhudairy said: “The answer is absolutely not, for many reasons outside the simplest reason which is regulatory and statutory.”

He said owning more than 10 per cent of Credit Suisse would bring additional regulatory requirements.

In a separate interview at a finance conference in Saudi Arabia, Credit Suisse chair Axel Lehmann said on Wednesday that financial assistance from the Swiss government “isn’t a topic” for the lender.

“We have strong capital ratios, a strong balance sheet,” he said, adding the bank was in the process of executing a radical restructuring aimed at arresting years of scandals and losses. “We already took the medicine.”

A day earlier, chief executive Ulrich Körner said customers were continuing to pull money from the bank, but at a much lower level than late last year, when Credit Suisse suffered SFr111bn of outflows.

Credit Suisse was forced to delay the publication of its annual report last week after the US Securities and Exchange Commission wanted further clarity on flaws with the bank’s internal controls that PwC had identified. The issues related to cash flow restatements going back to 2019.

When it did publish its annual report on Tuesday, Credit Suisse said “management did not design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements”.

The bank said its full-year 2022 results, when it reported its biggest annual loss since the financial crisis, were unaffected.

Credit Suisse shares are down 35 per cent this year and 84 per cent over the past two years.