Municipals were little changed Thursday as U.S. Treasuries were weaker and equities rallied.

The two-year muni-to-Treasury ratio Thursday was at 63%, the three-year was at 64%, the five-year at 66%, the 10-year at 70% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 66%, the 10-year at 70% and the 30-year at 91% at 4 p.m.

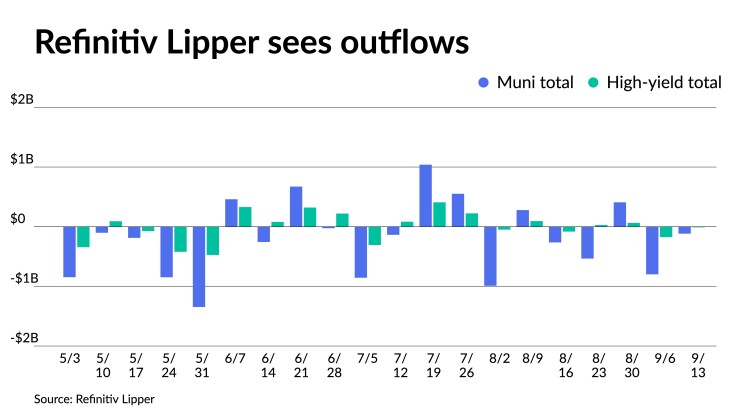

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

August proved to be a rough month for fixed income, especially for munis, but things have calmed down quite since the start of September, said Joshua Perry, a partner, portfolio manager and municipal credit analyst at Brown Advisory.

The market is anticipating the Federal Open Market Committee meeting on Sept. 19-20, but otherwise, the market is relatively steady, he said.

After several billion-dollar deals last week, including $2.6 billion of various purpose general bonds from California and $1.1 billion of consolidated bonds from the Port Authority of New York and New Jersey, issuance has fallen this week.

However, there are still several large deals including $926 million of general-purpose state personal income tax revenue bonds from the Dormitory Authority of the State of New York and $634 million of gas project revenue refunding bonds from the Central Plains Energy Project.

“We’re starting to see some discernment on the part of the new deals coming in about where on the curve people want to be,” he said.

“A lot of the belly [of the curve] where the market seems to be is very rich, especially, especially as part of that inversion,” Perry said.

That part of the curve is where oversubscription is the lightest, he noted.

“So there’s that push and pull; issuers obviously want the lowest total interest costs, investors want the highest risk-adjusted yield,” he said. “So we’re seeing how that plays out in the new-issue market specifically for where the oversubscription is and where it isn’t.”

For the remainder of the year, he said supply will be influenced by factors outside the muni market’s control such as possible rate hikes from the Fed and politics.

“Issuers are kind of forward-looking, so if they feel like something’s at risk, they might accelerate supply,” he said.

If issuers “feel like things are OK, they might continue to use some of that COVID money that still hasn’t been spent yet and try to wait out a better market, see if the Fed holding off calms the market down and they can get potentially better pricing,” Perry noted.

Investors in the municipal bond market are willing to sacrifice tight spreads for higher income in the current tax-exempt market where yield is attractive.

Despite the tight spreads on high-quality paper, the supply-demand dynamics are in full swing in the municipal market, according to John Luke Tyner, portfolio manager and fixed income analyst at Aptus Capital Advisors.

“We continue to see substantial demand for muni paper and not enough supply to keep in check,” Tyner said. “Spreads on high-quality paper remain tight; that goes across the board maturity-wise,” he added.

Still, heavy demand is driving the market, he said.

“Given there is yield behind bonds, some investors are okay settling with tighter spreads given the relative value now versus the past few years,” Tyner said.

Taxable equivalent yields are appealing and attractive for some investors, according to Cooper Howard, a fixed income strategist at Charles Schwab.

Howard suggests investors move out on the yield curve to take advantage of the opportunities.

“Despite a recent pullback, yields are near the highest they’ve been in the past 15 years,” Howard said on Wednesday. He noted that the tax-equivalent yield for the average municipal bond is 7% for an investor in the top tax bracket.

“We think that’s attractive,” he said. “For investors who have been sitting too short-term, we suggest they extend duration and lock in yields.”

Although an interest rate hike by the Federal Reserve Board this month is highly unlikely, according to Howard, November is a potential possibility.

“Although inflation is cooling it is still too high for the Fed’s liking,” he said. “With the economy showing greater potential for a soft landing, we think it’s likely the Fed will hold rates at an elevated level for an extended period of time rather than hiking again this cycle.”

In the meantime there are attractive opportunities in the asset class, he noted.

“Relative yields are below historical averages, but they have moved higher presenting a better entry point,” Howard said, adding that credit quality continues to remain strong although it’s likely peaked.

Meanwhile, there is an opportunity for the lower tax-rate clients within taxable bonds when compared to corporates given attractive spreads and government-backed collateral as low default rates continue in the municipal market, according to Tyner.

“If we do see a flush of supply come to market, I think it could push spreads out a bit and drum up strong demand,” he said.

Tyner said the current spread levels are too tight for their liking, but they are keeping an eye open for bonds trading cheap in the secondary market.

As these conditions abate, Tyner suggests investors stay the course and “pick your spots.”

“Don’t deviate from credit standards,” he continued. “Stick with structure.”

In the primary market Thursday, BofA Securities priced for Charlotte, North Carolina (Aa3//AA-/) $369.340 million of airport revenue bonds on behalf of the Charlotte Douglas International Airport. The first tranche, $258.420 million of non-AMT bonds, Series 2023A, saw 5s of 7/2025 at 3.22%, 5s of 2028 at 3.06%, 5s of 2033 at 3.24%, 5s of 2038 at 3.79%, 5s of 2043 at 4.13%, 5s of 2048 at 4.28%, 5s of 2053 at 4.33% and 5.25s of 2053 at 4.26%, callable 7/1/2033.

The second tranche, $110.920 million of AMT bonds, Series 2023B, saw 5s of 7/2025 at 3.83%, 5s of 2028 at 3.74%, 5s of 2033 at 3.91%, 5s of 2038 at 4.29%, 5s of 2043 at 4.55%, 5s of 2048 at 4.60% and 5.25s of 2053 at 4.58%, callable 7/1/2033.

BofA Securities priced for the California Municipal Finance Authority (/BBB+//) $100 million of AMT Republic Services Project solid waste disposal revenue bonds, Series 2023A, with 4.375s of 9/2053 with a mandatory tender date of 9/1/2033 priced at par.

In the competitive market, Montgomery County, Maryland (Aaa/AAA/AAA/), sold $280 million of consolidated public improvement bonds, Series 2023A, to Jefferies, with 5s of 8/2024 at 3.28%, 5s of 2028 at 2.95%, 5s of 2033 at 3.10%, 4s of 2038 at 3.95% and 4s of 2043 at 4.14%, callable 8/1/2031.

Wichita, Kansas, sold $113.875 million of GO temporary notes, Series 314, to BofA Securities, with 5s of 10/2024 at 3.68%, noncall.

Secondary trading

Washington 5s of 2024 at 3.37%. Maryland 5s of 2024 at 3.25%-3.28% versus 3.28% Tuesday. NYC TFA 5s of 2025 at 3.25%.

Connecticut 5s of 2028 at 3.03%. Delaware 5s of 2029 at 2.95%. DC 5s of 2030 at 3.03%.

Ohio 5s of 2032 at 3.10%. California Educational Facilities Authority 5s of 2033 at 2.82% versus 2.75% on 8/29. NYC 5s of 2034 at 3.36% versus 3.30% on 9/6.

Massachusetts 5s of 2047 at 4.16% versus 4.11% on 9/8. Metropolitan Water District of Southern California 5s of 2048 at 3.86% versus 3.88% Wednesday. NY Dorm Sales Tax 5s of 2053 at 4.34%-4.33%.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.25% and 3.13% in two years. The five-year was at 2.90%, the 10-year at 3.00% and the 30-year at 3.94% at 3 p.m.

The ICE AAA yield curve was cut up to three basis points: 3.28% (unch) in 2024 and 3.20% (+1) in 2025. The five-year was at 2.93% (+3), the 10-year was at 2.98% (+2) and the 30-year was at 3.96% (+1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.26% in 2024 and 3.14% in 2025. The five-year was at 2.91%, the 10-year was at 3.00% and the 30-year yield was at 3.93%, according to a 3 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.26% (+1) in 2024 and 3.17% (+1) in 2025. The five-year at 2.89% (+1), the 10-year at 2.91% (unch) and the 30-year at 3.91% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.013% (+3), the three-year was at 4.683% (+3), the five-year at 4.418% (+3), the 10-year at 4.287% (+4), the 20-year at 4.565% (+4) and the 30-year Treasury was yielding 4.386% (+5) near the close.

Mutual fund details

Refinitiv Lipper reported $116.737 million of outflows from municipal bond mutual funds in the week ending Wednesday following $798.474 million of outflows the week prior.

Exchange-traded muni funds reported inflows of $1.011 billion versus $135.277 million of outflows in the previous week. Ex-ETFs muni funds saw outflows of $1.128 billion after $663.197 million of outflows in the prior week.

Long-term muni bond funds had $68.356 million of inflows in the latest week after outflows of $323.542 million in the previous week. Intermediate-term funds had $29.521 million of outflows after $95.717 million of outflows in the prior week.

National funds had outflows of $35.791 million versus $641.188 million of outflows the previous week while high-yield muni funds reported outflows of $11.381 million versus outflows of $174.105 million the week prior.