Municipals rallied hard Thursday following another day of U.S. Treasury market gains while equities closed the session up as investors contemplate the end of Fed rate hikes.

Triple-A yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long. These were the largest gains the muni market has seen since October 10 and 11 in the days following the Hamas attack on Israel and the release of the minutes for the September Federal Open Market Committee meeting.

Following the Fed again holding rates steady this week, there has been “more willingness [for investors] to take risk, and a short squeeze on the market,” said James Pruskowski, chief investment officer at 16Rock Asset Management.

More investors are getting constructive that the Fed is “giving signs” it could be done hiking rates, even if the Fed wants to keep the option open on further tightening, according to Pruskowski.

Many people were “caught off guard in terms of the amount of cash they held under-invested,” he said.

Knowing that muni new-issuance is likely to slow heading into the holiday season, there has been a “grab for assets, especially out long,” he said.

“The market is on a relief rally, after being beaten by some hawkish Fed communication earlier last month,” said Jan Szilagyi, founder of Toggle AI. It’s unclear how long it will last, she said.

The relief rally has two parts, she noted.

For one, the market had “fallen meaningfully due to very hawkish Fed,” she said. Fed Chairman Jerome Powell welcomed the bond selloff but markets did not like that, she noted.

“When the Fed spoke in a more balanced way, some traders found reason to buy again,” she said.

For two, leading indicators “started to blare about a very oversold market for the last few days,” she said.

“These sharp drops clear all specs and allow the market to restart,” she said.

From here, Szilagyi said “the markets are still at lofty valuations and that the Fed might change its tune again, this time turning hawkish.”

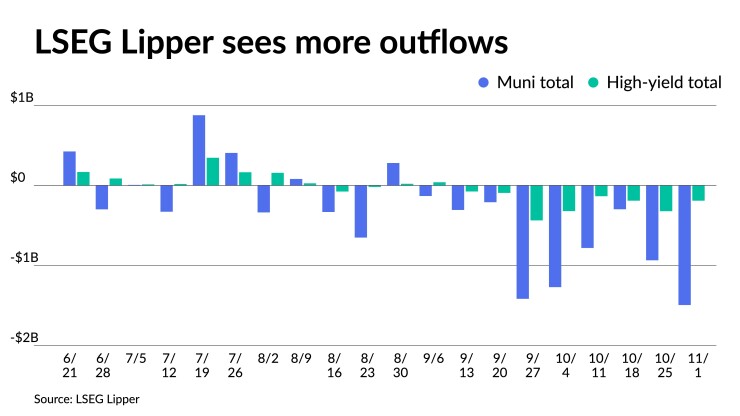

Investors continue to pull money from muni mutual funds with LSEG Lipper reporting $1.493 billion of outflows for the week ending Wednesday after $934.7 million of outflows the week prior.

High-yield saw outflows of $189.8 million after outflows of $321.3 million the previous week.

Meanwhile, exchange-traded fund flows and separately managed account flows are “supercharged,” Pruskowski said.

There are “mixed forces that are pointing in the positive direction at the expense of mutual funds,” he said.

The market “trading up, especially in the back end, is a function that longer-dated funds could see some new subscriptions,” he said.

Munis, though, remain relatively attractive, said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

The higher the muni-UST ratio, the better the relative value and buying opportunity in munis, he noted.

For the better part of the past few years, particularly on the shorter end of the curve, ratios had been decidedly rich. Now, the market is seeing better relative value, he said.

“I wouldn’t say that we’re at fair value, but we’ve moved closer to fair value throughout the second half of 2023,” Lipton said.

As the muni yield approaches the yield on a comparable Treasury, muni investors are gaining more of the tax benefit of owning munis, he noted.

The five-, 10- and 30-year muni-UST ratios reached historical lows in 2021.

The two-year muni-to-Treasury ratio Thursday was at 71%, the three-year was at 72%, the five-year at 73%, the 10-year at 74% and the 30-year at 92%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 72%, the three-year at 73%, the five-year at 71%, the 10-year at 72% and the 30-year at 89% at 4 p.m.

So while current ratios are below their long-run averages, “this elevation of the tights of 2021, coupled with current absolute yields, that effectively makes a case for buying municipal bonds, putting cash to work and locking in tax-efficient cash flows,” he said.

The remainder of the year will see a fair amount of tax loss harvesting activity, according to Lipton.

“There’s a great opportunity for tax loss swaps this year,” he said.

“The 4% type coupons out long are trading in the roughly $80 price range, and the 3% coupons on the long end are trading some somewhere around the low 60s,” he said. “So it’s a good opportunity to buy 5% coupons as replacements in the low 105-ish, 108-ish range.”

Secondary trading

NYC TFA 5s of 2024 at 3.73%. Maryland 5s of 2024 at 3.70% versus 3.73%-3.58% Wednesday and 3.74% on 10/25. Washington 5s of 2025 at 3.66%-3.50% versus 3.79% on 10/26.

Georgia 5s of 2028 at 3.37% versus 3.51%-3.50% Wednesday and 3.51%-5.53% on 10/25. Maryland 5s of 2029 at 3.40%. NY Dorm PIT 5s of 2030 at 3.66% versus 3.82% Wednesday.

Massachusetts 5s of 2032 at 3.43%. California 5s of 2033 at 3.57%-3.54% versus 3.71%-3.70% Wednesday and 3.71% on 10/25. Delaware 5s of 2034 at 3.58% versus 3.60%-3.58% Wednesday.

Oregon 5s of 2048 at 4.57% versus 4.81% Tuesday and 4.83% Monday. Massachusetts 5s of 2053 at 4.74%-4.69% versus 4.84%-4.86% Wednesday and 4.86%-4.69% Monday.

AAA scales

Refinitiv MMD’s scale was bumped 10 to 14 basis points: The one-year was at 3.64% (-10) and 3.53% (-12) in two years. The five-year was at 3.37% (-12), the 10-year at 3.44% (-14) and the 30-year at 4.45% (-12) at 3 p.m.

The ICE AAA yield curve was bumped nine to 13 basis points: 3.63% (-9) in 2024 and 3.60% (-10) in 2025. The five-year was at 3.38% (-13), the 10-year was at 3.43% (-13) and the 30-year was at 4.41% (-13) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped 10 to 13 basis points: The one-year was at 3.67% (-10) in 2024 and 3.57% (-12) in 2025. The five-year was at 3.42% (-12), the 10-year was at 3.46% (-13) and the 30-year yield was at 4.46% (-12), according to a 3 p.m. read.

Bloomberg BVAL was cut bumped 11 to 13 basis points: 3.66% (-12) in 2024 and 3.60% (-11) in 2025. The five-year at 3.38% (-12), the 10-year at 3.47% (-13) and the 30-year at 4.44% (-13) at 3:30 p.m.

Treasuries rallied.

The two-year UST was yielding 4.988% (+4), the three-year was at 4.786% (+2), the five-year at 4.649% (-2), the 10-year at 4.670% (-9), the 20-year at 5.001% (-13) and the 30-year Treasury was yielding 4.813% (-13) near the close.