Municipals were mostly steady to a touch softer in secondary trading while

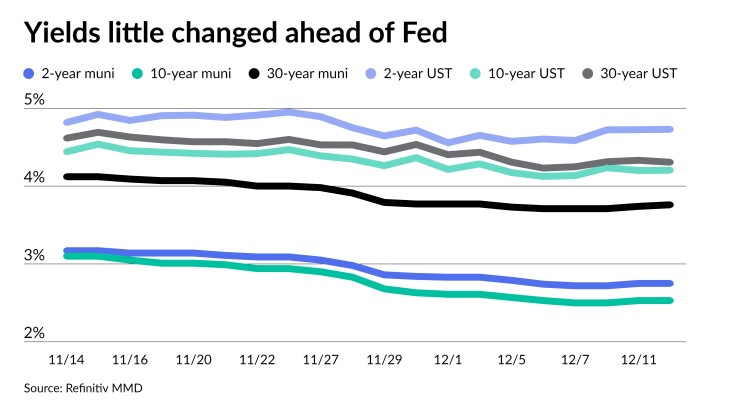

Triple-A yields rose a basis point or two while USTs made gains of two to three basis points on the day ahead of the conclusion of the Federal Open Market Committee’s meeting Wednesday, at which

Tuesday’s consumer price index report “will not have any meaningful impact on tomorrow’s likely decision to hold rates steady, but it provides the Fed some ammunition to reiterate that rate cuts as early as March 2024 remain premature,” said Olu Sonola, head of U.S. regional economics at Fitch Ratings.

Matt Peron, director of research and global head of solutions at Janus Henderson Investors, agreed.

“The in-line CPI report is unlikely to change the direction of markets or the Fed,” he said. “Though service prices remain stubborn, the overall picture is one of slowly normalizing inflation. However, it is unlikely to allow the Fed to relax its fight and, as such, could keep an aggressive tone.”

The focus turned to the primary market Tuesday. Loop Capital Markets priced and re-priced the largest deal of the day, an upsized $435.1 million deal for Ohio (Aaa/AA+/AAA/), up from the original $383.095 million with bumps of two to 10 basis points.

The deal consisted of $176.485 million of common schools GO refunding bonds with 4s of 3/2024 at 2.97%, 5s of 2028 at 2.62%, 5s of 2033 at 2.64% (-2) and 5s of 2037 at 2.99% (-10), callable 3/15/2033; $201.67 million of infrastructure improvement refunding GOs, with 4s of 9/2025 at 2.84%, 5s of 2028 at 2.62%, 5s of 2033 at 2.64% (-2) and 5s of 2037 at 2.99% (-10), callable 9/1/2033; and $56.955 million of conservation projects GO refunding bonds, with 4s of 3/2024 at 2.97%, 5s of 2028 at 2.62% and 5s of 2032 at 2.66%, noncall.

Piper Sandler & Co. priced for the San Bernardino Community College District (Aa1/AA//) $221 million of general obligation bonds, consisting of $51 million with 5s of 8/2024 at 2.84%, 5s of 2032 at 2.45%, 5s of 2033 at 2.45%, 5s of 2038 at 2.98%, 5s of 2043 at 3.52% and 5s of 2049 at 3.55%, callable 8/1/2031; and, $170 million with 5s of 8/2030 at 2.42%, 5s of 2033 at 2.45%, 5s of 2038 at 2.98%, 5s of 2043 at 3.52% and 5s of 2049 at 3.85%, callable 8/1/2031.

Goldman Sachs & Co. LLC priced for the Grand River Dam Authority, Oklahoma, (A1/AA-//) $205 million of revenue bonds with 5s of 6/2030 at 2.75%, 5s of 2033 at 2.83%, 5s of 2038 at 3.38% and 5s of 2042 at 3.75%, callable 6/1/2033.

Following

The two-year muni-to-Treasury ratio Monday was at 58%, the three-year at 59%, the five-year at 59%, the 10-year at 60% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 58%, the three-year at 58%, the five-year at 58%, the 10-year at 61% and the 30-year at 86% at 3:30 p.m.

“The market’s current stickiness, the resistance to lower prices, is an increasing constraint on volatility as the year winds down with nominal yields below or nearing levels from 1/1/23,” said Matt Fabian, partner at Municipal Market Analytics.

However, the continued strongly positive repricing “continues to push the entire curve, almost uniformly, into an oversold valuation,” he said. “The suggestion is for buyers to be extremely cautious, despite momentum being plainly positive, even at the far end of the long curve.”

Issuers should “absolutely be issuing if possible; the end of year outlook is positive on the surface but substantial volatility lies just below and could arrest or interrupt what have been easier primary market conditions,” Fabian added.

Indeed, more larger new-issues are popping up in the forward calendar, including $840 million of general obligation social and refunding bonds for the state of Connecticut set for retail pricing Monday. Bond Buyer 30-day visible supply sits at $5.86 billion.

Turning the attention to mutual fund flows, Fabian noted last week’s inflows seems “apt to be more about the passives and [exchange-traded funds] again,” he said. “Until active funds begin to regain past assets, which seems reasonable noting recent NAV gains, performance will be less trustworthy.”

AAA scales

Refinitiv MMD’s scale was cut two basis points out long: The one-year was at 2.92% (unch) and 2.75% (unch) in two years. The five-year was at 2.50% (unch), the 10-year at 2.53% (unch) and the 30-year at 3.76% (+2) at 3 p.m.

The ICE AAA yield curve was cut a basis points in spots: 2.91% (unch) in 2024 and 2.75% (+1) in 2025. The five-year was at 2.50% (+1), the 10-year was at 2.56% (unch) and the 30-year was at 3.71% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut one to two basis points: The one-year was at 2.90% (+1) in 2024 and 2.77% (+1) in 2025. The five-year was at 2.56% (+1), the 10-year was at 2.65% (+1) and the 30-year yield was at 3.68% (+1), according to a 4 p.m. read.

Bloomberg BVAL was little changed: 2.81% (unch) in 2024 and 2.73% (unch) in 2025. The five-year at 2.46% (unch), the 10-year at 2.55% (unch) and the 30-year at 3.63% (unch) at 4 p.m.

Treasuries improved.

The two-year UST was yielding 4.73% (flat), the three-year was at 4.431% (-1), the five-year at 4.223% (-3), the 10-year at 4.206% (-3), the 20-year at 4.485% (-2) and the 30-year Treasury was yielding 4.312% (-2) at the close.

Primary to come:

The Illinois State Toll Highway Authority (Aa3/AA-/AA-/) is set to price Thursday $900 million of toll highway senior revenue refunding bonds, 2024 Series A. RBC Capital Markets.

The City of Virginia Beach Development Authority (//BB+/) is set to price $463.4 million of Westminster-Canterbury on Chesapeake Bay residential care facility revenue bonds, consisting of $297.9 million Series A, $21 million of Series B-1, $41.5 million of Series B-2, $103 million of Series B-3. Ziegler.

Chicago (//A/A/) is set to price Thursday $393.595 million of AMT Chicago Midway Airport senior lien airport revenue refunding bonds, Series 2023C. Jefferies.

Competitive:

The Empire State Development Corp. is set to sell Thursday three series of personal income tax bonds, consisting of $344.02 million of PITs at 10:30 a.m. eastern, $249.805 million of climate bond certified PITs at 11:00 a.m. eastern and $252.805 million of climate bond certified PITs at 11:30 a.m. eastern.