Municipals were mixed in secondary trading, as $1.8 billion of GOs from New York City came to market in two series, as U.S. Treasury yields fell and equities ended up.

Several Federal Open Market Committee members saw a case to cut interest rates by 25 basis points in July, according to minutes of the July 30-31 minutes, setting the stage for a move in September.

“Several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision,” the minutes noted. “The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.”

Michael Gregory, BMO deputy chief economist, said the minutes show “how much closer” the Fed is to a 25-basis-point rate cut. He pointed to this passage from the minutes: “A majority of participants remarked that the risks to the employment goal had increased and many participants noted that the risks to the inflation goal had decreased,” which he sees as indicating “the proverbial policy scale is already tipping towards rate cuts.”

The markets will look to Federal Reserve Board Chair Jerome

“Jackson Hole, Wyoming, is well known for hikes but there will be no mention of them this week,” said Cooper Howard, a fixed-income strategist at Charles Schwab.

The focus, he noted, “will be on when the Fed will start cutting rates, how quickly they’ll move, and how low they will go.”

The Fed is expected to start cutting rates in September, followed a series of 25 basis point cuts in 2024, Howard said.

Muni yields have been on a bit of a “rollercoaster” over the past few years, where every few months the asset class has either been selling off or rallying by 30 to 50 basis points, said Jeremy Holtz, a portfolio manager at Income Research + Management.

When UST yields are “moving with a lot of velocity in either direction, munis don’t move as fast,” he said.

So if USTs are selling off, munis tend to sell off less, and when USTs rally significantly in a short period of time, munis tend to lag, he noted.

“We’ve seen some of that in the muni market over the last several weeks ago,” Holtz said.

With five- to 10-year muni-UST ratios around 70%, those are relatively attractive, he said.

The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 67%, the five-year at 68%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 71% and the 30-year at 88% at 3:30 p.m.

However, “we’re very unlikely to go back to a sustained period where ratios were 80% to 90% between five- and 10-years because there is a structural supply/demand imbalance,” Holtz said.

This week

There has not been much of a break in the rapid pace of issuance outside of the Fourth of July holiday week and the Federal Open Market Committee meeting weeks.

The surge in volume has had an effect on the market, helping to push muni-UST ratios higher than where they were a few months ago, according to Holtz.

Deals are being fairly “well absorbed,” but there has to be a bit of a new-issue concession to entice investors to get involved due to the onslaught of deals, he said.

August is traditionally a slower month for issuance, but that hasn’t been the case in August of this year, Holtz said, noting issuance is not as heavy as it was in May and June.

September and October will also be heavy months for supply, mostly due to issuers frontloading deals ahead of the election to avoid market volatility, he said.

Issuance in November and December should be on the lighter side, Holtz said.

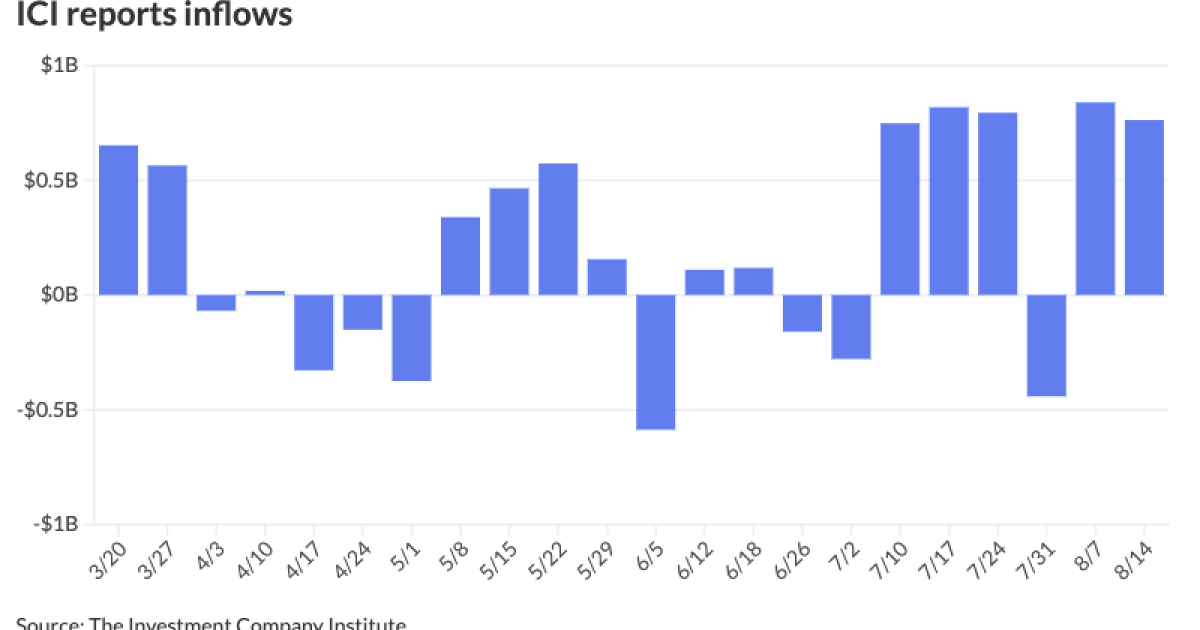

The Investment Company Institute reported $762 million of inflows into municipal bond mutual funds for the week ending Aug. 14 after $839 million of inflows the week prior.

Exchange-traded funds saw $175 million of inflows after $680 million of inflows the previous week.

In the primary market Wednesday, Loop Capital Markets preliminarily priced for institutions

Wells Fargo priced for the South Dakota Housing Development Authority (Aaa/AAA//) $250 million of homeownership mortgage bonds. The first tranche, $200 million of non-AMT bonds, 2024 Series C, saw all bonds at par — 3.3s of 11/2029, 4s of 2037, 4.05s of 2039, 4.5s of 2044 and 4.7s of 2049 — except for 6.25s of 2055 at 3.75%, callable 5/1/2033.

The second tranche, $50 million of taxables, 2024 Series D, saw all bonds price at parL 4.522s of 11/2025, 4.188s of 5/2029, 4.829s of 5/2034, 4.879s of 11/2034 and 4.999s of 5/2036, callable 5/1/2033.

J.P. Morgan priced for the Atlanta Development Authority $218.5 million of Westside Gulch Area Project senior revenue bonds. The first tranche, $61.5 million of Series 2024A-1, saw 5s of 4/2034 price at par, callable 4/1/2029.

The second tranche, $157 million of Series 2024A-2, saw 5.5s of 4/2039 price at par, callable 4/1/2029.

J.P. Morgan priced for the Public Utility District No. 2 of Grant County, Washington, (/AA/AA/) $181.235 million of Priest Rapids Hydroelectric Project revenue refunding bonds, 2024 Series B, with 5s of 1/2025 at 2.69%, 5s of 2029 at 2.55%, 5s of 2034 at 2.89%, 5s of 2039 at 3.18% and 4s of 2044 at 4.09%, callable 7/1/2034.

J.P. Morgan priced for the Nevada Housing Division (/AA+//) $172.41 million of senior taxable single-family mortgage revenue bonds, Series 2024F, saw 4.526s of 4/2025 at par, 4.241s of 4/2029 at par, 6s of 10/2029 at 4.241%, 4.882s of 4/2034 at par, 4.932s of 10/2034 at par, 5.132s of 10/2039 at par, 5.516s of 10/2044 at par, 5.586s of 10/2049 at par, 5.616s of 4/2054 at par and 6s of 10/2054 at 4.911%, callable 10/1/2033.

In the competitive market, New York City (Aa2/AA/AA/AA+/) sold $300 million of taxable GOs, Fiscal 2025 Series C, Subseries C-2, to J.P. Morgan, with 4.61s of 9/2037 at par, callable 9/1/2034.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 2.56% (-2) and 2.50% (-2) in two years. The five-year was at 2.46% (-2), the 10-year at 2.71% (unch) and the 30-year at 3.59% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to five basis points: 2.63% (-2) in 2025 and 2.53% (-3) in 2026. The five-year was at 2.45% (-5), the 10-year was at 2.67% (unch) and the 30-year was at 3.57% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve bumped up to three basis points: The one-year was at 2.62% (-2) in 2025 and 2.56% (-3) in 2026. The five-year was at 2.47% (-2), the 10-year was at 2.68% (unch) and the 30-year yield was at 3.56% (unch) at 3 p.m.

Bloomberg BVAL was mixed: 2.57% (-1) in 2025 and 2.53% (-1) in 2026. The five-year at 2.52% (-3), the 10-year at 2.67% (+3) and the 30-year at 3.59% (+2) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 3.931% (-6), the three-year was at 3.737% (-6), the five-year at 3.648% (-5), the 10-year at 3.791% (-2), the 20-year at 4.163% (-2) and the 30-year at 4.064% (flat) at 3:40 p.m.

Primary to come

The California Community Choice Financing Authority (A1///) is set to price $1 billion of Athene Annuity-funded Clean Energy Project Revenue Bonds, Series 2024. Goldman Sachs.

Dallas and Fort Worth, Texas, (A1/AA-/A+/AA) are set to price Thursday $713.41 million of Dallas Fort Worth International Airport non-AMT joint revenue refunding and improvement bonds, serials 2028-2044, term 2049. Wells Fargo.

Los Angeles County Public Works Financing Authority (/AA+/AA+/) is set to price Thursday $576.11 million of lease revenue bonds, serials 2024-2044, terms 2049, 2053. BofA Securities.

The Mabank Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $117.97 million of unlimited tax school building and refunding bonds, PSF Insured. FHN Financial Capital Markets.

Competitive

The North Texas Municipal Water District (Aa1/AAA//) is set to sell $153.705 million of Upper East Fork Wastewater Interceptor System Contract revenue refunding and improvement bonds at 11:30 a.m. eastern Thursday.

Gary Siegel contributed to this story.