Municipals were steady to firmer in spots, while U.S. Treasury yields fell and equities were mixed toward the end of the session.

Triple-A benchmarks were bumped up to three basis points, depending on the curve, while UST yields fell up to five basis points, pushing all tenors to year-to-date lows.

“The muni market underperformed against rallying USTs for the second week in a row [last week] given the nearly $14 billion new-issue calendar that has garnered all the attention,” said Birch Creek strategists in a report.

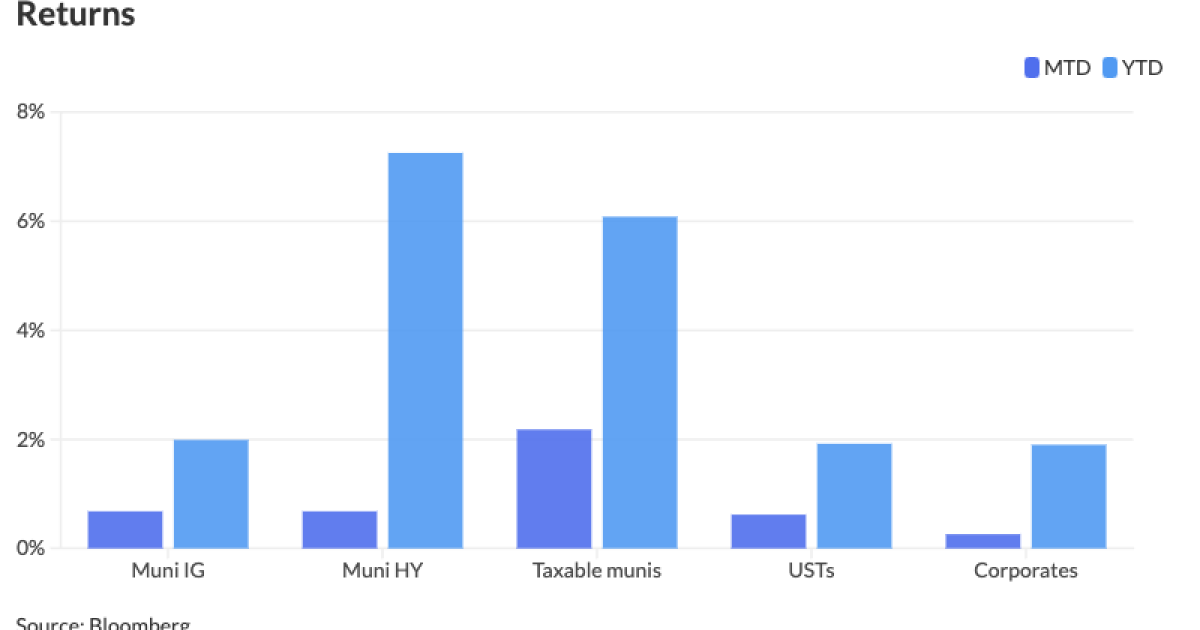

“This is the highest total return for the year since October 2023 of last year,” he said.

With the

“Although yields continue to be attractive, munis continue to be expensive when you compare munis to Treasuries,” he said.

The two-year muni-to-Treasury ratio Monday was at 66%, the three-year at 68%, the five-year at 69%, the 10-year at 73% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 67%, the 10-year at 71% and the 30-year at 87% at 3:30 p.m.

Muni yields were largely unchanged throughout most of the curve last week as the market gears up for the Fed to cut rates at its September meeting, Wong said. Ten-year notes fell by only 0.1 basis points to end the week at 2.62%, he said.

Fund flows remained strong as investors added

This is the second-largest inflow figure year-to-date after $1.413 billion for the week ending Jan. 31.

“The extra cash helped keep the wheels churning as most new issues saw modest oversubscriptions and competitive deals largely went away to investors,” Birch Creek strategists said.

“While market participants — including issuers — have been waiting months and months for the Fed to cut rates, it appears that some issuers are choosing to defer their borrowing plans until after this week’s expected move by the FOMC, as last week’s new issue volume was a robust 65% more than average and this week’s calendar is slated to come in 10% lower than average,” said Pat Luby, head of municipal strategy at CreditSights.

Supply picks back up in the coming week, as Birch Creek strategists expect several more heavy weeks of issuance ahead of the election.

Next week sees three billion-dollar-plus deals: the Texas Water Development Board with $1.6 billion of tax-exempts and taxable, the Los Angeles Unified School District with $1.1 billion of GO sustainability bonds, and the Port Authority of New York and New Jersey with a $1 billion deal.

The week of Sept. 30 sees the Dormitory Authority for the State of New York with a $1.3 billion deal on behalf of the Northwell Health Obligated Group.

The week of Oct. 7 sees New York City with $1.5 billion of GOs and the New York Transportation Development Corp. with $1.5 billion of special facilities refunding bonds for John F. Kennedy’s Terminal 6.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.50% (unch) and 2.32% (-3) in two years. The five-year was at 2.31% (-3), the 10-year at 2.63% (unch) and the 30-year at 3.52% (unch) at 3 p.m.

The ICE AAA yield curve was bumped to two basis points: 2.52% (unch) in 2025 and 2.36% (-2) in 2026. The five-year was at 2.32% (-2), the 10-year was at 2.57% (-1) and the 30-year was at 3.48% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.45% (unch) in 2025 and 2.34% (-2) in 2026. The five-year was at 2.33% (-2), the 10-year was at 2.58% (unch) and the 30-year yield was at 3.50% (unch) at 3 p.m.

Bloomberg BVAL was unchanged: 2.44% in 2025 and 2.38% in 2026. The five-year at 2.36%, the 10-year at 2.61% and the 30-year at 3.50% at 3:30 p.m.

Treasuries were better.

The two-year UST was yielding 3.564% (-2), the three-year was at 3.423% (-2), the five-year at 3.410% (-3), the 10-year at 3.622% (-4), the 20-year at 4.004% (-5) and the 30-year at 3.983% (flat) at 3:30 p.m.

Primary to come:

The JEA is set to price Tuesday

The Allegheny County Sanitary Authority (Aa3/AA-//) is set to price this week $360.46 million of sewer revenue refunding bond, serials 2024-2044, terms 2049, 2055. PNC Capital Markets.

The Washington State Housing Finance Commission (A3///) is set to price Thursday $314.403 million of municipal social certificates, Series 2024-1 Class A. Jefferies.

The Industrial Development Authority of the City of Yuma, Arizona, (/A/A/) is set to price Thursday $299 million of Yuma Regional Medical Center hospital revenue bonds, serials 2025-2044, term 2049, 2054. BofA Securities.

The Public Power Generation Agency (A2//A/) is set to price Tuesday $160 million of Whelan Energy Center Unit 2 revenue refunding bonds, Series A, serials 2026-2041. BofA Securities.

The Baseline Metropolitan District No. 1, Colorado, is set to price Thursday $155.075 million of special revenue refunding and improvement bonds and subordinate special revenue bonds, consisting of $132.575 million of special revenue refunding bonds (/AA//) insured by Assured Guaranty Inc., serials 2024-2039, terms 2044, 2049, 2054; and $22.5 million of unrated subordinated special revenue bonds, terms 2054. Wells Fargo.

The New York City Housing Development Corp. (Aa2///) is set to price Tuesday $143.39 million of taxable sustainable development housing impact bonds, Series D, serials 2030-2036, terms 2039, 2044, 2049, 2054. BofA Securities.

The Colorado Housing Finance Authority (Aaa/AAA//) is set to price Tuesday $116.035 million of single-family mortgage Class I taxable social bonds, serials 2025-2035, terms 2039, 2043, 2050. BofA Securities.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $114.43 million of water development revenue bonds, fresh water revolving fund Series 2024, serials 2025-2027, 2031. Stifel.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+//) is set to price Tuesday $108.315 million of taxable homeownership opportunity bonds, Series 84-T. Morgan Stanley.

The Missouri Joint Municipal Electric Utility Commission (A3//A/) is set to price Tuesday $105 million of Plum Point power project revenue refunding bonds, serials 2026-2034. RBC Capital Markets.

Competitive:

Illinois is set to sell $600 million taxable and tax-exempt general obligation bonds in three sales Tuesday, consisting of $150 million taxable GOs, Series October 2024A, at 10:15 a.m. eastern, $150 million of exempts, Series October 2024B, at 10:45 a.m. and $300 million of tax-exempt GOs, Series October 2024C at 11:15 a.m.

The Empire State Development Corp. is set to sell $341.525 million of state sales tax revenue bonds at 10:45 a.m. eastern Thursday.

Clover School District #2, South Carolina, (MIG1///) is set to sell $112.5 million of GO bond anticipation notes at 11 a.m. eastern Thursday.