Municipals were firmer Wednesday as the primary market picked up, led by the $2 billion retail pricing from the Regents of the University of California in the negotiated market and a $1.2 billion deal from the state of Washington in four series in the competitive market. U.S. Treasury yields rose slightly and equities ended up.

The two-year municipal to UST ratio Wednesday was at 64%, the five-year at 64%, the 10-year at 67% and the 30-year at 83%, according to Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the five-year at 65%, the 10-year at 67% and the 30-year at 81% at 4 p.m.

“Fixed income prices bounced positively last week,” as UST yields fell 10 to 15 basis points while tax-exempt muni yields fell four to five basis points, said Matt Fabian, a partner at Municipal Market Analytics.

“Importantly, municipal gains were established amid extremely heavy trading levels: total MSRB par traded exceeded $80 billion for the first time in two years and the 28th time since 2009,” he said.

“That much par changing hands suggests good, perhaps resilient price discovery: a good thing noting the numerous, otherwise highly concerning headlines that have started 2025,” Fabian noted.

The $80 billion “saw elevated buying and selling in lot sizes calibrated to retail customers as demand seems to keep coming/growing from the [separately managed account] platforms versus the traditional funds, where flows have been less consistent recently, Fabian said.

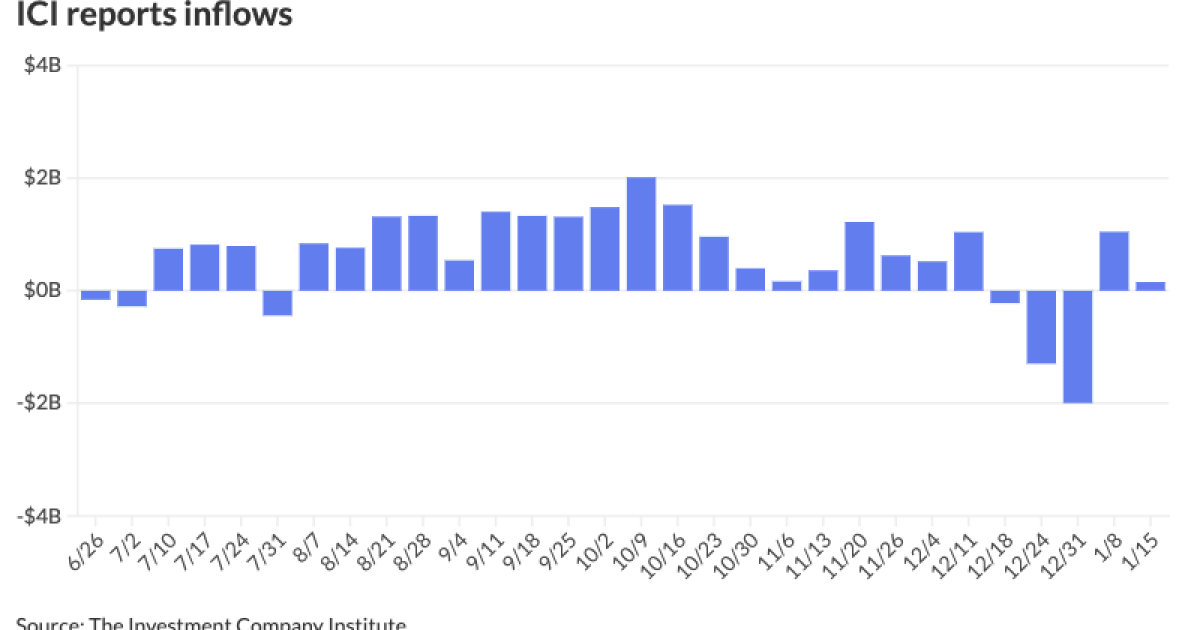

The Investment Company Institute reported inflows of $153 million for the week ending Jan. 15, following $1.046 billion of inflows the previous week.

Exchange-traded funds saw outflows of $342 million after inflows of $369 million of inflows the week prior, per ICI data.

The substantial reinvestment currently available right now helps, Fabian noted.

Slightly higher yields at longer maturities have helped the “retail demand component” year-to-date, he said.

Investor attention is focused on the California wildfires, said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

“California paper, undone by the wildfires and related downgrades, has cheapened up nicely for investors with cash,” Fabian said.

Los Angeles Department of Water and Power bonds provide at least 30 basis points above AAA following

From an investment perspective, Persson and Close believe essential service bonds will remain solid investments.

“Prices of bonds at the heart of the devastation have understandably fallen, but bidding remains constructive, and we believe fundamentals are sound,” they said.

Deals

In the primary market Wednesday, Morgan Stanley held a one-day retail order for the Regents of the University of California’s (Aa2/AA/AA/) $2 billion of general revenue refunding bonds, 2025 Series BZ, with 5s of 5/2025 at 2.61%, 5s of 2030 at 2.83%, 5s of 2035 at 3.13%, 5s of 2040 at 3.45%, 5s of 2045 at 3.86% and 5s of 2050 at 3.98%, callable 5/15/2035.

Jefferies preliminarily priced for the Massachusetts Clean Water Trust (Aaa/AAA/AAA/) $541.155 million of State Revolving Fund bonds. The first tranche, $261.77 million of Series 2026A green bonds, saw 5s of 2/2026 at 2.73%, 5s of 2030 at 2.88%, 5s of 2035 at 3.16%, 5s of 2040 at 3.52% and 5s of 2042 at 3.73%, callable 2/1/2035.

The second tranche, $146.61 million of Series 2026B sustainability bonds, saw 5s of 2/2039 at 3.44%, 5s of 2040 at 3.52% and 5s of 2045 at 3.95%, callable 2/1/2035.

The third tranche, $132.775 million of Series 2025 green bonds, saw 5s of 2/2026 at 2.73%, 5s of 2030 at 2.88%, 5s of 2035 at 3.16% and 5s of 2037 at 3.30%, callable 2/1/2035.

RBC Capital Markets priced and repriced for

The second tranche, $108.895 million of Series 2025B refunding bonds, saw 5s of 12/2025 at 2.83% (-3) and 5s of 2028 at 2.95% (-2), noncall.

BofA Securities priced for Portland, Oregon, (Aa2/AA//) $499.97 million of second lien sewer system revenue refunding bonds. The first tranche, $428.755 million of Series A, saw 5s of 10/2025 at 2.84%, 5s of 2030 at 2.95%, 5s of 2035 at 3.24%, 5s of 2040 at 3.57%, 5s of 2044 at 3.91% and 5s of 2049 at 4.11% and 5s of 2054 at 4.19%, callable 1/1/2035.

The second tranche, $71.215 million of Series B, with 5s of 6/2026 at 2.88%, 5s of 2030 at 3.01% and 5s of 2031 at 3.04%, noncall.

Morgan Stanley priced for the Maryland Health and Higher Educational Facilities Authority (A2/A//) $307.355 million of University of Maryland Medical System revenue bonds,, The first tranche, $234.725 million of fixed rate Series A bonds, saw 5s of 7/2025 at 2.96%, 5s of 2030 at 3.23%, 5s of 2035 at 3.58%, 5s of 2040 at 3.85%, 5s of 2042 at 4.05% and 5.25s of 2052 at 4.37%, callable 7/1/2035.

The second tranche, $72.63 million of long-term rate Series B bonds, saw 5s of 7/2045 with a mandatory tender date of 7/1/2031 at 3.37%, callable 7/1/2030.

BofA Securities priced for the Washington Health Care Facilities Authority (A2//A+/) $173.095 million of Fred Hutchinson Cancer Center revenue bonds, Series 2025A, saw 5s of 3/2026 at 2.99%, 5s of 2030 at 3.21%, 5s of 2035 at 3.55%, 5s of 2040 at 3.85% and 5s of 2045 at 4.45%, callable 3/1/2035.

In the competitive market, Washington (Aaa/AA+/AA+/) sold $87.125 million of various purpose GOs, Series 2025C — Bid Group 1, to BofA Securities, with 5s of 2/2026 at 2.75% and 5s of 2030 at 2.90%, noncall.

The state also sold $318.47 million of various purpose GOs, Series 2025C — Bid Group 2, to BofA Securities, with 5s of 2/20231 at 2.96%, 5s of 2035 at 3.18%, 5s of 2040 at 3.54% and 5s of 2042 at 3.74%, callable 2/1/2035.

Additionally, Washington sold $343.125 million of various purpose GOs, Series 2025C — Bid Group 3, to BofA Securities, with 5s of 2/2043 at 3.84%, 5s of 2045 at 4.00% and 5s of 2050 at 4.13%, callable 2/1/2035.

The state sold $420.445 million of motor vehicle, fuel tax and vehicle-related fees GO bonds, Series 2025D, to BofA Securities, with 5s of 6/2026 at 2.75%, 5s of 2030 at 2.90%, 5s of 2035 at 3.20%, 5s of 2040 at 3.54%, 5s of 2045 at 4.00% and 5s of 2050 at 4.13%, callable 6/1/2035.

Fairfax County, Virginia, (Aaa/AAA/AAA/) sold $378.15 million of public improvement bonds, Series 2025A, to BofA Securities, with 4s of 10/2025 at 2.80%, 5s of 2030 at 2.89%, 5s of 2035 at 3.14%, 4s of 2040 at 3.70% and 4s of 2044 at 4.05%, callable 4/1/2034.

Mecklenburg County, North Carolina, (Aaa/AAA/AAA/) sold $278..21 million of GO school bonds, Series 2025B, to Truist Securities, with 5s of 2/2026 at 2.74%, 5s of 2030 at 2.86%, 5s of 2035 at 3.11%, 4s of 2040 at 3.80% and 4s of 2045 at 4.09%, callable 2/1/2035.

Nevada (Aa1/AA+/AA+/) sold $174.9 million of GO limited tax of capital improvement and cultural affairs refunding bonds, Series 2025A, to J.P. Morgan with 5s of 10/2025 at 2.75%, 5s of 4/2030 at 2.95% and 5s of 4/2035 at 3.22%, noncall.

AAA scales

MMD’s scale was bumped two to four basis points: The one-year was at 2.72% (-4) and 2.74% (-4) in two years. The five-year was at 2.84% (-4), the 10-year at 3.07% (-4) and the 30-year at 3.98% (-2) at 3 p.m.

The ICE AAA yield curve was bumped one to two basis points: 2.76% (-1) in 2026 and 2.79% (-2) in 2027. The five-year was at 2.84% (-2), the 10-year was at 3.06% (-2) and the 30-year was at 3.89% (-2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped two to four basis points: The one-year was at 2.73% (-2) in 2025 and 2.76% (-2) in 2026. The five-year was at 2.82% (-2), the 10-year was at 3.04% (-2) and the 30-year yield was at 3.89% (-4) at 4 p.m.

Bloomberg BVAL was bumped two to three basis points: 2.69% (-2) in 2025 and 2.76% (-2) in 2026. The five-year at 2.87% (-3), the 10-year at 3.11% (-2) and the 30-year at 3.93% (-2) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.292% (+2), the three-year was at 4.341% (+2), the five-year at 4.425% (+3), the 10-year at 4.600% (+2), the 20-year at 4.891% (+1) and the 30-year at 4.819% (+1) at the close.

Primary to come

The Massachusetts Development Finance Agency (/BBB+/A-/) is set to price Thursday $337.825 million of UMass Memorial Health Care Obligated Group revenue refunding bonds, Series N, consisting of $237.825 million of Series N-1, and $100 million of Series N-2. Morgan Stanley.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Thursday $300 million of social housing mortgage finance program bonds, consisting of $100 million of 2025 Subseries A-1 bonds, serials 2025-2029, terms 2044, 2049, 2051, and $200 million of 2025 Subseries A-2 taxables, serials 2029-2036, terms 2039, 2044,2047, 2055. RBC Capital Markets.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Thursday $200 million of homeownership mortgage bonds, consisting of $160 million of Series A non-AMT bonds, serials 2029-2030, 2036-2037, terms 2040, 2045, 2050, 2055, and $40 million of Series B taxables, serials 2026-2036. BofA Securities.

Long Beach, California, (Aa2/AA+//) is set to price Thursday $119.945 million of non-AMT harbor revenue and revenue refunding bonds, Series 2025A, serials 2026-2042. BofA Securities.

Competitive

Greenwich, Connecticut, is set to sell $120 million of GO anticipation notes, Issue of 2025, at 11:30 a.m. eastern Thursday.